Does Shimao Property Holdings Limited's (HKG:813) Debt Level Pose A Problem?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Investors pursuing a solid, dependable stock investment can often be led to Shimao Property Holdings Limited (HKG:813), a large-cap worth HK$77b. Risk-averse investors who are attracted to diversified streams of revenue and strong capital returns tend to seek out these large companies. But, the health of the financials determines whether the company continues to succeed. This article will examine Shimao Property Holdings’s financial liquidity and debt levels to get an idea of whether the company can deal with cyclical downturns and maintain funds to accommodate strategic spending for future growth. Remember this is a very top-level look that focuses exclusively on financial health, so I recommend a deeper analysis into 813 here.

View our latest analysis for Shimao Property Holdings

Does 813 Produce Much Cash Relative To Its Debt?

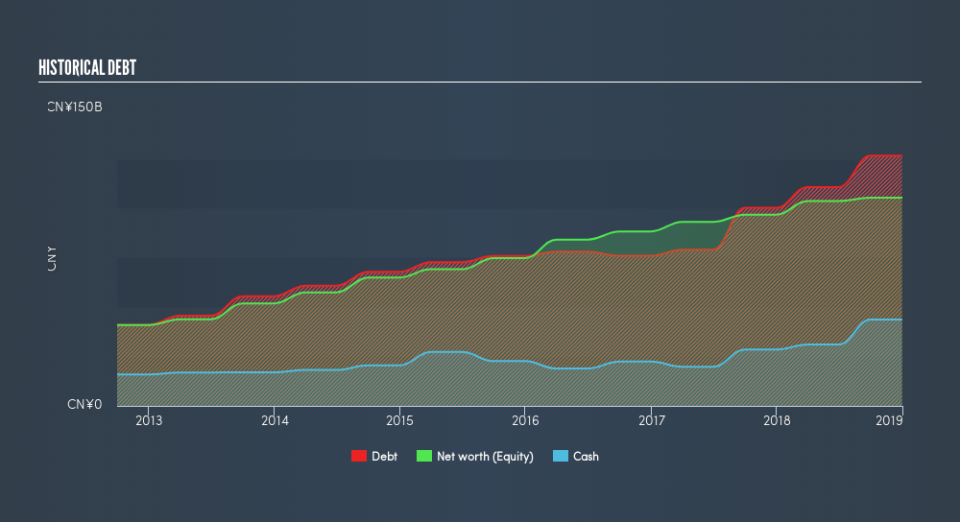

Over the past year, 813 has ramped up its debt from CN¥100b to CN¥127b – this includes long-term debt. With this growth in debt, 813 currently has CN¥44b remaining in cash and short-term investments , ready to be used for running the business. On top of this, 813 has generated CN¥2.2b in operating cash flow during the same period of time, leading to an operating cash to total debt ratio of 1.7%, signalling that 813’s debt is not covered by operating cash.

Can 813 meet its short-term obligations with the cash in hand?

With current liabilities at CN¥188b, the company has been able to meet these commitments with a current assets level of CN¥289b, leading to a 1.54x current account ratio. The current ratio is the number you get when you divide current assets by current liabilities. Generally, for Real Estate companies, this is a reasonable ratio as there's enough of a cash buffer without holding too much capital in low return investments.

Can 813 service its debt comfortably?

With total debt exceeding equities, Shimao Property Holdings is considered a highly levered company. This isn’t surprising for large-caps, as equity can often be more expensive to issue than debt, plus interest payments are tax deductible. Accordingly, large companies often have lower cost of capital due to easily obtained financing, providing an advantage over smaller companies.

Next Steps:

813’s debt and cash flow levels indicate room for improvement. Its cash flow coverage of less than a quarter of debt means that operating efficiency could be an issue. However, the company exhibits proper management of current assets and upcoming liabilities. I admit this is a fairly basic analysis for 813's financial health. Other important fundamentals need to be considered alongside. You should continue to research Shimao Property Holdings to get a better picture of the stock by looking at:

Future Outlook: What are well-informed industry analysts predicting for 813’s future growth? Take a look at our free research report of analyst consensus for 813’s outlook.

Valuation: What is 813 worth today? Is the stock undervalued, even when its growth outlook is factored into its intrinsic value? The intrinsic value infographic in our free research report helps visualize whether 813 is currently mispriced by the market.

Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.