Does True North Commercial Real Estate Investment Trust's (TSE:TNT.UN) Share Price Gain of 16% Match Its Business Performance?

You can receive the average market return by buying a low-cost index fund. But you can make superior returns by picking better-than average stocks. For example, the True North Commercial Real Estate Investment Trust (TSE:TNT.UN) share price is up 16% in the last three years, slightly above the market return. The stock price is up 2.9%: that's not amazing, but it's better than a kick in the teeth.

See our latest analysis for True North Commercial Real Estate Investment Trust

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the three years of share price growth, True North Commercial Real Estate Investment Trust actually saw its earnings per share (EPS) drop 3.2% per year. Based on these numbers, we think that the decline in earnings per share may not be a good representation of how the business has changed over the years. So other metrics may hold the key to understanding what is influencing investors.

We doubt the dividend payments explain the share price rise, since we don't see any improvement in that regard. It's much more likely that the fact that True North Commercial Real Estate Investment Trust has been growing revenue at 30% a year is seen as a genuine positive. In that case, the revenue growth might be more important to shareholders, for now, thus justifying a higer share price.

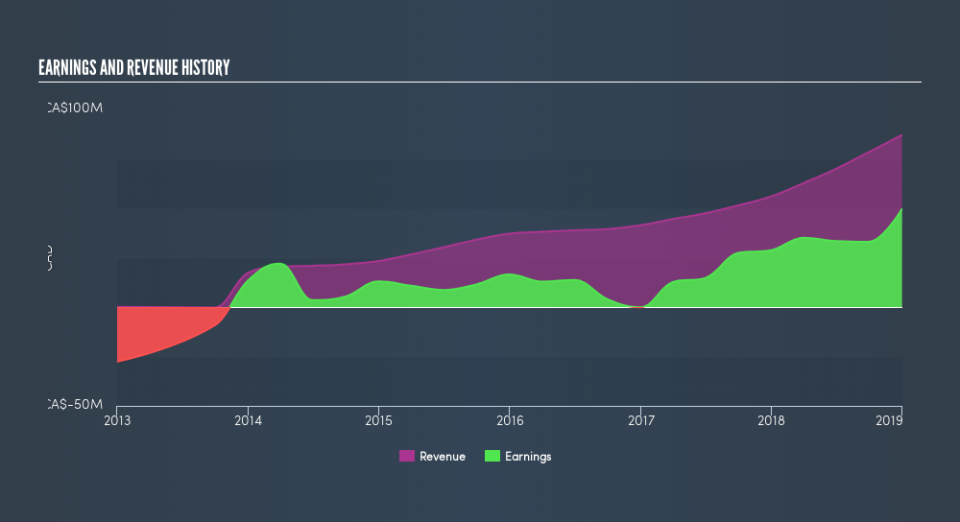

Depicted in the graphic below, you'll see revenue and earnings over time. If you want more detail, you can click on the chart itself.

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. You can see what analysts are predicting for True North Commercial Real Estate Investment Trust in this interactive graph of future profit estimates.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. We note that for True North Commercial Real Estate Investment Trust the TSR over the last 3 years was 53%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

We're pleased to report that True North Commercial Real Estate Investment Trust shareholders have received a total shareholder return of 13% over one year. That's including the dividend. That gain is better than the annual TSR over five years, which is 12%. Therefore it seems like sentiment around the company has been positive lately. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. Investors who like to make money usually check up on insider purchases, such as the price paid, and total amount bought. You can find out about the insider purchases of True North Commercial Real Estate Investment Trust by clicking this link.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.