Economist: Auto industry could create the next recession

The Detroit auto show will once again give car lovers reasons to brave the crowds and the cold, such as a chance to see the 2020 Ford Shelby GT 500 in the steel flesh.

But the auto show's backstory is clouded by potential economic stumbling blocks at every corner — ranging from pinched pocketbooks to stormy trading on Wall Street to a highly volatile trade war between the United States and China, among other countries.

It's possible that "the auto business will create the next recession, not housing," Jonathan Smoke, chief economist for Cox Automotive, told a group of journalists gathered this week in Detroit for a preview of the annual industry and public gathering, officially called the North American International Auto Show.

The risks of a recession, which many including Smoke aren't forecasting for 2019, go up significantly if the trade war rages on and heavy tariffs disrupt the auto industry. An estimated 3 million to 4 million new car sales would be lost if the proposed tariffs were slapped on imported cars and auto parts — a decline that’s bigger than what would likely happen in the next recession, Smoke said.

The big worry ahead: President Donald Trump has threatened to put a 25-percent tariff on imported cars and auto parts sometime later in 2019.

So far, the United States has held off on Trump's threat, which the auto industry is very much against.

Right now, many auto companies expect to continue to be profitable in 2019, but the auto analysts still anticipate more job losses and a decline in sales.

More: Follow the latest auto show news

More: These are the best places to retire in every state

More: 'We're going to electrify the F-Series,' Ford exec says

Auto sales to dip in 2019

U.S. sales of cars and light trucks are projected to drop to 16.8 million in 2019, down from 17.2 million in 2018, according to Robert Dye, chief economist for Dallas-based Comerica.

Cox Automotive forecasts light-vehicle sales this year to finish 16.8 million cars and light trucks, as well. Cox sees sales slipping further to 16.5 million in 2020, noting that the risks go up for an even lower sales volume in 2020 if there is a recession.

General Motors and other auto makers remain more optimistic and project industry sales closer to something in the low-17 million range for 2019.

But Smoke said many people aren't focusing enough on a trade deadline looming next month, when the next step could be taken to put tariffs on all imported autos and parts.

A Feb. 17 deadline exists, he said, for the Trump administration to issue its report to justify using national security grounds for imposing tariffs on imported autos and parts. Section 232 of the Trade Act of 1962 grants the president broad legal authority to impose tariffs in the name of national security.

The administration used national security as the reason to earlier impose tariffs on imported steel and aluminum, which analysts say drove up car prices more than an estimated 1 percent. A tariff on Chinese parts raised car prices somewhat further.

Smoke said it's expected that there would be a six-month window to implement a new tariff of 25 percent on imported autos and parts. As a result, a move in February could be used as part of negotiations.

"They need a lever to get China, the European Union and Japan to do a trade deal late in the year," Smoke said.

The hope would remain that no major trading partner would actually be affected if trade negotiations were successful.

Stay connected: Sign up for USA TODAY's Cars newsletter

Trade fight a threat for autos

"The trade battle with China is probably the No. 1 risk we're going to monitor," said Carl Tannenbaum, chief economist at Northern Trust in Chicago.

Tannenbaum ranks what he calls "trade friction" as the top threat on the horizon for the U.S. auto industry.

"The outlook is a little cloudier for autos than it is for some other sectors," Tannenbaum said.

Congress also still must approve a trade deal negotiated by the Trump administration to replace the North American Free Trade Agreement.

"This setup is likely the best auto tariff protection the NAFTA region will see under Trump," wrote Morningstar auto analyst David Whiston in early January.

For that reason, he said the United States-Mexico-Canada Agreement, which was signed Nov. 30, 2018, should be ratified.

Whiston noted that ratification seems likely in Canada and Mexico, but the U.S. Congress, particularly the Democrat-controlled House of Representatives, has concerns about proper enforcement of the agreement's labor rights in Mexico.

"U.S. unions seem lukewarm on the agreement now, as do some Democrats, but we think USMCA needs to be ratified."

For auto executives, the trade issue is top-of-mind, even if it's not discussed in great detail.

Fiat Chrysler CEO Mike Manley told the Free Prees on Monday that the uncertainty surrounding cross border trading creates issues for the business, like it would for any company.

"The faster that we can get to certainty, the better it is for us," Manley said, "because it enables us to plan in an environment where we have a long enough view so that we know the investments that we're making are going to be right for the environment that we will find ourselves in when those investments come to fruition."

