Duke Energy: More demand for power means more gas plants, delaying NC carbon dioxide cuts

Duke Energy has told the N.C. Utilities Commission it wants to build additional natural gas plants and bring offshore wind farms online within the next decade to meet increased demand from booming economic development activity across the Carolinas.

The utility filed an update to its joint carbon reduction and resource plan filing last week, saying that an “unprecedented” amount of power needed by anticipated new large customers will force it to overhaul the plan it filed last year.

That increased demand means the utility needs to add 44.5 gigawatts across the Carolinas by 2038, up from 36.8 GW it estimated in its filing last year, according to Duke. At the same time, Duke intends to retire six North Carolina coal plants that total 8.45 GW of generation.

To accomplish all of that, Duke said it will need to delay compliance with a North Carolina state law that initially required it to slash carbon dioxide emissions by 70% from 2005 levels by 2030.

Instead, it intends to meet the goal by 2035, a target Duke said its modeling indicates is only possible if it builds offshore wind farms and small modular nuclear reactors. Those two technologies specifically allow the Utilities Commission to push back the carbon reduction deadline.

Clean energy and environmental advocates criticized the filing, arguing that more natural gas plants are an inefficient, ineffective way to reach net zero by 2050 and could end up being costlier than focusing on solar and wind energy. Key to that critique is concern that gas plants built in the latter part of this decade or early 2030s could end up being stranded assets, meaning North Carolina electricity customers will pay for them even though they are generating little or no electricity.

“What we need to really be careful of is that we’re making the right choice the first time to build these resources that are going to get us to our statutory clean energy targets, not building fossil fuels to satisfy short-term demand when those facilities are going to take 30 years to pay off,” Will Scott, the Environmental Defense Fund’s Southeast climate and clean energy director, said in an interview.

The 2021 state law said Duke must accomplish the carbon cuts as cheaply as possible while also assuring reliability. In its filing, Duke said that to meet the new demand while ensuring reliability and continuing the transition away from carbon-heavy resources, it needs to hasten the addition of new generation.

Duke’s plans include:

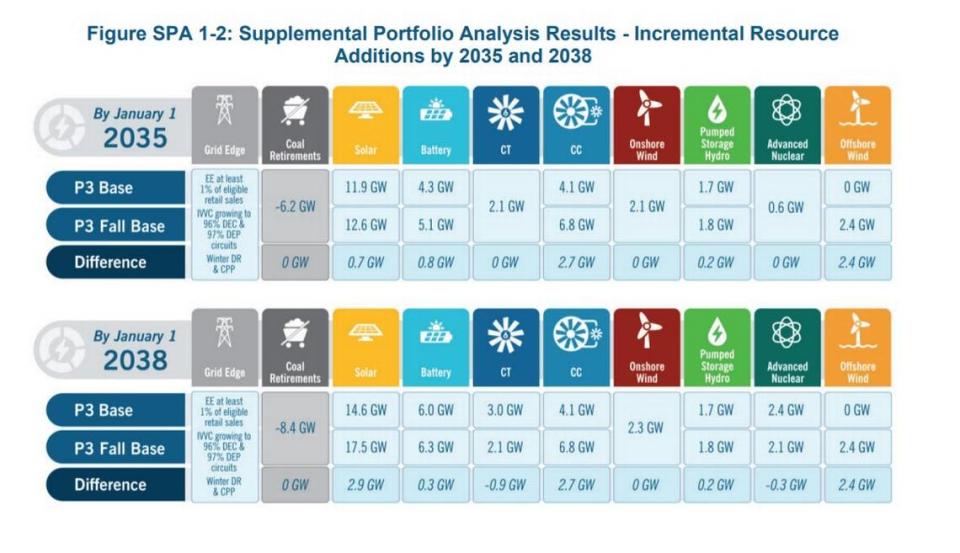

Increasing the amount of new solar brought online by 2033 from 8.8 to 9 gigawatts and by 2038 from 14.6 to 17.5 GW, including some increased procurement by 2026.

Increasing the amount of new natural gas in the Carolinas by 2033 from 6.2 to 8.9 GW, while removing a planned 0.85 GW of “peaker plant” generation by 2038. The increased amount of gas includes two proposed new gas plants in Person County instead of the previously announced one, with an additional new plant in South Carolina.

Add 2.7 GW of battery storage by 2031, with Duke’s model calling for a total of 5.1 GW by 2035 and 6.3 by 2038. That includes batteries that are paired with and charge from solar panels, as well as standalone batteries that charge from power on the grid.

