Does Metallurgical Corporation of China (HKG:1618) Have A Healthy Balance Sheet?

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk. So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies Metallurgical Corporation of China Ltd. (HKG:1618) makes use of debt. But is this debt a concern to shareholders?

What Risk Does Debt Bring?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for Metallurgical Corporation of China

What Is Metallurgical Corporation of China's Debt?

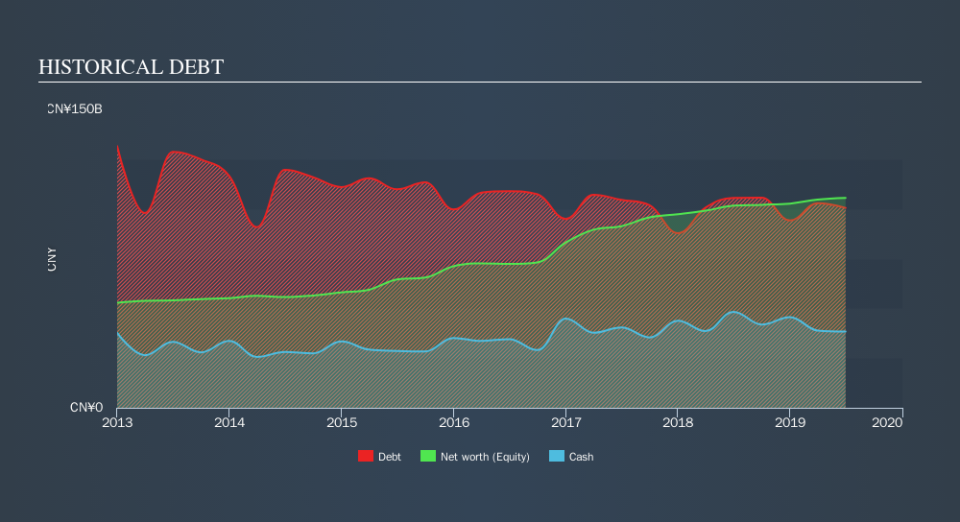

You can click the graphic below for the historical numbers, but it shows that Metallurgical Corporation of China had CN¥100.5b of debt in June 2019, down from CN¥106.0b, one year before. However, it also had CN¥38.4b in cash, and so its net debt is CN¥62.1b.

A Look At Metallurgical Corporation of China's Liabilities

According to the last reported balance sheet, Metallurgical Corporation of China had liabilities of CN¥312.1b due within 12 months, and liabilities of CN¥36.4b due beyond 12 months. Offsetting these obligations, it had cash of CN¥38.4b as well as receivables valued at CN¥227.4b due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by CN¥82.6b.

Given this deficit is actually higher than the company's market capitalization of CN¥55.1b, we think shareholders really should watch Metallurgical Corporation of China's debt levels, like a parent watching their child ride a bike for the first time. Hypothetically, extremely heavy dilution would be required if the company were forced to pay down its liabilities by raising capital at the current share price.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Metallurgical Corporation of China's debt is 3.6 times its EBITDA, and its EBIT cover its interest expense 5.8 times over. This suggests that while the debt levels are significant, we'd stop short of calling them problematic. One way Metallurgical Corporation of China could vanquish its debt would be if it stops borrowing more but continues to grow EBIT at around 20%, as it did over the last year. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Metallurgical Corporation of China can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Over the last three years, Metallurgical Corporation of China recorded free cash flow worth a fulsome 99% of its EBIT, which is stronger than we'd usually expect. That positions it well to pay down debt if desirable to do so.

Our View

Neither Metallurgical Corporation of China's ability to handle its total liabilities nor its net debt to EBITDA gave us confidence in its ability to take on more debt. But its conversion of EBIT to free cash flow tells a very different story, and suggests some resilience. Looking at all the angles mentioned above, it does seem to us that Metallurgical Corporation of China is a somewhat risky investment as a result of its debt. Not all risk is bad, as it can boost share price returns if it pays off, but this debt risk is worth keeping in mind. Another positive for shareholders is that it pays dividends. So if you like receiving those dividend payments, check Metallurgical Corporation of China's dividend history, without delay!

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.