Easy Come, Easy Go: How IncentiaPay (ASX:INP) Shareholders Got Unlucky And Saw 95% Of Their Cash Evaporate

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

As an investor, mistakes are inevitable. But you want to avoid the really big losses like the plague. So take a moment to sympathize with the long term shareholders of IncentiaPay Limited (ASX:INP), who have seen the share price tank a massive 95% over a three year period. That'd be enough to cause even the strongest minds some disquiet. And over the last year the share price fell 79%, so we doubt many shareholders are delighted. The falls have accelerated recently, with the share price down 39% in the last three months.

While a drop like that is definitely a body blow, money isn't as important as health and happiness.

See our latest analysis for IncentiaPay

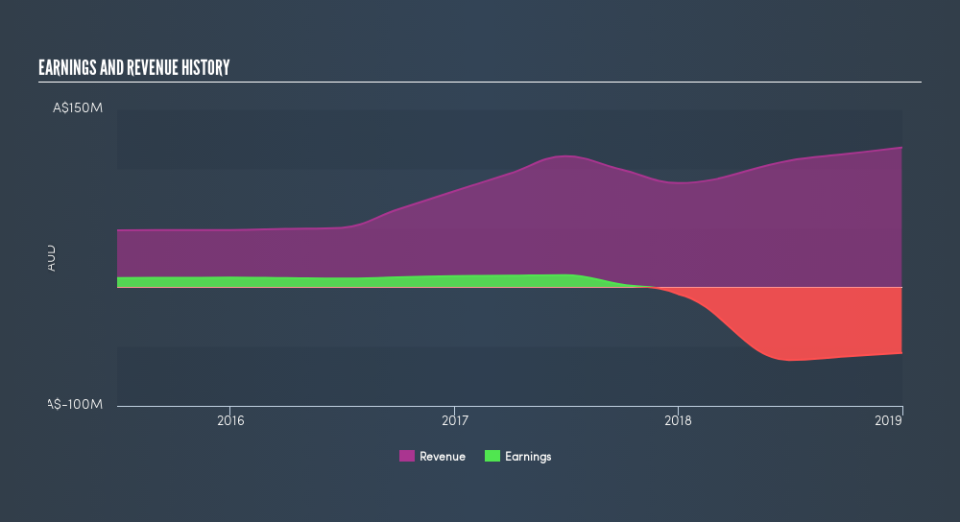

IncentiaPay isn't a profitable company, so it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over three years, IncentiaPay grew revenue at 28% per year. That is faster than most pre-profit companies. So on the face of it we're really surprised to see the share price down 62% a year in the same time period. The share price makes us wonder if there is an issue with profitability. Sometimes fast revenue growth doesn't lead to profits. If the company is low on cash, it may have to raise capital soon.

You can see how revenue and earnings have changed over time in the image below, (click on the chart to see cashflow).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. Dive deeper into the earnings by checking this interactive graph of IncentiaPay's earnings, revenue and cash flow.

A Different Perspective

Over the last year, IncentiaPay shareholders took a loss of 79%. In contrast the market gained about 12%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Shareholders have lost 60% per year over the last three years, so the share price drop has become steeper, over the last year; a potential symptom of as yet unsolved challenges. We would be wary of buying into a company with unsolved problems, although some investors will buy into struggling stocks if they believe the price is sufficiently attractive. If you want to research this stock further, the data on insider buying is an obvious place to start. You can click here to see who has been buying shares - and the price they paid.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.