Dropped by your property insurance provider? A premium spike? Here’s what you can do.

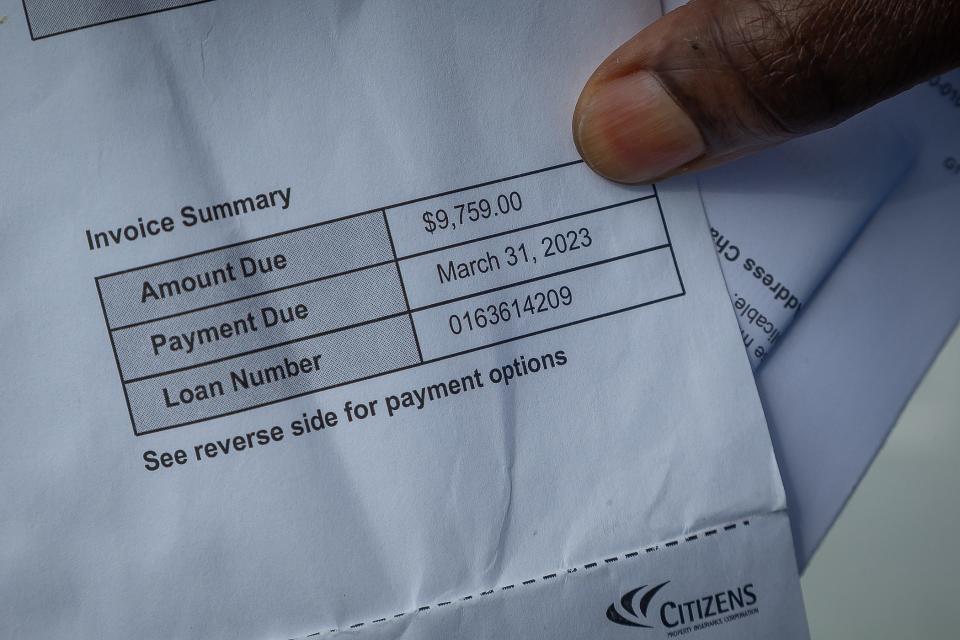

For more and more Florida homeowners, the bearer of bad news arrives in the mailbox. It’s a letter from your property insurance provider, either letting you know that your renewal is going up or that you’re being dropped altogether.

If you’re facing either of these situations, there are things that you can and should do. Chief among them: Contact your insurance agent as soon as possible.

“The good news, which is the bad news, is that we’re all in the same boat,” said Helen Borrero, an agent with Shoreline Insurance in Palm Beach Gardens.

Many Floridians are finding that the cost to insure their homes is reaching an unsustainable peak, to the point that some recently told The Palm Beach Post they were struggling to pay for necessities, putting off retirement or were considering leaving the Sunshine State.

Your home or car is flooded: Here's what to do now.

More: Florida lawmakers eye expanding property insurance reforms to all types of insurance

Borrero, who has worked in the industry for 30 years and in two other states, said she has “never seen it this bad.”

“We need to complain to our legislators, to our governor, to our senators, to our congressmen. They need to do something,” she said.

Here are tips experts offered in the event of high premiums or dropped coverage.

Should you do upgrades?

Having a conversation with your insurance agent can provide insight into why their premium went up in the first place.

After a client gets a high renewal, Mary Marquez, who owns Brightway Insurance in West Palm Beach, said she will look to shop around before even considering reducing coverage. Often that means getting a policy with the state-run Citizens Property Insurance Corp. if the price and amount of coverage is right.

The insurance market now is “very narrow,” Marquez said, so the options out there are limited.

“Now, it’s more like who is willing to offer me coverage,” she said. “As a consumer, it’s not like you’re going to be with Citizens for many years.”

There are other ways to reduce costs, but the results will vary and it all depends on the amount of risk a homeowner is willing to take.

One of Marquez’s clients opted to increase their hurricane deductible in order to reduce their premium, she said. That means in the event of a property-damaging storm, the homeowner will have to pay more to meet their deductible before the insurance company pays a claim.

Credits for certain home improvements can be applied to lower premiums but typically cost more than what the savings would be. Examples include installing alarms for fires and burglars; using specific hurricane-impact doors, windows and garages; and conducting a wind mitigation inspection.

Marquez would advise her clients to invest in home upgrades only to protect the home, not just for the insurance savings.

Added Borrero: “Just because you spend $50,000 on a roof doesn’t mean you get a huge credit on the policy. You’re just insurable because you have a new roof and more carriers are likely to accept your risk.”

Some insurance companies offer credits for homes that are within gated communities or how the home was built, like masonry or concrete blocks vs. wood frame, Borrero said.

‘I almost had a heart attack’: Florida homeowners rattled by property insurance costs

Another aspect to look at is the amount of coverage you have. Some homeowners without mortgages opt to go without wind insurance and take on that risk rather than pay an annual premium. Homeowners can also save by running a replacement cost estimator, which is a way to determine how much per square foot it will cost to replace the home. Homeowners can also switch from using replacement costs of their personal contents to actual cash value.

All told, homeowners should review their policy with their agent every year to make sure they’re getting the right amount of coverage.

Insurance provider going out of business?

Again, you should get in touch with your insurance agent after receiving notice that your insurance company is dropping your coverage, whether that's in the form of a policy cancellation if the company is in financial trouble or a non-renewal notice.

“Communication is key,” Barrero said. “Start shopping it. Get those inspections ready because everybody is going to ask for them.”

Insurance companies will likely ask for two inspections: wind mitigation and four-point. A wind mitigation inspection, which takes a look at the home’s features that protect against wind damage, is valid for five years. A four-point inspection that takes a look at roofing, plumbing, air conditioning and the electrical system is valid for 12 months.

Editorial: Fixing insurance means more than kissing up to big insurers

Your ability to shop around for coverage with the help of your insurance agent will depend on what type of agent they are. If they are a captive agent, they work for just one insurance company; if they’re an independent agent, they sell policies from multiple insurance companies.

The notice of non-renewal will come at the end of the policy's duration and will inform the homeowner when coverage will end. A canceled policy can come at any time, though. If you don’t have a new policy by that time, some insurance companies won’t insure you or will levy a fee against you for letting the coverage lapse through a no-prior-insurance surcharge.

If your agent isn’t being responsive, it might be time to shop for a new agent, too.

“If somebody tells you ‘no’ for an answer, or ‘it’s just Citizens,’ ask them why,” Marquez said. “Get on it right away.”

Hannah Morse covers consumer issues for The Palm Beach Post. Drop a line at hmorse@pbpost.com, call 561-820-4833 or follow her on Twitter @mannahhorse.

This article originally appeared on Palm Beach Post: Florida property insurance: What to do about premium hike, dropped coverage