How Does Zhong Hua International Holdings Limited (HKG:1064) Affect Your Portfolio Volatility?

If you're interested in Zhong Hua International Holdings Limited (HKG:1064), then you might want to consider its beta (a measure of share price volatility) in order to understand how the stock could impact your portfolio. Volatility is considered to be a measure of risk in modern finance theory. Investors may think of volatility as falling into two main categories. First, we have company specific volatility, which is the price gyrations of an individual stock. Holding at least 8 stocks can reduce this kind of risk across a portfolio. The second sort is caused by the natural volatility of markets, overall. For example, certain macroeconomic events will impact (virtually) all stocks on the market.

Some stocks mimic the volatility of the market quite closely, while others demonstrate muted, exagerrated or uncorrelated price movements. Some investors use beta as a measure of how much a certain stock is impacted by market risk (volatility). While we should keep in mind that Warren Buffett has cautioned that 'Volatility is far from synonymous with risk', beta is still a useful factor to consider. To make good use of it you must first know that the beta of the overall market is one. A stock with a beta greater than one is more sensitive to broader market movements than a stock with a beta of less than one.

See our latest analysis for Zhong Hua International Holdings

What does 1064's beta value mean to investors?

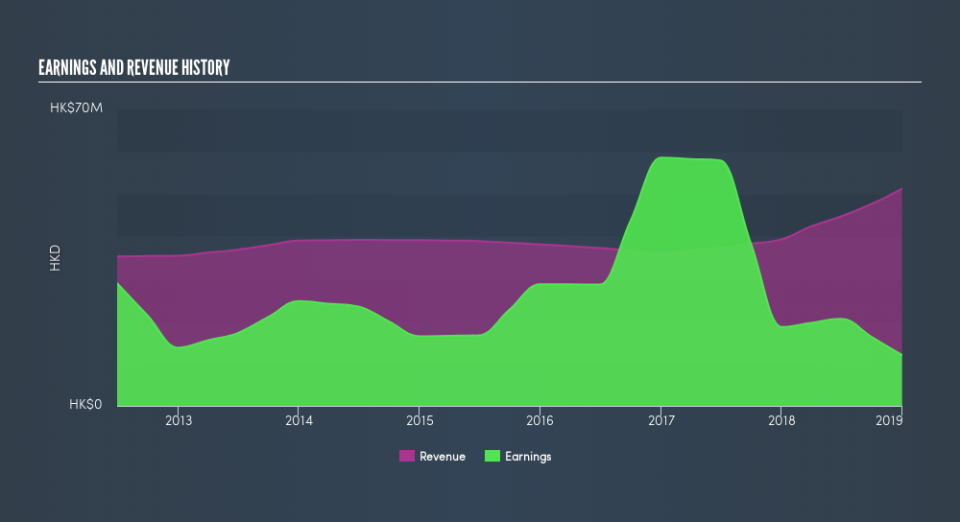

Zooming in on Zhong Hua International Holdings, we see it has a five year beta of 1.37. This is above 1, so historically its share price has been influenced by the broader volatility of the stock market. Based on this history, investors should be aware that Zhong Hua International Holdings are likely to rise strongly in times of greed, but sell off in times of fear. Share price volatility is well worth considering, but most long term investors consider the history of revenue and earnings growth to be more important. Take a look at how Zhong Hua International Holdings fares in that regard, below.

Could 1064's size cause it to be more volatile?

Zhong Hua International Holdings is a noticeably small company, with a market capitalisation of HK$114m. Most companies this size are not always actively traded. It has a relatively high beta, suggesting it is fairly actively traded for a company of its size. Because it takes less capital to move the share price of a small company like this, when a stock this size is actively traded it is quite often more sensitive to market volatility than similar large companies.

What this means for you:

Beta only tells us that the Zhong Hua International Holdings share price is sensitive to broader market movements. This could indicate that it is a high growth company, or is heavily influenced by sentiment because it is speculative. Alternatively, it could have operating leverage in its business model. Ultimately, beta is an interesting metric, but there's plenty more to learn. In order to fully understand whether 1064 is a good investment for you, we also need to consider important company-specific fundamentals such as Zhong Hua International Holdings’s financial health and performance track record. I highly recommend you dive deeper by considering the following:

Future Outlook: What are well-informed industry analysts predicting for 1064’s future growth? Take a look at our free research report of analyst consensus for 1064’s outlook.

Past Track Record: Has 1064 been consistently performing well irrespective of the ups and downs in the market? Go into more detail in the past performance analysis and take a look at the free visual representations of 1064's historicals for more clarity.

Other Interesting Stocks: It's worth checking to see how 1064 measures up against other companies on valuation. You could start with this free list of prospective options.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.