The Dyadic International (NASDAQ:DYAI) Share Price Is Up 327% And Shareholders Are Delighted

While Dyadic International, Inc. (NASDAQ:DYAI) shareholders are probably generally happy, the stock hasn't had particularly good run recently, with the share price falling 12% in the last quarter. But that doesn't change the fact that the returns over the last three years have been spectacular. Indeed, the share price is up a whopping 327% in that time. So the recent fall doesn't do much to dampen our respect for the business. The only way to form a view of whether the current price is justified is to consider the merits of the business itself.

See our latest analysis for Dyadic International

Dyadic International recorded just US$1,743,236 in revenue over the last twelve months, which isn't really enough for us to consider it to have a proven product. So it seems that the investors focused more on what could be, than paying attention to the current revenues (or lack thereof). It seems likely some shareholders believe that Dyadic International has the funding to invent a new product before too long.

We think companies that have neither significant revenues nor profits are pretty high risk. There is almost always a chance they will need to raise more capital, and their progress - and share price - will dictate how dilutive that is to current holders. While some such companies go on to make revenue, profits, and generate value, others get hyped up by hopeful naifs before eventually going bankrupt. Of course, if you time it right, high risk investments like this can really pay off, as Dyadic International investors might know.

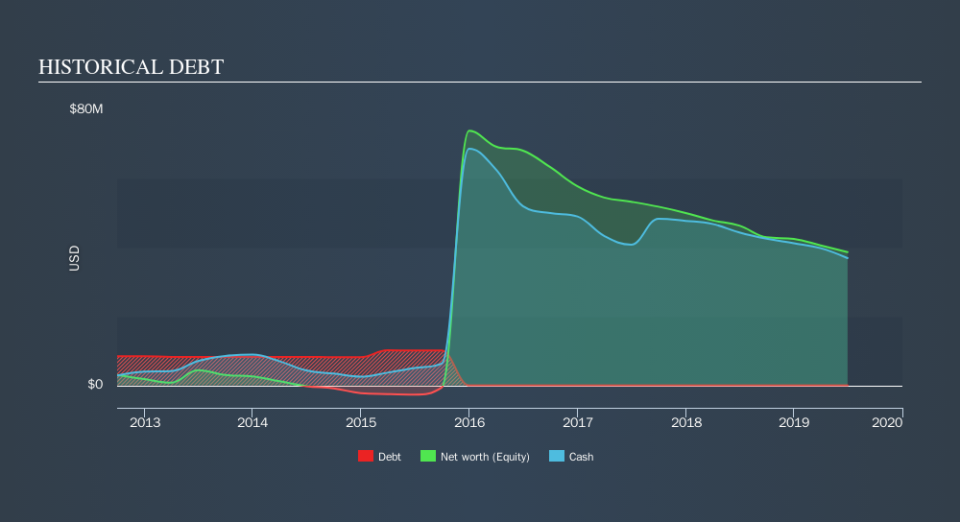

Dyadic International has plenty of cash in the bank, with cash in excess of all liabilities sitting at US$35m, when it last reported (June 2019). That allows management to focus on growing the business, and not worry too much about raising capital. And with the share price up 62% per year, over 3 years, the market is focussed on that blue sky potential. You can see in the image below, how Dyadic International's cash levels have changed over time (click to see the values). You can click on the image below to see (in greater detail) how Dyadic International's cash levels have changed over time.

It can be extremely risky to invest in a company that doesn't even have revenue. There's no way to know its value easily. One thing you can do is check if company insiders are buying shares. If they are buying a significant amount of shares, that's certainly a good thing. Luckily we are in a position to provide you with this free chart of insider buying (and selling).

A Different Perspective

It's nice to see that Dyadic International shareholders have received a total shareholder return of 267% over the last year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 31% per year), it would seem that the stock's performance has improved in recent times. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. You could get a better understanding of Dyadic International's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.