How Does Xin Point Holdings Limited (HKG:1571) Fare As A Dividend Stock?

Is Xin Point Holdings Limited (HKG:1571) a good dividend stock? How can we tell? Dividend paying companies with growing earnings can be highly rewarding in the long term. If you are hoping to live on the income from dividends, it's important to be a lot more stringent with your investments than the average punter.

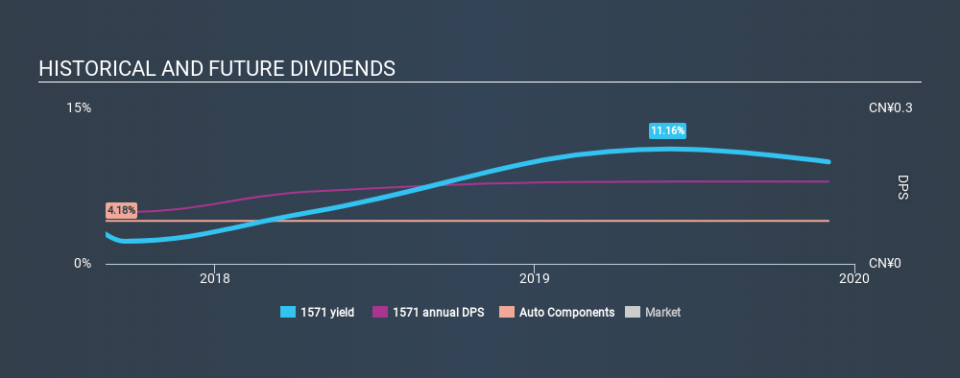

Xin Point Holdings pays a 9.9% dividend yield, and has been paying dividends for the past two years. A high yield probably looks enticing, but investors are likely wondering about the short payment history. The company also bought back stock equivalent to around 0.6% of market capitalisation this year. That said, the recent jump in the share price will make Xin Point Holdings's dividend yield look smaller, even though the company prospects could be improving. Some simple analysis can offer a lot of insights when buying a company for its dividend, and we'll go through this below.

Explore this interactive chart for our latest analysis on Xin Point Holdings!

Payout ratios

Dividends are usually paid out of company earnings. If a company is paying more than it earns, then the dividend might become unsustainable - hardly an ideal situation. As a result, we should always investigate whether a company can afford its dividend, measured as a percentage of a company's net income after tax. Xin Point Holdings paid out 53% of its profit as dividends, over the trailing twelve month period. A payout ratio above 50% generally implies a business is reaching maturity, although it is still possible to reinvest in the business or increase the dividend over time.

In addition to comparing dividends against profits, we should inspect whether the company generated enough cash to pay its dividend. Unfortunately, while Xin Point Holdings pays a dividend, it also reported negative free cash flow last year. While there may be a good reason for this, it's not ideal from a dividend perspective.

With a strong net cash balance, Xin Point Holdings investors may not have much to worry about in the near term from a dividend perspective.

Consider getting our latest analysis on Xin Point Holdings's financial position here.

Dividend Volatility

From the perspective of an income investor who wants to earn dividends for many years, there is not much point buying a stock if its dividend is regularly cut or is not reliable. The company has been paying a stable dividend for a few years now, but we'd like to see more evidence of consistency over a longer period. During the past two-year period, the first annual payment was CN¥0.10 in 2017, compared to CN¥0.16 last year. Dividends per share have grown at approximately 26% per year over this time.

We're not overly excited about the relatively short history of dividend payments, however the dividend is growing at a nice rate and we might take a closer look.

Dividend Growth Potential

While dividend payments have been relatively reliable, it would also be nice if earnings per share (EPS) were growing, as this is essential to maintaining the dividend's purchasing power over the long term. Xin Point Holdings's earnings per share have fallen -40% over the past year. This is a pretty serious concern, and it would be worth investigating whether something fundamental in the business has changed - or broken. We do note though, one year is too short a time to be drawing strong conclusions about a company's future prospects.

Conclusion

When we look at a dividend stock, we need to form a judgement on whether the dividend will grow, if the company is able to maintain it in a wide range of economic circumstances, and if the dividend payout is sustainable. Xin Point Holdings gets a pass on its dividend payout ratio, but it paid out virtually all of its cash flow as dividends. This may just be a one-off, but we'd keep an eye on this. Earnings per share are down, and to our mind Xin Point Holdings has not been paying a dividend long enough to demonstrate its resilience across economic cycles. There are a few too many issues for us to get comfortable with Xin Point Holdings from a dividend perspective. Businesses can change, but we would struggle to identify why an investor should rely on this stock for their income.

Now, if you want to look closer, it would be worth checking out our free research on Xin Point Holdings management tenure, salary, and performance.

If you are a dividend investor, you might also want to look at our curated list of dividend stocks yielding above 3%.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.