Drop In Consumer Sentiment Shows U.S. Bracing For Recession. Are You Prepared?

The latest monthly report on consumers' economic outlook offers a reminder on why the average American needs to be prepared for any financial future.

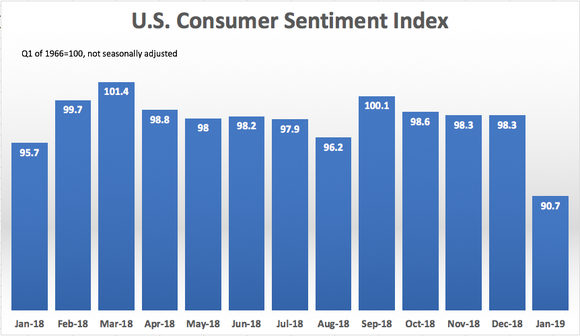

The University of Michigan's monthly consumer sentiment index for January fell 7.7% to 90.7 from a December reading of 98.3 in its preliminary report. That's the worst reading since just before the 2016 election. Economists polled by Refinitiv expected the index to fall to 96.4.

"The loss was due to a host of issues including the partial government shutdown, the impact of tariffs, instabilities in financial markets, the global slowdown and the lack of clarity about monetary policies," said Richard Curtin, chief economist for the Surveys of Consumers.

A downturn in consumer sentiment has some worried about the economy going forward. Image source: Getty Images

Curtin said that while the January falloff in optimism is certainly consistent with a slowdown in the pace of growth, it does not yet indicate the start of a sustained downturn in economic activity.

Other key takeaways from the report:

The index of consumer expectations also fell sharply to 78.3, down from 87.0 in December (a 10% drop).

The index for current economic conditions hit 110. It was 116.1 in December (down 5.3%).

What does this mean for overall economy?

The decline was primarily focused on prospects for the U.S. economy going into 2019, with the year-ahead outlook now judged to be the worst since mid-2014.

"Aside from the direct economic impact from these various issues on the economy, the indirect effect meant that half of all consumers believed that these events would have a negative impact on (President) Trump's ability to focus on economic growth," Curtin explained.

One bright spot Curtin noted was the strength in personal finances, which should keep consumption expenditures at favorable levels in 2019. But he cautioned that consumers are sensing a need to reinforce their precautionary savings, which could put a drag on discretionary spending.

"Evolving job and wage prospects, which were slightly weaker in early January, are critical to extending the current expansion," Curtin said.

The University of Michigan's Consumer Sentiment Index fell 7.6 points in January. Source: Surveys of Consumers, chart by author

What's a consumer to do?

Most personal finance experts emphasize the need for people to be prepared for potential downturns in their finances. It's prudent financial planning to amass three to six months worth of emergency living expenses in the bank to have at the ready for when life throws you a curveball, like another recession.

Because the U.S. economy is heavily reliant on consumer spending, downturns in outlook like this could lead to actual downturns in spending. How do you, consumer, prepare? If you work in retail, service industries, or sales, expect fewer customers to make purchases or fewer clients to buy your services. Plan ahead and build up your cushion. Knowing you have those available funds to get you through economic turmoil can be enough to improve your sentiment, which in turn, stimulates greater economic growth.

If you don't have three to six months worth of living expenses saved for emergencies, now is the time to start cutting your spending and building up your cash reserves. This might look like any number of things, depending on your circumstances. You could bring in extra money by starting a side hustle and joining the gig economy by dogwalking on Rover or driving for Uber. You could tutor neighbors or hold a garage sale after using Marie Kondo's decluttering technique to organize your home.

A caveat on this consumer sentiment survey: This survey is a gauge of general consumer sentiment and like any survey, may not accurately reflect the situation in your specific community. And as with any monthly report, sentiments change, in part, based on current events. But the signs are definitely pointing to a change. Being sure you are prepared for a downturn will help raise your personal sentiment about where the economy is headed.