Spending up to $14 million exploring what it would cost to add 2.4 GW of offshore wind from the three existing leases off North Carolina, with 0.8 available by 2033 and 1.6 more by 2038.

Spending up to $440 million through 2026 to explore small modular nuclear reactors, the first of which would be built at the Belews Creek site in Stokes County, possibly by early 2034. That would be followed by five similar reactors by the end of the 2030s. Over the next two years, Duke plans to select a reactor and vendor, submit early permits for the project and work on construction permits and license applications for Belews Creek. The first of up to six reactors would be planned for a second site by early 2037. The timeline developed by Duke would see half a gigawatt of advanced nuclear online by 2035, with 2.1 GW by 2038.

Spending up to $64.5 million through 2026 to develop 1.2 GWs of onshore wind that will be available by 2033, with roughly another gigawatt projected to come online by 2038.

Duke projects that its plan would increase electric bills for Duke Energy Carolinas customers $52 by 2033 and $80 by 2038. The projection for Duke Energy Progress customers is $57 by 2033 and $81 by 2038.

The Utilities Commission will review Duke’s plan along with alternatives and comments offered by environmental groups, industrial customers and other interested parties. It is expected to issue an order on the plan by the end of 2024.

Approval of the plan does not represent approval of the individual power plants, which still need to receive individual approvals from the commission, sometimes federal energy authorities and state environmental regulators.

‘A stranded asset bomb?’

Natural gas plants are typically opposed by environmental groups and scientists, who argue that they release methane, a high-powered but short-lived greenhouse gas while cutting — but not eliminating — carbon dioxide emissions.

But gas plants are a favored method of generation among other Southern utilities that, like Duke, are scrambling to meet increased demand.

In total, the plan calls for Duke to build 10 new gas plants between 2029 and 2033, including five combined-cycle turbine plants that will likely run much of the time and five less efficient combustion turbine plants that will likely run when demand is higher.

Duke told the Utilities Commission the gas plants will become increasingly important to maintain reliability and keep costs down as coal plants are retired.

Environmental groups are challenging the assumption that gas plants will end up being cheaper in the long run. And they have been quick to note that during Winter Storm Elliott’s Christmas Eve 2022 blackouts, equipment malfunctions at a gas plant in Rockingham County caused it to operate at reduced capacity.

Tyler Norris, a Ph.D. student at Duke University’s Nicholas School of the Environment, pointed to modeling in the update where Duke suggests the plants would cease burning gas by 2050, with hydrogen making up 6% of the company’s generation. At the same time, the gas plants would make up 16% of the utility’s potential power generation.

Phrased differently, the utility’s modeling suggests the gas plants will only be generating the maximum amount of power they are built for toward the beginning of their lives.

“Duke’s forecasted energy mix suggests that its proposed gas combined cycle plants will be fully utilized for only a limited number of years before those plants have to be curtailed to comply with the state’s decarbonization mandate,” Norris wrote in an email to The News & Observer.

He continued, “For this reason, these facilities may be among the most expensive combined cycle gas power plants recently proposed in the United States, on a levelized basis.”

Calculating cost on a levelized basis means taking the value of building and operating the plant over its assumed lifetime. If the plant can produce less energy after 2050 due to state law, the levelized cost could rapidly increase.

Combined cycle natural gas plants are one of the workhorses of Duke’s fleet, constantly generating power.

By comparison, combustion turbines are less efficient and more expensive to operate. Combustion turbines are typically used when demand is highest — they’re often referred to as “peaker plants” because they’re used when electricity demand peaks.

New gas plants are projected to have a useful life of at least 30 years. That means that a typical plant built today would likely either be operating into the 2050s, well past the period when North Carolina is supposed to have reached net zero;. Alternatively, its equipment would need to be overhauled so it could burn pure hydrogen or be shuttered even while customers are still paying for it.

The concern that the state’s utility customers will be paying for gas plants to not run increases with this filing, said Nick Jimenez, a Southern Environmental Law Center senior attorney who has represented numerous environmental groups in the Carbon Plan.

“They’re not going to be able to keep running in 2050,” Jimenez told The News & Observer. Shortly after, Jimenez said, “It looks like a stranded asset bomb.”

Gov. Roy Cooper’s office expressed similar concerns, calling for an approach that leans less on natural gas and more on wind and solar.

“This plan is a step in the right direction but it relies too much on natural gas which costs consumers and slows the progress toward clean energy that is required by law. Natural gas might benefit shareholders right now but it sticks ratepayers with the costs during price spikes and long after the plants close,” Jordan Monaghan, a Cooper spokesman, said in a statement.

