Easy Come, Easy Go: How WLS Holdings (HKG:8021) Shareholders Got Unlucky And Saw 89% Of Their Cash Evaporate

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

As an investor, mistakes are inevitable. But you have a problem if you face massive losses more than once in a while. So spare a thought for the long term shareholders of WLS Holdings Limited (HKG:8021); the share price is down a whopping 89% in the last three years. That might cause some serious doubts about the merits of the initial decision to buy the stock, to put it mildly. The more recent news is of little comfort, with the share price down 25% in a year. On the other hand the share price has bounced 5.9% over the last week.

We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

See our latest analysis for WLS Holdings

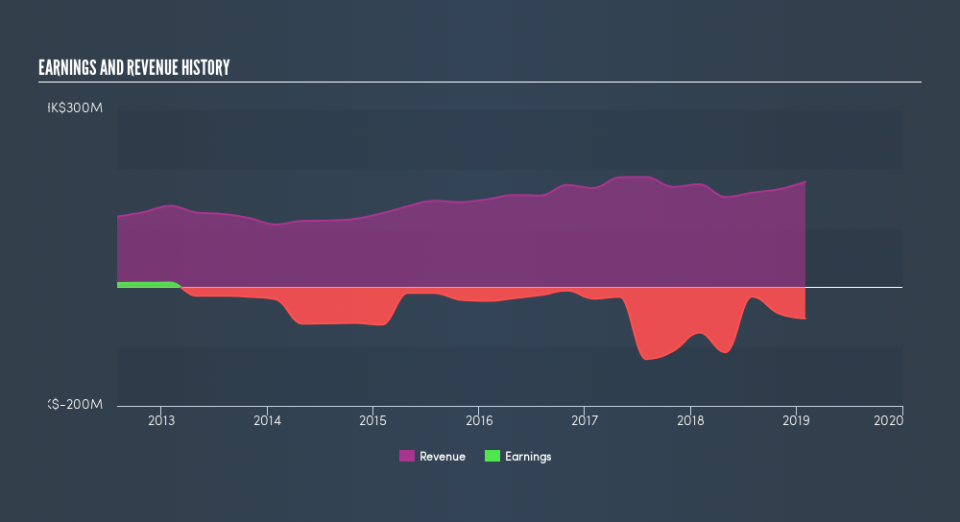

Because WLS Holdings is loss-making, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last three years, WLS Holdings saw its revenue grow by 2.4% per year, compound. That's not a very high growth rate considering it doesn't make profits. But the share price crash at 52% per year does seem a bit harsh! We generally don't try to 'catch the falling knife'. Before considering a purchase, take a look at the losses the company is racking up.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

This free interactive report on WLS Holdings's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

The last twelve months weren't great for WLS Holdings shares, which performed worse than the market, costing holders 25%. Meanwhile, the broader market slid about 1.1%, likely weighing on the stock. Unfortunately, the longer term story isn't pretty, with investment losses running at 52% per year over three years. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.