Does NAGA Group's Social Trading App Make It Appealing?

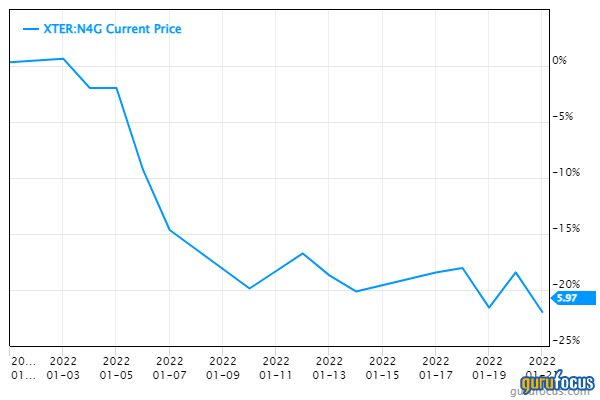

Germany-based financial services company NAGA Group AG (XTER:N4G) has not been spared by the overall stock market crash. The stock is down over 20% so far this year due to the general collapse of global markets.

The S&P 500 Index has plunged more than 11% this year, with the France 40 Index declining nearly 6%. The DAX 30 and the U.K. 100 Index have fallen by more than 6% and 3%, respectively.

However, as Warren Buffett (Trades, Portfolio) strongly advocates, the best time to buy stocks is when prices are low. Unfortunately, some investors tend to run away during a bearish market. Thats why sometimes prices can continue to fall for extended periods.

Nonetheless, this could also be a perfect time to identify potentially discounted stocks that have a strong case for a rebound.

For instance, NAGA shares were on an upward trajectory before the recent pullback. The stock gained more than 1,100% between February of 2020 and Dec. 30, 2021.

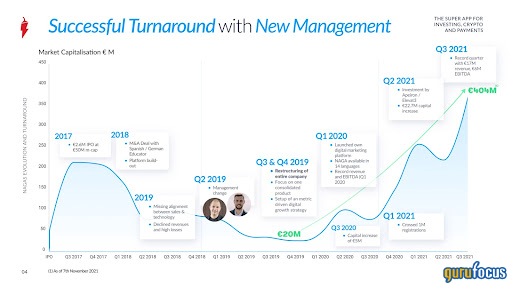

The turnaround

The rally coincided with a restructuring plan that included a change in management.

Source: Company presentation.

NAGA has delivered 11 consecutive quarters of record growth, with its social trading app amassing more than 1 million users as of 2021.

The app allows users to trade stocks and cryptocurrencies through the popular auto-copying feature. Social trading is now one of the fastest-growing investment strategies used by novice investors. The practice has also gained the attention of experienced investors that are too busy with other things to monitor the markets.

In November, the company launched NAGA Pay, adding more features to its social trading platform. Investors can now buy and sell stocks and cryptocurrencies, copy other investors trades as well as pay for products and services from the app.

Promising growth

NAGAs revenue surpassed 55 million euros ($62.3 million) last year, up from 24.4 million euros in 2020, while Ebitda nearly doubled to 12.8 million euros. The company said the increased top line was boosted by trading volume that more than doubled to 250 billion euros from 121 billion euros.

The companys crypto trading service also got a boost from the launch of NAGA Coin, which has a market cap of $45 million.

After extending its product offering to payments and crypto trading services, the company's long-term growth looks compelling.

At the current price of about 5.48 euros, NAGA trades at a reasonable price-sales ratio of about 12.74. Therefore, its exciting growth make the stock an attractive option for long-term investors.

Conclusion

In summary, NAGAs all-in-one social trading platform could help accelerate its recovery after implementing a turnaround plan. Therefore, with the stock pulling back more than 26%, it could be a good opportunity to invest in the stock.

This article first appeared on GuruFocus.