E-mini Dow Jones Industrial Average (YM) Futures Technical Analysis – Strengthens Over 27015, Weakens Under 27009

December E-mini Dow Jones Industrial Average futures are trading lower as we move closer to the release of several announcements from the U.S. Federal Reserve at 18:00 GMT. Policymakers are expected to cut rates by 25 basis points. However, there is some uncertainty over the need for additional rate cuts in October and December. The Fed’s interest rate projections may shed some light on this issue.

At 15:16 GMT, December E-mini Dow Jones Industrial Average futures are at 27060, down 50 or -0.20%.

Rising inflation is one of the issues that could cause the Fed to be less-aggressive with its rate cuts than the financial markets anticipate.

“One of the recent concerns expressed by the Fed is that inflation has been stubbornly low,” said Willie Delwiche, investment strategist at Baird. “Latest figures for the median CPI, however, show inflation continuing to drift higher.”

“While not celebrating inflation in its own right, this does suggest that the economy could be moving out of the environment that has persisted in the wake of the financial crisis,” Delwiche said.

Daily Technical Analysis

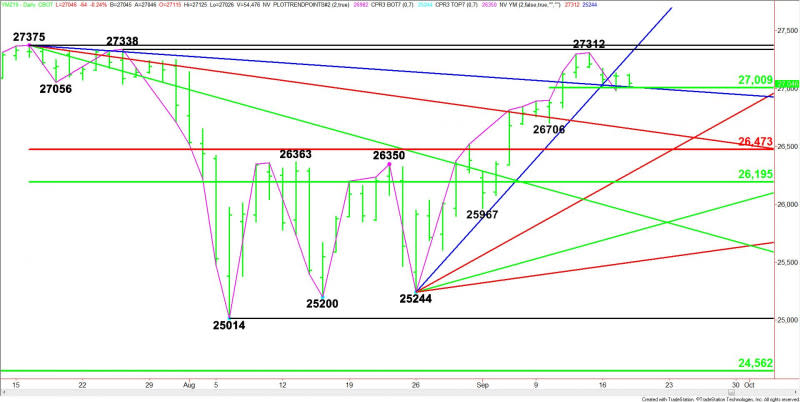

The main trend is up according to the daily swing chart. A trade through 27312 will signal a resumption of the uptrend. The Dow is in no position to change the main trend to down, but there is room for a normal 50% to 61.8% correction.

The minor range is 26706 to 27312. Its 50% level or pivot at 27009 has controlled the price action the last three sessions.

The major retracement zone support is 26473 to 26195.

Daily Technical Forecast

Based on the early price action and the current price at 27060, the direction of the December E-mini Dow Jones Industrial Average the rest of the session on Wednesday is likely to be determined by trader reaction to the downside Gann angle at 27015 and the minor pivot at 27009.

Bullish Scenario

A sustained move over 27015 will indicate the presence of buyers. If this can create enough upside momentum then look for a move into the uptrending Gann angle at 27292.

Overtaking 27292 will put the Dow in a bullish position with the next targets layered at 27312, 27338 and 27375.

Bearish Scenario

A sustained move under 27009 will signal the presence of sellers. This could be the trigger point for an acceleration into the minor bottom at 26708, followed closely be a downtrending Gann angle at 26655. If the angle fails then look for the selling to possibly extend into the Fibonacci level at 26473.

This article was originally posted on FX Empire

More From FXEMPIRE:

Global Markets Are Mixed, FOMC Decision At Hand, U.S. Housing Data Gives Big Surprise

EUR/USD Mid-Session Technical Analysis for September 18, 2019

Natural Gas Price Forecast – Natural gas markets pulled back ahead of Fed

S&P 500 Price Forecast – Stock markets looking for direction ahead of Fed

GBP/USD Price Forecast – British pound struggles at the 1.25 level again