Easy Come, Easy Go: How Kesar Terminals & Infrastructure (NSE:KTIL) Shareholders Got Unlucky And Saw 88% Of Their Cash Evaporate

As an investor, mistakes are inevitable. But you want to avoid the really big losses like the plague. So spare a thought for the long term shareholders of Kesar Terminals & Infrastructure Limited (NSE:KTIL); the share price is down a whopping 88% in the last three years. That would certainly shake our confidence in the decision to own the stock. The more recent news is of little comfort, with the share price down 55% in a year. Even worse, it's down 21% in about a month, which isn't fun at all.

We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

See our latest analysis for Kesar Terminals & Infrastructure

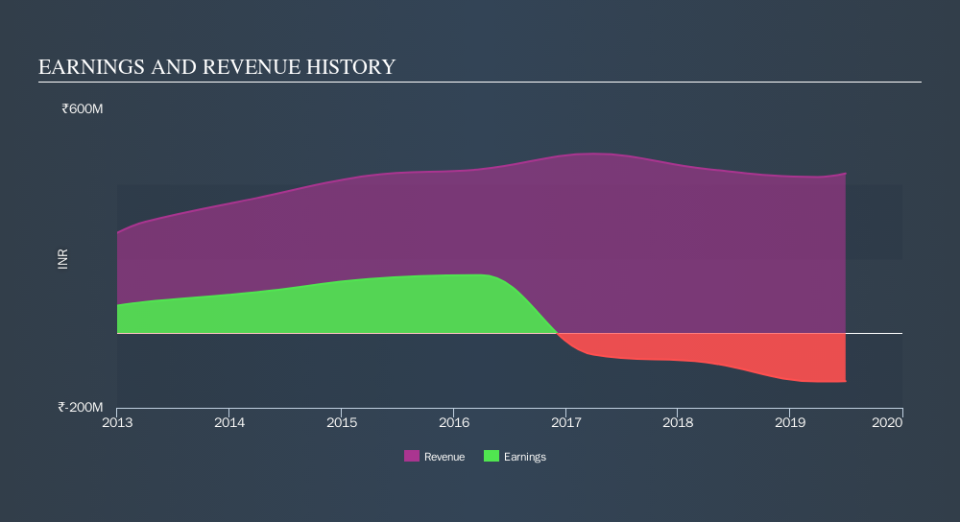

Given that Kesar Terminals & Infrastructure didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

This free interactive report on Kesar Terminals & Infrastructure's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Kesar Terminals & Infrastructure shareholders are down 54% for the year (even including dividends) , but the market itself is up 7.8%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 27% per year over five years. We realise that Buffett has said investors should 'buy when there is blood on the streets', but we caution that investors should first be sure they are buying a high quality businesses. Keeping this in mind, a solid next step might be to take a look at Kesar Terminals & Infrastructure's dividend track record. This free interactive graph is a great place to start.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.