Does Zhenro Properties Group (HKG:6158) Deserve A Spot On Your Watchlist?

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Zhenro Properties Group (HKG:6158). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

View our latest analysis for Zhenro Properties Group

Zhenro Properties Group's Improving Profits

In the last three years Zhenro Properties Group's earnings per share took off like a rocket; fast, and from a low base. So the actual rate of growth doesn't tell us much. Thus, it makes sense to focus on more recent growth rates, instead. It's good to see that Zhenro Properties Group's EPS have grown from CN¥0.47 to CN¥0.52 over twelve months. I doubt many would complain about that 11% gain.

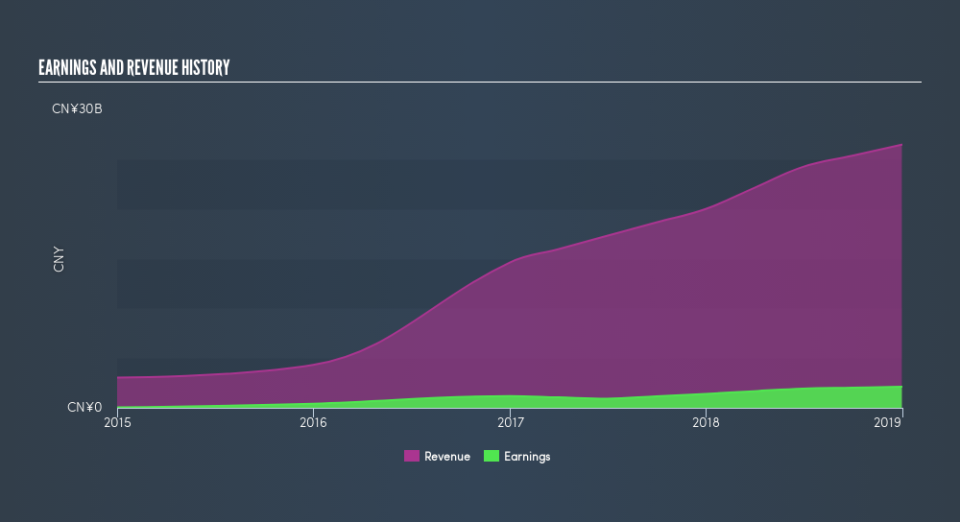

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. While we note Zhenro Properties Group's EBIT margins were flat over the last year, revenue grew by a solid 32% to CN¥26b. That's a real positive.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Zhenro Properties Group.

Are Zhenro Properties Group Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

We did see some selling in the last twelve months, but that's insignificant compared to the whopping CN¥1.2b that the Non-Executive Director, Guoqiang Ou spent acquiring shares. The average price paid was about CN¥4.95. The quantum of that insider purchase is both rare and a sight to behold, not unlike an endangered Amur Leopard in the wild.

On top of the insider buying, we can also see that Zhenro Properties Group insiders own a large chunk of the company. Indeed, with a collective holding of 65%, company insiders are in control and have plenty of capital behind the venture. This makes me think they will be incentivised to plan for the long term - something I like to see. And their holding is extremely valuable at the current share price, totalling CN¥13b. That means they have plenty of their own capital riding on the performance of the business!

While insiders are apparently happy to hold and accumulate shares, that is just part of the pretty picture. That's because on our analysis the CEO, Benlong Wang, is paid less than the median for similar sized companies. For companies with market capitalizations between CN¥14b and CN¥45b, like Zhenro Properties Group, the median CEO pay is around CN¥3.7m.

Zhenro Properties Group offered total compensation worth CN¥3.2m to its CEO in the year to December 2018. That seems pretty reasonable, especially given its below the median for similar sized companies. While the level of CEO compensation isn't a huge factor in my view of the company, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. I'd also argue reasonable pay levels attest to good decision making more generally.

Does Zhenro Properties Group Deserve A Spot On Your Watchlist?

As I already mentioned, Zhenro Properties Group is a growing business, which is what I like to see. Better yet, insiders are significant shareholders, and have been buying more shares. To me, that all makes it well worth a spot on your watchlist, as well as continuing research. Once you've identified a business you like, the next step is to consider what you think it's worth. And right now is your chance to view our exclusive discounted cashflow valuation of Zhenro Properties Group. You might benefit from giving it a glance today.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Zhenro Properties Group, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.