Trump tweets on Volkswagen

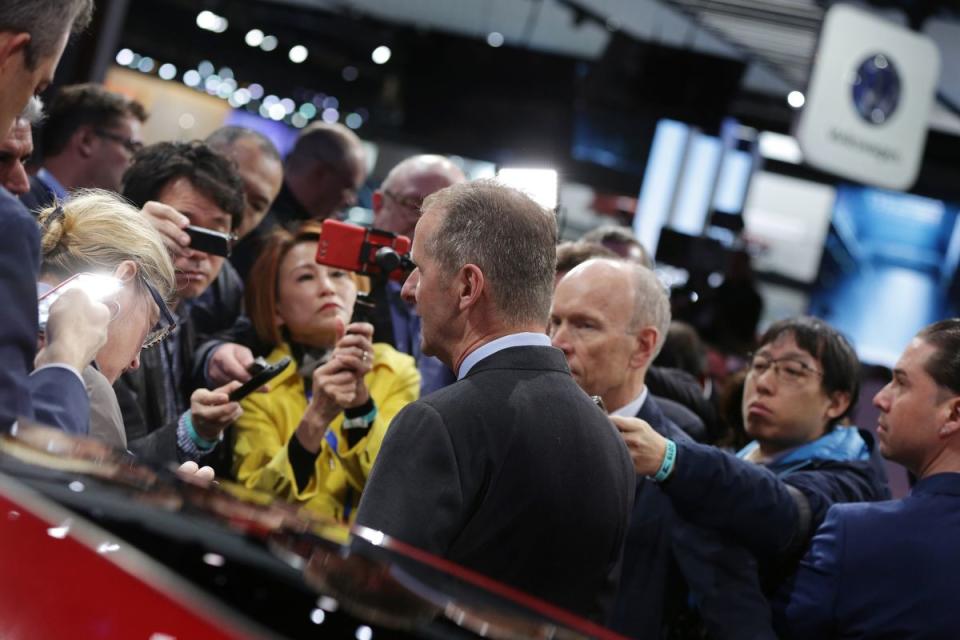

Herbert Diess, CEO of Volkswagen AG, said in a media roundtable Monday that he understands what's driving the Trump administration in its commitment to the manufacturing base and jobs here. And Volkswagen is making more moves to become more of a volume player in the United States.

The German automaker used the Detroit auto show Monday morning to announce big plans for its plant in Chattanooga, Tennessee, where the company will have its first electric vehicle facility in North America.

More: Volkswagen goes electric: Automaker to spend $800M, launch new facility

Tennessee Gov. Bill Haslam, whose term ends soon, took part in the Detroit announcement and wore a Volkswagen dress shirt embroidered with his name.

Trump praised the VW move in Tennessee via Twitter calling it "A big win!"

Volkswagen will be spending 800 million dollars in Chattanooga, Tennessee. They will be making Electric Cars. Congratulations to Chattanooga and Tennessee on a job well done. A big win!

— Donald J. Trump (@realDonaldTrump) January 15, 2019

The $800 million project is expected to generate another 1,000 jobs. The first Volkswagen electric vehicle is expected to roll out from the Chattanooga facility in 2022.

President Trump and executives from VW and other automakers in Germany discussed the investments of the auto companies in the United States in December. Trump has been trying to pressure the German automakers into opening more factories here.

Scott Keogh, president and CEO of the Volkswagen Group of America, would not speculate on the possibility of a 25-percent tariff on imported autos and parts being put in place. He would only say the company is working with concerns about trade issues in mind.

"We're setting up strategically for local sourcing," Keogh said. "These are all things we are navigating."

Trade, of course, isn't the only hurdle in the economic obstacle course ahead in 2019.

Interest rates may be headed even higher, with some expecting the Federal Reserve to raise rates one or two more times in 2019. Higher rates mean higher payments for auto buyers — and contribute to the possibility that more new car buyers could be pushed out of the market.

The average five-year, new car loan is 4.77 percent, up from 4.44 percent a year ago, according to Bankrate.com.

Higher-priced cars and SUVs, of course, only put more pressure on consumers. The average new car payment was $533 a month in 2018, according to Cox Automotive. That amounts to 10.2 percent of the median household income.

In general, most Americans cannot afford to spend 10 percent of their income on all their transportation costs, Smoke said.

Everyday consumers are increasingly asking: "Who can afford to pay for these new vehicles?’ ” said Charlie Chesbrough, Cox Automotive’s senior economist.

And while the vast majority of Americans don't care about the stock market, Chesbrough said, consumers who buy new cars and trucks do start to worry when they see triple-digit declines in the Dow Jones industrial average on a given day. Many have more wealth and invest some of their money in the market via their 401(k) plans, mutual funds or brokerage accounts.

Consider these statistics from Cox Automotive:

More than 54 percent of vehicles sold in 2012 were priced under $30,000. At the same time, only 6 percent were priced above $50,000.

By the end of 2018, about 23 percent of vehicles sold in the United States were priced above $50,000. And only one third were priced less than $30,000.

More: Shelby GT 500, Toyota Supra lead the parade of reveals at the Detroit auto show

The auto industry is pegging much of its fortunes on trucks and SUVs, not sedans, though Volkswagen unveils a new 2020 Passat at the Detroit auto show.

Plenty of good news is out there, of course. The U.S. jobless rate was 3.9 percent in December, up from the 49-year low of 3.7 percent in November. Gas prices are relatively cheap.

"Jobs are plentiful and wages are going up. Low oil prices are a positive too," Comerica's Dye said.

Economists have increasingly become more concerned about a potential recession in late 2020 or earlier — but not 2019.

"I expect to see a little cooler growth for the U.S. economy in 2019 compared with 2018," Dye said. "Global growth looks like it is cooling and the tailwind from the 2018 U.S. tax cuts will be fading through 2019."

No doubt, things just feel a little blah and way too unsettled even when you walk through the auto show, which is less glitzy than previous years.

Going forward, the fortunes of the auto industry will depend on whether the storm hits hard — or blows over — when it comes to trade talks, rate hikes and the timing of the next recession.

Contact Susan Tompor: stompor@freepress.com or 313-222-8876. Follow Susan on Twitter @Tompor.

This article originally appeared on Detroit Free Press: Economist: Auto industry could create the next recession