Ecopetrol (EC) Earnings and Revenues Increase Y/Y in Q1

Ecopetrol SA EC reported first-quarter 2019 net income of 2,745 billion Colombian pesos, higher than 2,615 billion Colombian pesos in the March quarter of 2018. Moreover, revenues of 15,943 billion Colombian pesos were higher than 14,643 billion Colombian pesos reported in the March quarter of 2018.

Higher daily oil equivalent production and increased transported volumes of the commodity attributed to the year-over-year improvement in quarterly results.

Segmental Performances

Being an integrated energy firm, Ecopetrol operates through Exploration and Production, Transportation and Logistics, and Refining and Petrochemicals segments.

Exploration and Production: The company generates operating income of 3,032 billion Colombian pesos from this business, which is marginally above 3,003 billion Colombian pesos a year ago. The surge in daily oil equivalent production backed this improvement.

The company produced 727.9 thousand barrels of oil equivalent per day (mboed), up from 701.0 mboed in the March quarter of 2018. Crude volumes — representing almost 82% of total production — were 597 thousand barrels per day (mbd), up from 577.9 mbd in the prior-year quarter.

Average realized Brent oil price was reported at $63.8 per barrel, down from $67.2 in the year-ago period.

Transportation and Logistics: The unit contributed operating profit of 2,247 billion Colombian pesos, up from 1,898 billion Colombian pesos in first-quarter 2018. This was owing to expansion in transported volumes of crude oil.

Refining and Petrochemicals: Ecopetrol incurred an operating loss of 240 billion Colombian pesos in this segment against a profit of 279 billion Colombian pesos in the comparable quarter last year. Lower margin from Barrancabermeja refinery hurt the segment’s performance.

Financial Position

Through first-quarter 2019, the company invested $647 million of capital. Of the total capital budget, production accounted for nearly 77%.

As of Mar 31, 2019, Ecopetrol had cash and cash equivalents of 8,938 billion Colombian pesos while total debt including short-term and long-term loans plus borrowings was roughly 37,728 billion Colombian pesos. The company’s debt-to-capitalization ratio is 41.7%.

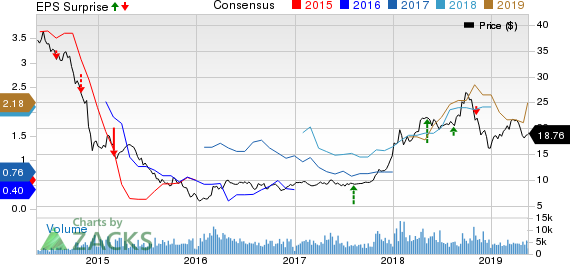

Ecopetrol S.A. Price, Consensus and EPS Surprise

Ecopetrol S.A. price-consensus-eps-surprise-chart | Ecopetrol S.A. Quote

Zacks Rank and Other Key Picks

Ecopetrolsports a Zacks Rank #1 (Strong Buy). Other prospective players in the energy space are Enterprise Products Partners LP EPD, Hess Corp. HES and Anadarko Petroleum Corp. APC. All the stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Enterprise Products has average positive earnings surprise of 17% for the past four quarters.

Hess is likely to witness earnings growth of 116.2% through 2019.

Anadarko Petroleum has average positive earnings surprise of 6.6% for the past four quarters.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +98%, +119% and +164% in as little as 1 month. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Enterprise Products Partners L.P. (EPD) : Free Stock Analysis Report

Ecopetrol S.A. (EC) : Free Stock Analysis Report

Anadarko Petroleum Corporation (APC) : Free Stock Analysis Report

Hess Corporation (HES) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research