Earnings Update: Internationella Engelska Skolan i Sverige Holdings II AB (publ) Just Reported And Analysts Are Boosting Their Estimates

Investors in Internationella Engelska Skolan i Sverige Holdings II AB (publ) (STO:ENG) had a good week, as its shares rose 3.9% to close at kr74.20 following the release of its quarterly results. It was a pretty mixed result, with revenues beating expectations to hit kr814m. Statutory earnings fell 2.0% short of analyst forecasts, reaching kr3.85 per share. Following the result, analysts have updated their earnings model, and it would be good to know whether they think there's been a strong change in the company's prospects, or if it's business as usual. We thought readers would find it interesting to see analysts' latest (statutory) post-earnings forecasts for next year.

Check out our latest analysis for Internationella Engelska Skolan i Sverige Holdings II

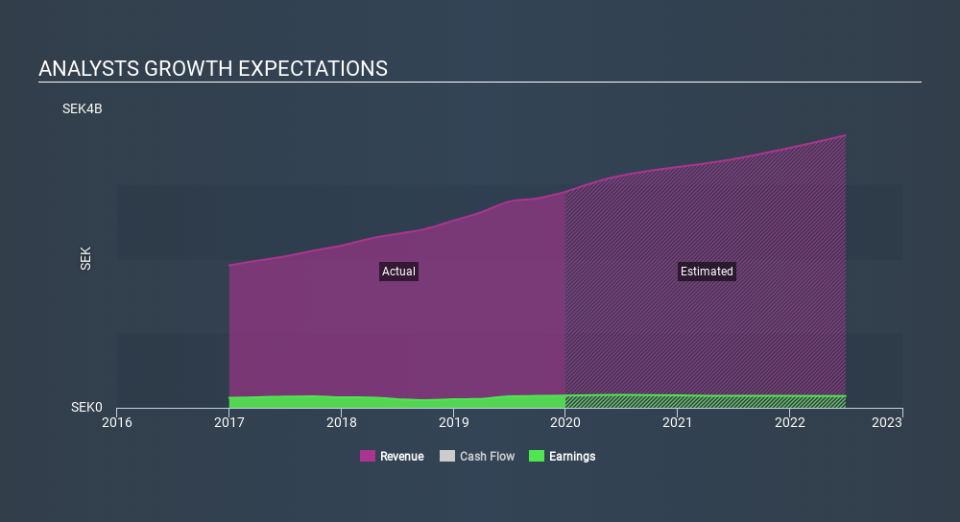

Following the latest results, Internationella Engelska Skolan i Sverige Holdings II's lone analyst are now forecasting revenues of kr3.11b in 2020. This would be a credible 7.5% improvement in sales compared to the last 12 months. Statutory earnings per share are expected to accumulate 7.4% to kr4.37. Before this earnings report, analysts had been forecasting revenues of kr2.96b and earnings per share (EPS) of kr3.85 in 2020. So it seems there's been a definite increase in optimism about Internationella Engelska Skolan i Sverige Holdings II's future following the latest results, with a nice increase in the earnings per share forecasts in particular.

Despite these upgrades, analysts have not made any major changes to their price target of kr82.00, suggesting that the higher estimates are not likely to have a long term impact on what the stock is worth.

It can be useful to take a broader overview by seeing how analyst forecasts compare, both to the Internationella Engelska Skolan i Sverige Holdings II's past performance and to peers in the same market. It's pretty clear that analysts expect Internationella Engelska Skolan i Sverige Holdings II's revenue growth will slow down substantially, with revenues next year expected to grow 7.5%, compared to a historical growth rate of 14% over the past three years. By way of comparison, other companies in this market with analyst coverage, are forecast to grow their revenue at 9.3% per year. Factoring in the forecast slowdown in growth, it seems obvious that analysts still expect Internationella Engelska Skolan i Sverige Holdings II to grow slower than the wider market.

The Bottom Line

The biggest takeaway for us from these new estimates is that the consensus upgraded its earnings per share estimates, showing a clear improvement in sentiment around Internationella Engelska Skolan i Sverige Holdings II's earnings potential next year. They also upgraded their revenue estimates for next year, even though sales are expected to grow slower than the wider market. There was no real change to the consensus price target, suggesting that the intrinsic value of the business has not undergone any major changes with the latest estimates.

With that in mind, we wouldn't be too quick to come to a conclusion on Internationella Engelska Skolan i Sverige Holdings II. Long-term earnings power is much more important than next year's profits. We have analyst estimates for Internationella Engelska Skolan i Sverige Holdings II going out as far as 2022, and you can see them free on our platform here.

Another thing to consider is whether management and directors have been buying or selling stock recently. We provide an overview of all open market stock trades for the last twelve months on our platform, here.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.