Don't Ignore The Fact That This Insider Just Sold Some Shares In Saab AB (publ) (STO:SAAB B)

We note that the Saab AB (publ) (STO:SAAB B) Senior VP & Head of Business Area Aeronautics, Jonas Hjelm, recently sold kr107k worth of stock for kr305 per share. However we note that the sale only shrunk their holding by 7.4%.

Check out our latest analysis for Saab

Saab Insider Transactions Over The Last Year

Over the last year, we can see that the biggest insider sale was by the insider, Håkan Buskhe, for kr6.3m worth of shares, at about kr318 per share. That means that an insider was selling shares at around the current price of kr315. We generally don't like to see insider selling, but the lower the sale price, the more it concerns us. We note that this sale took place at around the current price, so it isn't a major concern, though it's hardly a good sign. Notably Håkan Buskhe was also the biggest buyer, having purchased kr6.8m worth of shares.

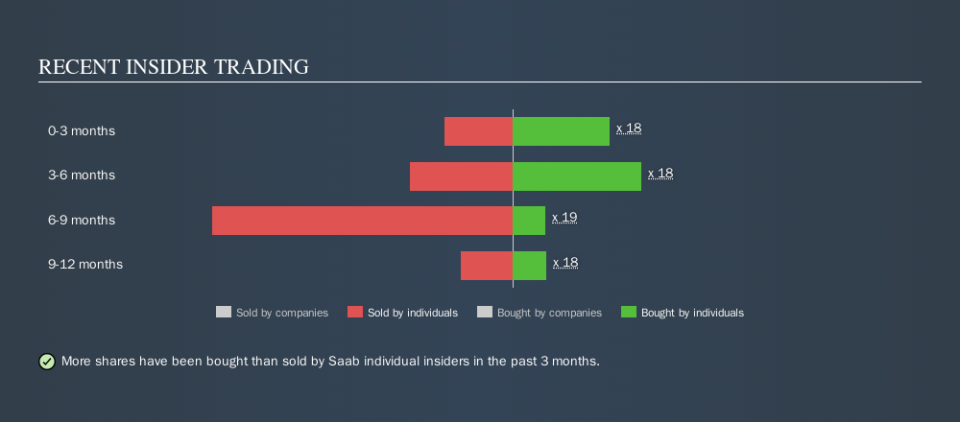

Over the last year, we can see that insiders have bought 23440.309999999998 shares worth kr6.8m. On the other hand they divested 41882.36 shares, for kr13m. Over the last year we saw more insider selling of Saab shares, than buying. You can see a visual depiction of insider transactions (by individuals) over the last 12 months, below. If you want to know exactly who sold, for how much, and when, simply click on the graph below!

I will like Saab better if I see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Insider Ownership of Saab

Another way to test the alignment between the leaders of a company and other shareholders is to look at how many shares they own. Usually, the higher the insider ownership, the more likely it is that insiders will be incentivised to build the company for the long term. Insiders own 0.2% of Saab shares, worth about kr99m. This level of insider ownership is good but just short of being particularly stand-out. It certainly does suggest a reasonable degree of alignment.

So What Does This Data Suggest About Saab Insiders?

The recent insider purchases are heartening. On the other hand the transaction history, over the last year, isn't so positive. The more recent transactions are a positive, but Saab insiders haven't shown the sustained enthusiasm that we look for, although they do own a decent number of shares, overall. So they seem pretty well aligned, overall. Therefore, you should should definitely take a look at this FREE report showing analyst forecasts for Saab.

Of course Saab may not be the best stock to buy. So you may wish to see this free collection of high quality companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.