Does Major Holdings (HKG:1389) Have A Healthy Balance Sheet?

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We note that Major Holdings Limited (HKG:1389) does have debt on its balance sheet. But the real question is whether this debt is making the company risky.

What Risk Does Debt Bring?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for Major Holdings

What Is Major Holdings's Net Debt?

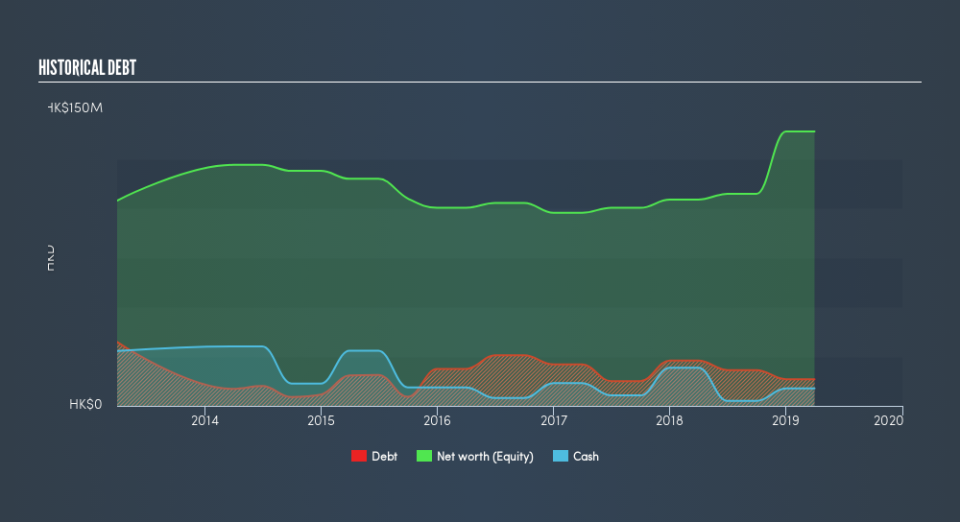

You can click the graphic below for the historical numbers, but it shows that Major Holdings had HK$13.5m of debt in March 2019, down from HK$29.0m, one year before. However, it also had HK$8.88m in cash, and so its net debt is HK$4.63m.

How Strong Is Major Holdings's Balance Sheet?

According to the last reported balance sheet, Major Holdings had liabilities of HK$34.3m due within 12 months, and liabilities of HK$3.15m due beyond 12 months. On the other hand, it had cash of HK$8.88m and HK$13.3m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by HK$15.2m.

Of course, Major Holdings has a market capitalization of HK$233.3m, so these liabilities are probably manageable. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Given net debt is only 1.5 times EBITDA, it is initially surprising to see that Major Holdings's EBIT has low interest coverage of 0.25 times. So while we're not necessarily alarmed we think that its debt is far from trivial. Shareholders should be aware that Major Holdings's EBIT was down 97% last year. If that decline continues then paying off debt will be harder than selling foie gras at a vegan convention. The balance sheet is clearly the area to focus on when you are analysing debt. But it is Major Holdings's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we always check how much of that EBIT is translated into free cash flow. Over the most recent two years, Major Holdings recorded free cash flow worth 57% of its EBIT, which is around normal, given free cash flow excludes interest and tax. This cold hard cash means it can reduce its debt when it wants to.

Our View

While Major Holdings's interest cover makes us cautious about it, its track record of (not) growing its EBIT is no better. But its not so bad at converting EBIT to free cash flow. Taking the abovementioned factors together we do think Major Holdings's debt poses some risks to the business. While that debt can boost returns, we think the company has enough leverage now. Given our hesitation about the stock, it would be good to know if Major Holdings insiders have sold any shares recently. You click here to find out if insiders have sold recently.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.