Easy Come, Easy Go: How Parkson Retail Asia (SGX:O9E) Shareholders Torched 99% Of Their Cash

Some stocks are best avoided. It hits us in the gut when we see fellow investors suffer a loss. For example, we sympathize with anyone who was caught holding Parkson Retail Asia Limited (SGX:O9E) during the five years that saw its share price drop a whopping 99%. And it's not just long term holders hurting, because the stock is down 67% in the last year. There was little comfort for shareholders in the last week as the price declined a further 38%.

While a drop like that is definitely a body blow, money isn't as important as health and happiness.

View our latest analysis for Parkson Retail Asia

Parkson Retail Asia wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

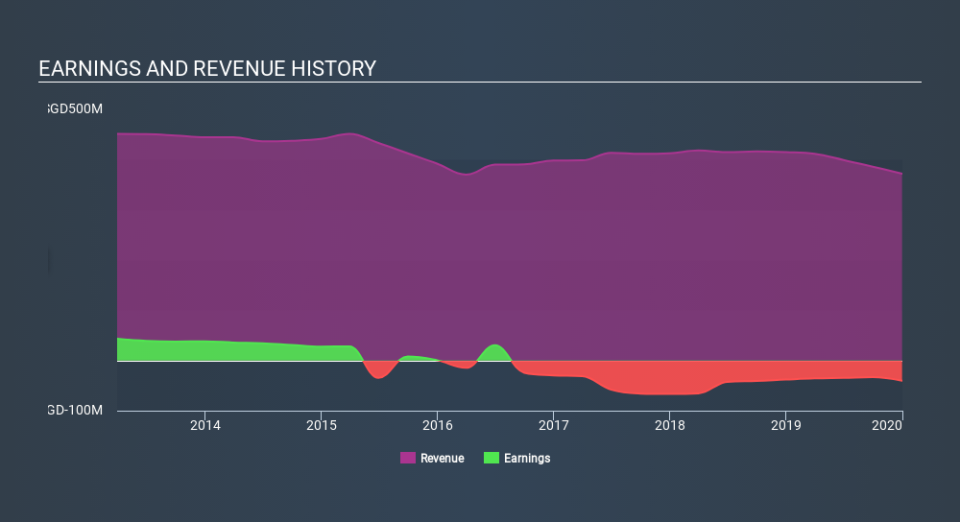

Over half a decade Parkson Retail Asia reduced its trailing twelve month revenue by 1.2% for each year. That's not what investors generally want to see. The share price fall of 62% (per year, over five years) is a stern reminder that money-losing companies are expected to grow revenue. It takes a certain kind of mental fortitude (or recklessness) to buy shares in a company that loses money and doesn't grow revenue. That is not really what the successful investors we know aim for.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

While the broader market lost about 22% in the twelve months, Parkson Retail Asia shareholders did even worse, losing 67%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 61% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. It's always interesting to track share price performance over the longer term. But to understand Parkson Retail Asia better, we need to consider many other factors. Even so, be aware that Parkson Retail Asia is showing 4 warning signs in our investment analysis , and 3 of those are significant...

We will like Parkson Retail Asia better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SG exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.