Is Eclipse Resources Corp (ECR) A Good Stock To Buy?

It was a rough fourth quarter for many hedge funds, which were naturally unable to overcome the big dip in the broad market, as the S&P 500 fell by about 7% during October and average hedge fund losing about 3%. The Russell 2000, composed of smaller companies, performed even worse, trailing the S&P by about 4 percentage points during the first half of Q4, as investors fled less-known quantities for safe havens. This was the case with hedge funds, who we heard were pulling money from the market amid the volatility, which included money from small-cap stocks, which they invest in at a higher rate than other investors. This action contributed to the greater decline in these stocks during the tumultuous period. We will study how this market volatility affected their sentiment towards Eclipse Resources Corp (NYSE:ECR) during the quarter below.

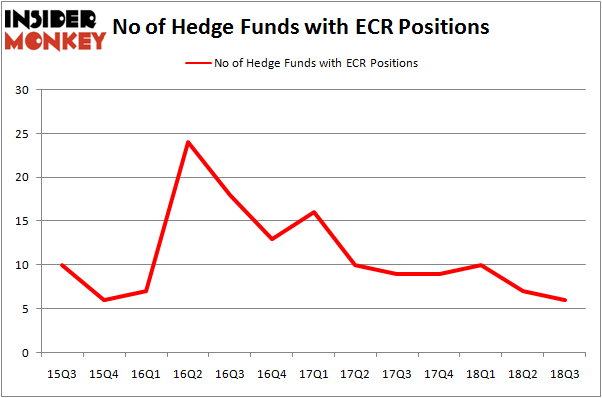

Eclipse Resources Corp (NYSE:ECR) has experienced a decrease in hedge fund sentiment of late. ECR was in 6 hedge funds' portfolios at the end of the third quarter of 2018. There were 7 hedge funds in our database with ECR holdings at the end of the previous quarter. Our calculations also showed that ECR isn't among the 30 most popular stocks among hedge funds.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds' large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that'll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 24% through December 3, 2018. That's why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We're going to go over the latest hedge fund action encompassing Eclipse Resources Corp (NYSE:ECR).

How are hedge funds trading Eclipse Resources Corp (NYSE:ECR)?

At the end of the third quarter, a total of 6 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -14% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in ECR over the last 13 quarters. With hedge funds' sentiment swirling, there exists an "upper tier" of notable hedge fund managers who were adding to their stakes meaningfully (or already accumulated large positions).

Among these funds, Rubric Capital Management held the most valuable stake in Eclipse Resources Corp (NYSE:ECR), which was worth $4.3 million at the end of the third quarter. On the second spot was Renaissance Technologies which amassed $1.7 million worth of shares. Moreover, Fondren Management, D E Shaw, and Millennium Management were also bullish on Eclipse Resources Corp (NYSE:ECR), allocating a large percentage of their portfolios to this stock.

Because Eclipse Resources Corp (NYSE:ECR) has faced a decline in interest from the smart money, it's safe to say that there lies a certain "tier" of funds that decided to sell off their positions entirely by the end of the third quarter. At the top of the heap, Dmitry Balyasny's Balyasny Asset Management sold off the largest stake of the 700 funds tracked by Insider Monkey, worth about $0.1 million in stock, and Ken Griffin's Citadel Investment Group was right behind this move, as the fund said goodbye to about $0 million worth. These bearish behaviors are interesting, as total hedge fund interest fell by 1 funds by the end of the third quarter.

Let's now take a look at hedge fund activity in other stocks - not necessarily in the same industry as Eclipse Resources Corp (NYSE:ECR) but similarly valued. We will take a look at PAR Technology Corporation (NYSE:PAR), Guaranty Bancshares, Inc. (NASDAQ:GNTY), VSE Corporation (NASDAQ:VSEC), and Yintech Investment Holdings Limited (NASDAQ:YIN). All of these stocks' market caps are similar to ECR's market cap.

[table] Ticker, No of HFs with positions, Total Value of HF Positions (x1000), Change in HF Position PAR,5,19408,2 GNTY,4,14052,-1 VSEC,5,4244,-2 YIN,1,204,-1 Average,3.75,9477,-0.5 [/table]

View table here if you experience formatting issues.

As you can see these stocks had an average of 3.75 hedge funds with bullish positions and the average amount invested in these stocks was $9 million. That figure was $7 million in ECR's case. PAR Technology Corporation (NYSE:PAR) is the most popular stock in this table. On the other hand Yintech Investment Holdings Limited (NASDAQ:YIN) is the least popular one with only 1 bullish hedge fund positions. Compared to these stocks Eclipse Resources Corp (NYSE:ECR) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.

Related Content

How to Best Use Insider Monkey To Increase Your Returns

Billionaire Ken Fisher’s Top Dividend Stock Picks

30 Stocks Billionaires Are Crazy About: Insider Monkey Billionaire Stock Index