Some Edison (WSE:EDN) Shareholders Have Copped A Big 58% Share Price Drop

Statistically speaking, long term investing is a profitable endeavour. But unfortunately, some companies simply don't succeed. For example the Edison S.A. (WSE:EDN) share price dropped 58% over five years. That's an unpleasant experience for long term holders. Shareholders have had an even rougher run lately, with the share price down 40% in the last 90 days.

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

View our latest analysis for Edison

Given that Edison didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

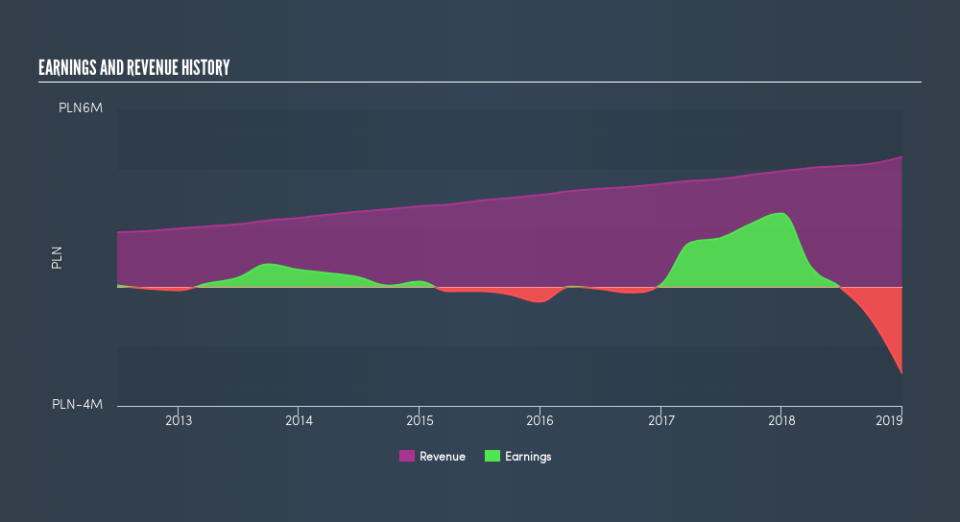

Over five years, Edison grew its revenue at 12% per year. That's a fairly respectable growth rate. The share price, meanwhile, has fallen 16% compounded, over five years. That suggests the market is disappointed with the current growth rate. That could lead to an opportunity if the company is going to become profitable sooner rather than later.

The graphic below shows how revenue and earnings have changed as management guided the business forward. If you want to see cashflow, you can click on the chart.

Take a more thorough look at Edison's financial health with this free report on its balance sheet.

A Different Perspective

We're pleased to report that Edison shareholders have received a total shareholder return of 9.0% over one year. Notably the five-year annualised TSR loss of 16% per year compares very unfavourably with the recent share price performance. This makes us a little wary, but the business might have turned around its fortunes. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

Of course Edison may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on PL exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.