Easy Come, Easy Go: How Varvaressos European Spinning Mills (ATH:VARNH) Shareholders Got Unlucky And Saw 82% Of Their Cash Evaporate

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Long term investing works well, but it doesn't always work for each individual stock. We don't wish catastrophic capital loss on anyone. Spare a thought for those who held Varvaressos S.A. European Spinning Mills (ATH:VARNH) for five whole years - as the share price tanked 82%. Shareholders have had an even rougher run lately, with the share price down 23% in the last 90 days. We note that the company has reported results fairly recently; and the market is hardly delighted. You can check out the latest numbers in our company report.

While a drop like that is definitely a body blow, money isn't as important as health and happiness.

See our latest analysis for Varvaressos European Spinning Mills

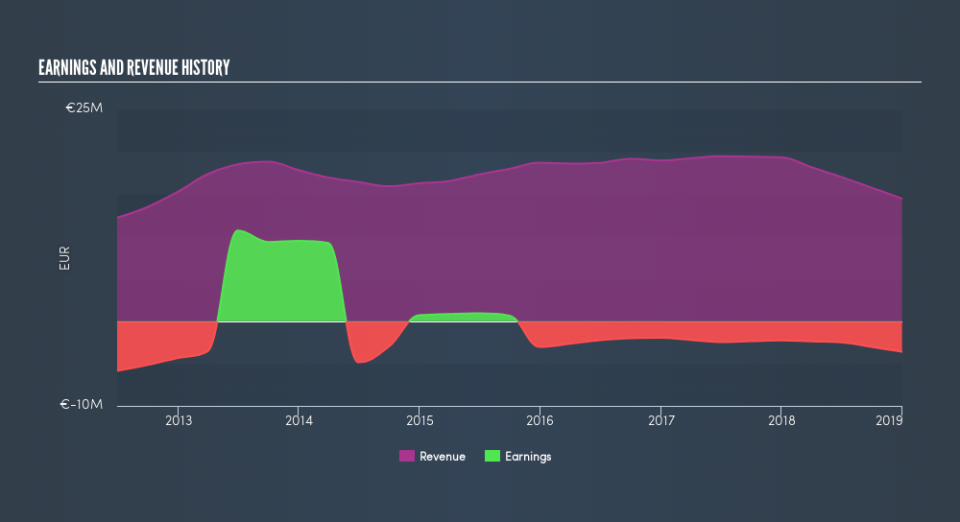

Varvaressos European Spinning Mills isn't a profitable company, so it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last half decade, Varvaressos European Spinning Mills saw its revenue increase by 0.7% per year. That's far from impressive given all the money it is losing. Nonetheless, it's fair to say the rapidly declining share price (down 29%, compound, over five years) suggests the market is very disappointed with this level of growth. While we're definitely wary of the stock, after that kind of performance, it could be an over-reaction. We'd recommend focussing any further research on the likelihood of profitability in the foreseeable future, given the muted revenue growth.

The chart below shows how revenue and earnings have changed with time, (if you click on the chart you can see the actual values).

Balance sheet strength is crucual. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between Varvaressos European Spinning Mills's total shareholder return (TSR) and its share price change, which we've covered above. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. We note that Varvaressos European Spinning Mills's TSR, at -76% is higher than its share price return of -82%. When you consider it hasn't been paying a dividend, this data suggests shareholders have benefitted from a spin-off, or had the opportunity to acquire attractively priced shares in a discounted capital raising.

A Different Perspective

Although it hurts that Varvaressos European Spinning Mills returned a loss of 3.1% in the last twelve months, the broader market was actually worse, returning a loss of 4.8%. What is more upsetting is the 25% per annum loss investors have suffered over the last half decade. This sort of share price action isn't particularly encouraging, but at least the losses are slowing. You could get a better understanding of Varvaressos European Spinning Mills's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

But note: Varvaressos European Spinning Mills may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GR exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.