Easy Come, Easy Go: How Oasmia Pharmaceutical (STO:OASM) Shareholders Got Unlucky And Saw 72% Of Their Cash Evaporate

Oasmia Pharmaceutical AB (publ) (STO:OASM) shareholders will doubtless be very grateful to see the share price up 52% in the last month. But will that heal all the wounds inflicted over 5 years of declines? Unlikely. Five years have seen the share price descend precipitously, down a full 72%. While the recent increase might be a green shoot, we're certainly hesitant to rejoice. The million dollar question is whether the company can justify a long term recovery.

See our latest analysis for Oasmia Pharmaceutical

We don't think Oasmia Pharmaceutical's revenue of kr11,166,000 is enough to establish significant demand. This state of affairs suggests that venture capitalists won't provide funds on attractive terms. So it seems shareholders are too busy dreaming about the progress to come than dwelling on the current (lack of) revenue. It seems likely some shareholders believe that Oasmia Pharmaceutical has the funding to invent a new product before too long.

We think companies that have neither significant revenues nor profits are pretty high risk. You should be aware that there is always a chance that this sort of company will need to issue more shares to raise money to continue pursuing its business plan. While some such companies go on to make revenue, profits, and generate value, others get hyped up by hopeful naifs before eventually going bankrupt. Oasmia Pharmaceutical has already given some investors a taste of the bitter losses that high risk investing can cause.

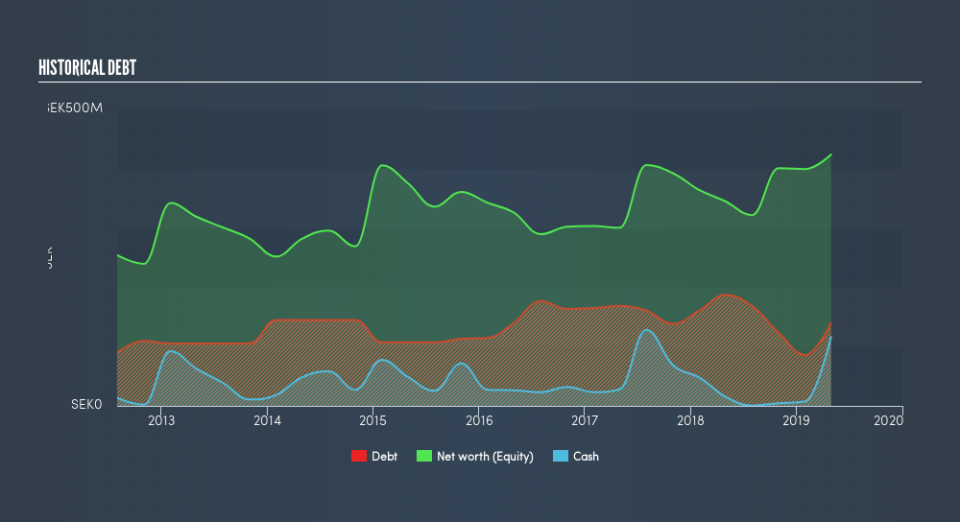

Our data indicates that Oasmia Pharmaceutical had kr106,061,000 more in total liabilities than it had cash, when it last reported in April 2019. That makes it extremely high risk, in our view. But with the share price diving 22% per year, over 5 years, it's probably fair to say that some shareholders no longer believe the company will succeed. The image below shows how Oasmia Pharmaceutical's balance sheet has changed over time; if you want to see the precise values, simply click on the image. You can see in the image below, how Oasmia Pharmaceutical's cash levels have changed over time (click to see the values).

In reality it's hard to have much certainty when valuing a business that has neither revenue or profit. Would it bother you if insiders were selling the stock? I'd like that just about as much as I like to drink milk and fruit juice mixed together. It costs nothing but a moment of your time to see if we are picking up on any insider selling.

A Different Perspective

Oasmia Pharmaceutical shareholders gained a total return of 1.0% during the year. But that was short of the market average. On the bright side, that's still a gain, and it is certainly better than the yearly loss of about 22% endured over half a decade. So this might be a sign the business has turned its fortunes around. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SE exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.