E-Commerce Aids Columbia Sportswear (COLM) Amid Low Store Traffic

Columbia Sportswear Company COLM, like many other textile-apparel players, has been benefiting from its growing e-commerce business. Also, the company’s focus on strategic priorities and store optimization bodes well. We believe that these factors keep the company well placed in the face of soft store traffic amid the pandemic and escalated cost burden. Further, on its fourth-quarter 2020 earnings call, the company issued the 2021 guidance, which is based on anticipations of sequential revival in retail store traffic as well as sales all through the year.

For 2021, the company expects net sales of $2.95-3 billion, indicating an 18-20% increase from the figure reported in the year-ago period. This is expected to be backed by spring and fall 2021 orders, continued growth in DTC e-commerce as well as growth revival in DTC brick-and-mortar sales. The company projects net sales growth in high teens percentage to the low 20% range in the first half of the year. In 2021, operating income is expected to be $320-$346 million, suggesting an operating margin of 10.8-11.5%. In 2020, the company’s operating income and margin came in at $137 million and 5.5%, respectively. Finally, management envisions earnings per share of $3.75-$4.05 for the ongoing year compared with $1.62 reported in 2020. Let’s delve deeper.

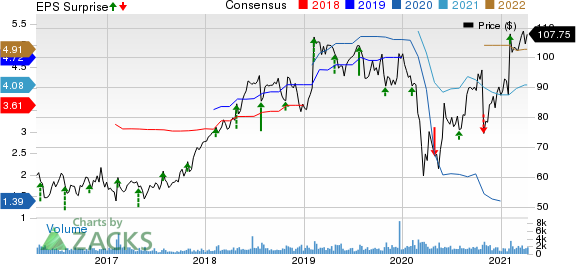

Columbia Sportswear Company Price, Consensus and EPS Surprise

Columbia Sportswear Company price-consensus-eps-surprise-chart | Columbia Sportswear Company Quote

E-commerce Strength & Strategic Priorities Aid

Columbia Sportswear remains on track with its Experience First initiative or the X1 initiative, which is aimed at enhancing e-commerce operations to keep pace with the evolving consumer environment. Notably, the company’s e-commerce platform has been largely operational during the pandemic, except for some distribution center closures. The company on its fourth-quarter 2020 earnings call noted that its mobile-first e-commerce platform, X1, performed brilliantly in the peak season and led to better site performance as well as conversion. X1 went live in North America for the Columbia, SOREL and Mountain Hardwear brands in the third quarter of 2020. Prior to this, the company had successfully deployed X1 across Europe and prAana in 2019.

In the fourth quarter of 2020, the company’s direct-to-consumer (DTC) e-commerce sales surged 41% and formed about one-fourth of the company’s total sales mix on the back of better-than-anticipated consumer demand. In full-year 2020, DTC e-commerce sales increased 39% and formed 19% of the total sales mix, with growth across all brands. Certainly, DTC e-commerce is seeing robust momentum, with more consumers opting to shop online. This channel is likely to continue performing well in the forthcoming periods. On its last earnings call, management said that the company will continue strengthening its DTC business and improving support processes. In fact, its guidance for 2021 includes continued growth in DTC e-commerce as well as growth revival in DTC brick-and-mortar sales.

Moving on, the company remains focused on its strategic priorities. To this end, it intends to continue with its demand creation investments, which are aimed at driving brand awareness and aiding sales. Further, the company remains committed to enhancing consumers’ experience and its digital capacity in all networks and regions. It will also continue exploring growth opportunities in the DTC business and improving support processes. Finally, it is keen on investing in its people and optimizing its organization across its brand portfolio. Notably, management remains encouraged about its e-commerce growth, which along with its wholesale orders for the spring and fall 2021 seasons is expected to aid continued business revival in 2021.

Further, Columbia Sportswear is on track with recalibrating its DTC store strategy, given the current retail landscape. The company shut 13 underperforming stores in the United States and one in Europe in 2020, which were mainly full-priced branded stores. The company intends to selectively restart store openings in 2021, depending on market conditions. At present, it expects to open about 8 stores in the United States, mainly outlet stores.

The Roadblocks

In fourth-quarter 2020, both earnings and sales declined year over year and were affected by concerns related to COVID-19. Most of the company-owned stores were open throughout the fourth quarter, apart from some isolated temporary closures due to local regulations or safety factors. However, management highlighted that brick-and-mortar traffic was significantly below the year-ago period’s level. Traffic has been most affected in stores and destination locations, as well as stores operating in markets dependent on tourists. The company expects traffic in these regions to remain soft till the resumption of international tourism activities. Further, it is battling industry-wide supply-chain and capacity restrictions, which in turn is leading to delayed receipts and customer deliveries.

Additionally, SG&A expenses, as a percentage of sales, have been rising year over year for the past few quarters. The metric went up from 36.1% to 37.5% in the fourth quarter of 2020. Also, the gross margin continued to be somewhat affected by elevated freight costs in the fourth quarter. The company’s operating income of $123.7 million declined 11%, with the operating margin contracting from 14.5% to 13.5%. Management intends to continue its investments to create demand, drive brand awareness and enhance digital capabilities. Though these investments are likely to fuel growth, they might weigh on margins.

That being said, the company has been focused on curtailing costs, which along with the abovementioned drivers should keep it well positioned. We note that this Zacks Rank #3 (Hold) company’s shares have rallied 15.4% in the past three months compared with the industry’s growth of 4.1%.

3 Solid Textile-Apparel Picks

Gildan Activewear GIL, with a Zacks Rank #1 (Strong Buy), has a long-term earnings growth rate of 9%. You can see the complete list of today’s Zacks #1 Rank stocks here.

G-III Apparel GIII, with a Zacks Rank #1, has a long-term earnings growth rate of 11.6%.

Delta Apparel DLA has Zacks Rank #1 and its bottom line has outperformed the Zacks Consensus Estimate by a wide margin in the trailing four quarters, on average.

These Stocks Are Poised to Soar Past the Pandemic

The COVID-19 outbreak has shifted consumer behavior dramatically, and a handful of high-tech companies have stepped up to keep America running. Right now, investors in these companies have a shot at serious profits. For example, Zoom jumped 108.5% in less than 4 months while most other stocks were sinking.

Our research shows that 5 cutting-edge stocks could skyrocket from the exponential increase in demand for “stay at home” technologies. This could be one of the biggest buying opportunities of this decade, especially for those who get in early.

See the 5 high-tech stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Columbia Sportswear Company (COLM) : Free Stock Analysis Report

GIII Apparel Group, LTD. (GIII) : Free Stock Analysis Report

Gildan Activewear, Inc. (GIL) : Free Stock Analysis Report

Delta Apparel, Inc. (DLA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research