Does Pilani Investment and Industries's (NSE:PILANIINVS) Share Price Gain of 29% Match Its Business Performance?

Buying a low-cost index fund will get you the average market return. But across the board there are plenty of stocks that underperform the market. Unfortunately for shareholders, while the Pilani Investment and Industries Corporation Limited (NSE:PILANIINVS) share price is up 29% in the last three years, that falls short of the market return. Unfortunately, the share price has fallen 19% over twelve months.

View our latest analysis for Pilani Investment and Industries

Because Pilani Investment and Industries is loss-making, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

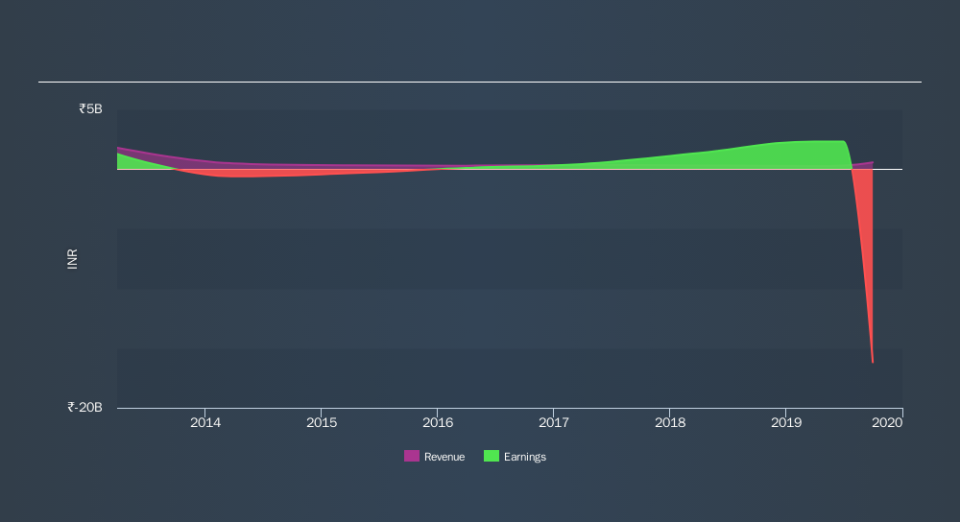

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. Dive deeper into the earnings by checking this interactive graph of Pilani Investment and Industries's earnings, revenue and cash flow.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, Pilani Investment and Industries's TSR for the last 3 years was 34%, which exceeds the share price return mentioned earlier. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

While the broader market gained around 5.5% in the last year, Pilani Investment and Industries shareholders lost 18% (even including dividends) . However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Longer term investors wouldn't be so upset, since they would have made 5.5%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. You could get a better understanding of Pilani Investment and Industries's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.