Economists all sound the same alarm after the better-than-expected jobs report

The October jobs report came in strong, but economists are not sanguine.

New non-farm payrolls came in at 630,000, versus 580,000 that was expected. The unemployment rate also dropped from 7.9% to 6.9%, 0.7 percentage points lower than economists' predictions.

But a slew of economists are sounding the same warning about the October numbers: Good as they may be, the benefits of government stimulus are down to the dregs, as COVID-19 cases are accelerating.

"Much of the strength in recent months has likely been due to CARES Act spending, which is now fading,” TD Securities economists wrote in note Friday. “The ongoing surge in COVID cases also cautions against extrapolating from the strength."

This week, the U.S. crossed the threshold of 100,000 new daily COVID cases and then hit 120,000 new cases Thursday, record highs for the virus.

Commentary from Moody’s echoed TD’s, adding that “without additional support, the resurgence of the pandemic will deal yet another blow to businesses in high-touch service sectors, which are already struggling to recover from the first shock.”

“Some of these firms may never recover, leaving a large number of people out of a job for an extended period,” Moody’s Robard Williams said.

With the protracted election and a divided Congress, there’s more pessimism for fiscal support than optimism.

November payrolls may fall outright

Amidst lockdowns and infection spikes earlier this year, bars, restaurants, cafés, hotels, and other parts of the hospitality and leisure industry were hit particularly hard. Similarly, when infections subsided and society reopened, the industry has seen a bounce back.

Unfortunately, with this new ongoing wave of infections, the hospitality industry is once again in the crosshairs.

“November warning lights are red,” wrote Pantheon’s Ian Shepherdson. “We expect the goods sector and retailing to continue strengthening, but the outlook for leisure and hospitality is now deteriorating rapidly as COVID infections and hospitalizations soar.”

Though the leisure and hospitality numbers were higher than in August, many economists share this view. Capital Economics senior U.S. economist Andrew Hunter said that the "slowdown in hiring in leisure and hospitality might be an early sign that virus concerns were starting to weigh.”

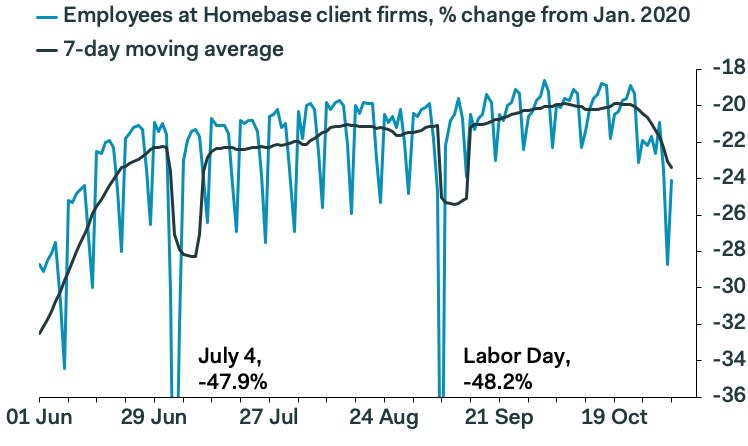

Data from Homebase, a popular employment scheduling software for small businesses, showed fewer employee payrolls at small businesses, Shepherdson pointed out, noting that this was "even before the wave of restrictions on activity we think will be imposed by state and local government over the next couple months."

Should the trend continue, Shepherdson sees November payrolls possibly falling outright, “by perhaps 500,000. And because they expect cases to top 200,000 per day by Thanksgiving, things don’t look rosy.

“We see little prospect of a quick turnaround,” wrote Shepherdson.

ING's James Knightley raised the same concern about what the virus will do to the service sector.

“Increased hospitalizations may force state Governors to take the tough decision to shut parts of the economy to try and contain the virus spread,” he wrote, and added that the retail sector is also vulnerable, not just the leisure and hospitality business.

The economy and the coronavirus are the same issue

Though some people — including many voters in exit polls — see the coronavirus and the economy as two different issues, this once again illustrates that they are one and the same. The coronavirus is directing the show.

Economists like Knightley are not confident that new legislation will come quickly to cushion the economic blow from the new surge like the CARES act, but see more response from the Federal Reserve as likely.

TD’s economics team added that the fact that October’s results were strong — even if the future looks bleak — “will lessen the case for another large fiscal stimulus package.” This scenario appeared to play out Friday morning as Senate majority leader Mitch McConnell indicated that the strong October jobs report supported the case for a smaller fiscal response.

Another consensus point from economists was that even though they considered the October numbers strong, they’re still way behind February.

"New month, same story," wrote Indeed's economic research director Nick Bunker. "The recovery continues, but we still don't know how long it will take."

-

Ethan Wolff-Mann is a writer at Yahoo Finance focusing on consumer issues, personal finance, retail, airlines, and more. Follow him on Twitter @ewolffmann.

Simple chart shows how much small businesses continue to struggle

Beware of ‘banks’ offering huge interest rates on savings accounts

63% of Americans have concerns about a coronavirus vaccine: Poll

Government should collect wealth data just like income: Berkeley economists

Intergenerational conflict is getting worse, Deutsche Bank warns

For tutorials and information on investing and trading stocks, check out Cashay

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit.