Does The Realia Business, S.A. (BME:RLIA) Share Price Tend To Follow The Market?

Anyone researching Realia Business, S.A. (BME:RLIA) might want to consider the historical volatility of the share price. Volatility is considered to be a measure of risk in modern finance theory. Investors may think of volatility as falling into two main categories. First, we have company specific volatility, which is the price gyrations of an individual stock. Holding at least 8 stocks can reduce this kind of risk across a portfolio. The other type, which cannot be diversified away, is the volatility of the entire market. Every stock in the market is exposed to this volatility, which is linked to the fact that stocks prices are correlated in an efficient market.

Some stocks mimic the volatility of the market quite closely, while others demonstrate muted, exagerrated or uncorrelated price movements. Some investors use beta as a measure of how much a certain stock is impacted by market risk (volatility). While we should keep in mind that Warren Buffett has cautioned that 'Volatility is far from synonymous with risk', beta is still a useful factor to consider. To make good use of it you must first know that the beta of the overall market is one. A stock with a beta below one is either less volatile than the market, or more volatile but not corellated with the overall market. In comparison a stock with a beta of over one tends to be move in a similar direction to the market in the long term, but with greater changes in price.

View our latest analysis for Realia Business

What does RLIA's beta value mean to investors?

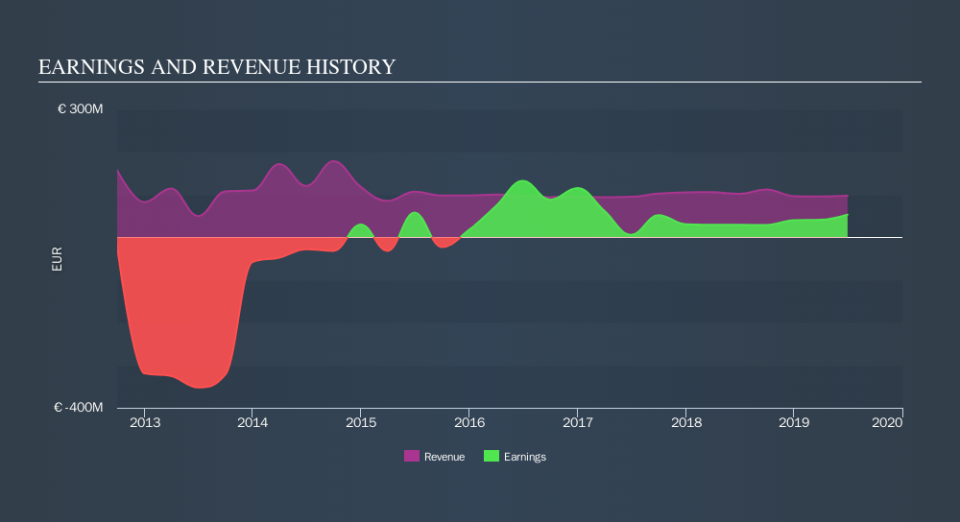

As it happens, Realia Business has a five year beta of 0.95. This is fairly close to 1, so the stock has historically shown a somewhat similar level of volatility as the market. Using history as a guide, we might surmise that the share price is likely to be influenced by market voltility going forward but it probably won't be particularly sensitive to it. Share price volatility is well worth considering, but most long term investors consider the history of revenue and earnings growth to be more important. Take a look at how Realia Business fares in that regard, below.

Could RLIA's size cause it to be more volatile?

Realia Business is a small cap stock with a market capitalisation of €766m. Most companies this size are actively traded. It takes less capital to move the share price of small companies, and they are also more impacted by company specific events, so it's a bit of a surprise that the beta is so close to the overall market.

What this means for you:

Since Realia Business has a beta close to one, it will probably show a positive return when the market is moving up, based on history. If you're trying to generate better returns than the market, it would be worth thinking about other metrics such as cashflows, dividends and revenue growth might be a more useful guide to the future. In order to fully understand whether RLIA is a good investment for you, we also need to consider important company-specific fundamentals such as Realia Business’s financial health and performance track record. I highly recommend you dive deeper by considering the following:

Financial Health: Are RLIA’s operations financially sustainable? Balance sheets can be hard to analyze, which is why we’ve done it for you. Check out our financial health checks here.

Past Track Record: Has RLIA been consistently performing well irrespective of the ups and downs in the market? Go into more detail in the past performance analysis and take a look at the free visual representations of RLIA's historicals for more clarity.

Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.