Don't Buy Best Mart 360 Holdings Limited (HKG:2360) For Its Next Dividend Without Doing These Checks

It looks like Best Mart 360 Holdings Limited (HKG:2360) is about to go ex-dividend in the next 4 days. If you purchase the stock on or after the 10th of December, you won't be eligible to receive this dividend, when it is paid on the 30th of December.

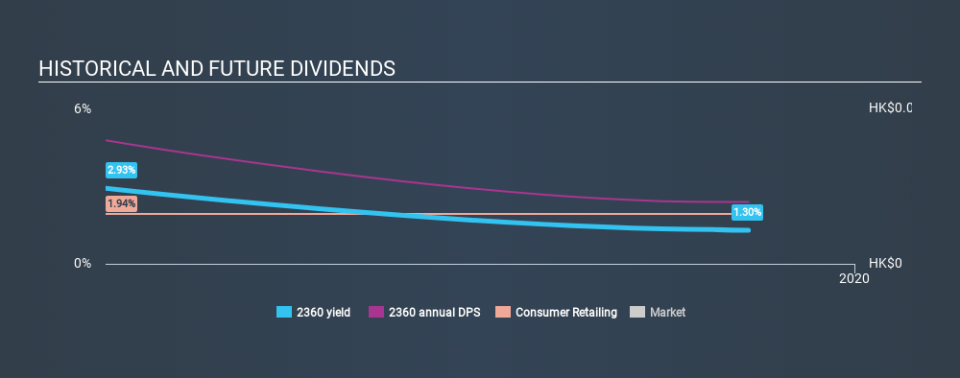

Best Mart 360 Holdings's next dividend payment will be HK$0.015 per share, and in the last 12 months, the company paid a total of HK$0.03 per share. Calculating the last year's worth of payments shows that Best Mart 360 Holdings has a trailing yield of 1.3% on the current share price of HK$2.3. Dividends are an important source of income to many shareholders, but the health of the business is crucial to maintaining those dividends. That's why we should always check whether the dividend payments appear sustainable, and if the company is growing.

Check out our latest analysis for Best Mart 360 Holdings

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. Best Mart 360 Holdings paid out 95% of its earnings, which is more than we're comfortable with, unless there are mitigating circumstances. Yet cash flows are even more important than profits for assessing a dividend, so we need to see if the company generated enough cash to pay its distribution. It paid out 88% of its free cash flow as dividends, which is within usual limits but will limit the company's ability to lift the dividend if there's no growth.

It's good to see that while Best Mart 360 Holdings's dividends were not well covered by profits, at least they are affordable from a cash perspective. Still, if the company continues paying out such a high percentage of its profits, the dividend could be at risk if business turns sour.

Click here to see how much of its profit Best Mart 360 Holdings paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Companies with falling earnings are riskier for dividend shareholders. If earnings decline and the company is forced to cut its dividend, investors could watch the value of their investment go up in smoke. From this viewpoint, it's unfortunate that earnings per share have declined 13% over the last year.

We'd also point out that Best Mart 360 Holdings issued a meaningful number of new shares in the past year. Trying to grow the dividend while issuing large amounts of new shares reminds us of the ancient Greek tale of Sisyphus - perpetually pushing a boulder uphill.

This is Best Mart 360 Holdings's first year of paying a dividend, so it doesn't have much of a history yet to compare to.

The Bottom Line

From a dividend perspective, should investors buy or avoid Best Mart 360 Holdings? Earnings per share have been shrinking in recent times. Worse, Best Mart 360 Holdings's paying out a majority of its earnings and more than half its free cash flow. Positive cash flows are good news but it's not a good combination. Bottom line: Best Mart 360 Holdings has some unfortunate characteristics that we think could lead to sub-optimal outcomes for dividend investors.

Curious about whether Best Mart 360 Holdings has been able to consistently generate growth? Here's a chart of its historical revenue and earnings growth.

If you're in the market for dividend stocks, we recommend checking our list of top dividend stocks with a greater than 2% yield and an upcoming dividend.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.