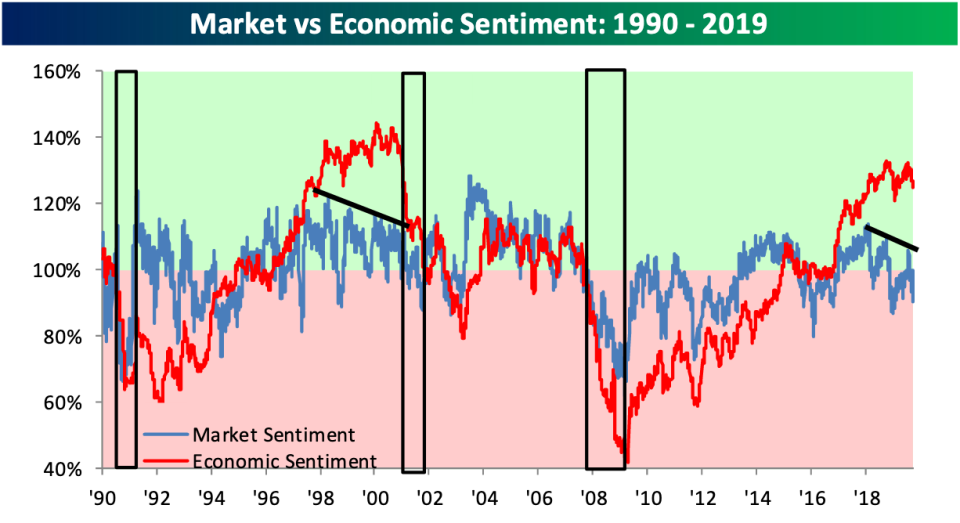

These diverging lines sum up the whole story: Morning Brief

Friday, October 11, 2019

The economy looks fine, the market disagrees

The final quarter of the decade has about 10 weeks left. And with the 2020s about to begin, the question everyone is asking themselves is when the next recession will hit the U.S. economy.

At Yahoo Finance's latest All Markets Summit held Thursday in New York, leaders from a variety of industries weighed in on the topic of the next recession.

Minneapolis Fed President Neel Kashkari most succinctly captured the general consensus about where we stand right now. "My base case scenario is not a recession," Kashkari told Yahoo Finance's Brian Cheung.

"I still think the US economy is going to grow, but the risks have materially increased to the downside," Kashkari added. The yield curve, the slowdown in manufacturing, and the decline in business investment in America are indicative of some concerning trends in the U.S. economy in Kashkari’s view. But with job growth continuing and wages rising, it is hard to view a recession as imminent.

"We are all concerned about the indicators we're seeing in manufacturing," said Barbara Humpton, CEO of Siemens USA. "That is a vital indicator for many, many of our customers. We understand the geopolitical factors at work right now."

Joe Ucuzoglu, CEO of Deloitte U.S., added during the same panel that, "The data are clear. Obviously, in the manufacturing sector across several key economies around the globe you do see some level of slowing."

Ucuzoglu noted, however, that, "manufacturing represents about 14% of the U.S. economy. And there are huge pockets of strength across the broader economy, including in the services segment." And as we've noted many times, the U.S. economy is ultimately defined by what happens in the service sector, which accounts for 85% GDP.

These "on the one hand, on the other" views of the economy are also largely in-line with what we see in economic data. On the one hand companies are worried about the economy, on the other hand, they continue to hire.

And this divergence is also captured in Bespoke Investment Group's latest sentiment report, which offers investors a great visualization of the divide we see across financial markets and economic indicators.

Overall, economic sentiment remains near its highest levels since before the tech bubble. And while this reading has oscillated some over the last year along with market volatility, the general read on the economy has remained upbeat.

Financial markets, however, have had decreasingly positive views, and the divide currently seen between economic and market sentiment is eerily similar to what was seen before the tech bubble.

"Will this current period be a repeat of the late 1990s?" Bespoke asks in a report published Thursday.

"It’s a small sample size, so it’s far from certain at this point, but investors should be extra vigilant for any signs of consumer sentiment starting to show significant signs of deterioration. Unfortunately, positive sentiment towards the economy can only get so strong until it starts to level out (which it has done in recent months) or even deteriorate."

With the U.S. economy currently still creating more jobs than are likely needed to support labor market growth, it is hard to build a base case scenario in which we soon enter a recession, as Kashkari outlines.

But we also can't ignore that markets are saying something negative about the outlook. Indicating, perhaps, a material increase in the downside risks to the economy.

By Myles Udland, reporter and co-anchor of The Final Round. Follow him @MylesUdland

What to watch today

Economy

8:30 a.m. ET: Import price index month-on-month, September (0.0% expected, -0.5% in August); Import price index year-on-year, September (-2.1% expected, -2.0% in August); Export price index month-on-month, September (-0.1% expected, -0.6% in August), Export price index year-on-year, September (-1.4% in August)

10:00 a.m. ET: University of Michigan Sentiment index, October preliminary (92.0 expected, 93.2 in September); U. of Mich. Current Conditions Index, October preliminary (109.0 expected, 108.5 in September); U. of Michigan Expectations Index, October preliminary (82.5 expected, 83.4 in September)

From Yahoo Finance

If you missed our Yahoo Finance All Markets Summit yesterday, watch it here. And here are some of the stories you missed from the event:

CFTC says cryptocurrency ether is a commodity, and ether futures are next

Eric Trump broadens his attacks on Democrats: Politics 'creates an evilness'

Bethenny Frankel: ‘Most people don’t work’

Merck CEO Kenneth Frazier on vaccines: 'We have to counter misinformation'

Top News

Oil spikes on Iran tanker explosion

With U.S. tariffs looming, China drums up hope for a partial trade deal

FAA failed to properly review 737 MAX jet anti-stall system: JATR findings

YAHOO FINANCE HIGHLIGHTS

The 2020 Social Security increase falls short

Dallas Fed's Kaplan: Yield curve was a 'reality check' for supporting earlier rate cuts

Democratic presidential hopeful Michael Bennet unveils ambitious affordable housing plan

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.