Pipeline company seeks a shorter NC route with more natural gas. What does that mean?

Duke’s response

Asked how Duke plans to protect ratepayers as 2050 nears and the natural gas plants either transition to hydrogen or are used less often, Norton, the Duke spokesman, said the company believes it has chosen the best route forward.

“We believe our plan represents the most reasonable, least cost plan to serve customer needs while meeting the energy demands of a growing and economically vibrant region,” Norton wrote in an email

Notably, one of those new natural gas plants will be built in South Carolina. And Duke does not intend to count the emissions for that plant against its North Carolina target, the company wrote in its filing.

That means the electricity from that plant could be used to power homes in North Carolina, but the emissions from it would not count against the targets that are in North Carolina’s law.

Asked if the carbon accounting played a factor in siting the plant in South Carolina instead of North Carolina, Bill Norton, a Duke spokesman, pointed to economic growth across the two states, saying new generation is necessary everywhere.

“Carbon accounting played no role in the siting decision,” Norton wrote.

Hydrogen generation?

Another concern about the gas buildout is a lack of details in the plan about how Duke plans to generate the hydrogen the facilities are supposed to be able to burn along with — and eventually instead of — natural gas.

Duke’s most recent modeling shows the utility believes natural gas will be its dominant source of energy in the Carolinas in 2033, responsible for 39% of generation. That’s projected to slip to 25% by 2038 and then 0% by 2050.

Company officials have said the plants will be built to be capable of burning hydrogen along with natural gas. In its 2050 modeling, the company said hydrogen will make up 5% of North Carolina’s energy mix.

In its previous filing, Duke indicated that it expects to start mixing 1% hydrogen into its natural gas in 2035, increasing to 2% by 2038 and 3% by 2041.

Scott pointed to sparse details in the filing about how Duke plans to generate hydrogen. The utility was part of a Southeast Regional Hydrogen Hub proposal that would have brought billions of dollars of federal investment to the region, but the U.S. Department of Energy did not fund the proposal.

“We just have an open-ended commitment to gas hoping that the hydrogen will materialize down the line, but we haven’t seen any specifics on how Duke plans to make that happen especially given the rejection of the regional hydrogen hub proposal,” Scott said.

Increased demand

Duke officials told the N.C. Utilities Commission that when they conducted modeling in early 2023, they accounted for eight large economic development projects in the company’s North and South Carolina territories. When the company revamped its forecast for electricity demand later in 2023, it found 27 additional economic development projects with significant electricity demand.

The nature of many of those facilities exacerbates the demand crunch, according to Duke executives. In testimony filed with the Commission, Kendal Bowman, Duke’s North Carolina state president, said many of the new economic development projects need large amounts of energy around the clock.

“Importantly, if economic development continues on a trend similar to 2023, even more incremental resources will be needed to meet growing customer demand,” Bowman said.

Put together, those projects effectively mean adding three counties that would each be the third-largest Duke serves across the Carolinas, with each providing more demand than all but Wake and Mecklenburg, company officials said.

At the same time, Duke expects there to be nearly 175,000 electric vehicles on the road across the Carolina in 2038, much higher than the roughly 11,000 EVs that are being driven in 2024.

A lifeline for coal?

There is some concern among advocates that Duke could use the steadily growing demand for electricity to push back the 2035 deadline it set for itself to fully exit coal power generation.

“Until those plants officially come offline, there’s always the potential they’ll find some reason to just ramp them back up,” Jimenez said.

Duke has 8.4 gigawatts of coal-fired powerplants in the Carolinas, all located in North Carolina. Those plants not only release high levels of carbon dioxide, but are also increasingly expensive to fuel.

In its filing, Duke references a high-growth projection in which it sees a 40% growth in demand by 2033 compared to its projections from the fall.

“Under such a scenario, even more resource additions would be needed, and further, it would be necessary to consider potential deferral of select coal retirements and push out the target date for achieving the Interim Target,” Duke officials wrote in their North Carolina supplement, referencing the North Carolina law requiring it to decrease carbon dioxide emissions 70% from 2005 levels by 2030 with some limited exceptions.

In response to a question about whether the new load growth leaves open the possibility that coal could be left online past 2035, Norton, the Duke spokesman, wrote, “Exiting coal by 2035 limits significant future risks for our customers, and we continue to target that date.”

This story was produced with financial support from the Hartfield Foundation and Green South Foundation, in partnership with Journalism Funding Partners, as part of an independent journalism fellowship program. The N&O maintains full editorial control of the work. If you would like to help support local journalism, please consider signing up for a digital subscription, which you can do here.