Dow, Bitcoin Teeter as Markets Wait for FOMC Bounce

Neither Dow futures nor the bitcoin price showed much conviction ahead of Wednesday’s US stock market open, as Wall Street pined for a dovish FOMC statement on interest rates and crypto traders waited for BTC to make its next major push.

Dow Futures Hover Near Tuesday Close

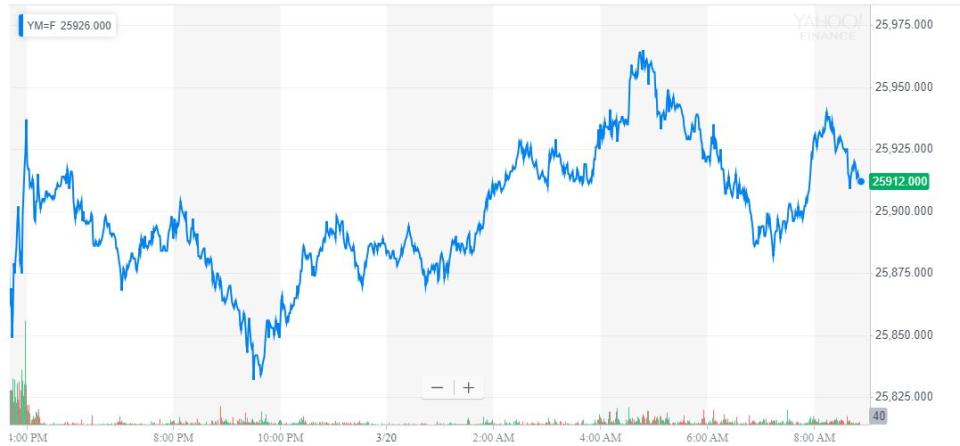

As of 9:05 am ET, Dow Jones Industrial Average futures had lost 14 points or 0.05 percent, implying a loss of 25.38 points at the open. S&P 500 and Nasdaq futures also slipped into the red, dropping 0.04 percent and 0.02 percent, respectively. Futures tracking all three indices had traded higher earlier in the day.

Dow futures bounced around Tuesday’s index close ahead of Wednesday’s opening bell. | Source: Yahoo Finance

On Tuesday, the stock market opened to sharp gains but bled lower throughout the day. By session close, the Dow had lost 26.72 points or 0.1 percent, while the S&P 500 ticked down by 0.37 points or 0.01 percent. The Nasdaq, despite giving up earlier gains, managed to close at 7,723.95 for a session increase of 9.47 points or 0.12 percent.

The afternoon sell-off was partially driven by China, which reportedly yanked key trade concessions, including removing the controversial Boeing 737 MAX 8 from the draft list of American products that it would buy to help the US reduce its trade deficit.

Stock Market Confident of Dovish FOMC Statement

This morning, US stock futures are bouncing around index close prices as Wall Street awaits the Federal Open Market Committee (FOMC) interest rate decision, which will be published within the Federal Reserve’s policy statement this afternoon at 2 pm ET.

As CCN reported, Fed Fund futures imply a staggering 98.7 percent chance that the Federal Reserve will not change interest rates, with the remaining 1.3 percent hedging against the outside chance that the Fed lowers rates more quickly than expected. Futures suggest there is virtually no chance that the central bank will raise rates in 2019.