Electric car drivers face £500 hit as insurance and tax bills rise

Electric car drivers face paying £500 a year more to keep their vehicles on the road as insurance premiums shoot up and tax charges kick in.

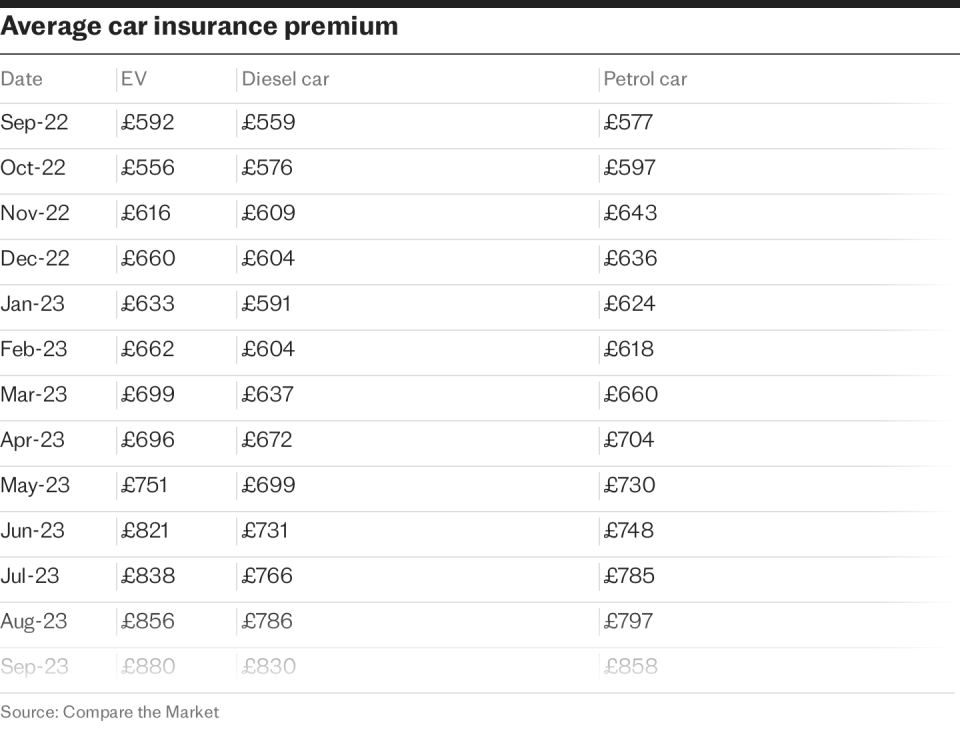

The average cost to insure an electric car rose by £313 year on year in November, growing from £616 to £929 in the space of 12 months, according to price comparison site Compare the Market.

Meanwhile, looming car tax changes will force owners to eventually pay an extra £180 a year in vehicle excise duty (VED).

Zero-emission vehicles are currently exempt from VED, with the tax levied on petrol and diesel vehicles using public roads. But this will change from April 2025.

Electric car owners will be liable to pay the standard rate of £180 a year, in a move which the Government says will “ensure all drivers begin to pay a fairer tax contribution”.

New electric cars registered on or after April 1, 2025, will pay £10 in the first year, before then going onto the standard £180 rate.

The Treasury predicts the expansion of the tax regime will be worth an additional £515m in 2025-26, £985m in 2026-27 and almost £1.6bn in 2027-28.

April 2025 will also bring an end to the “expensive car supplement” exemption for electric vehicles.

The tax, which costs £390 annually for five years after buying a car valued at £40,000 or more, will apply to around half of all electric vehicle models at current prices.

It is the latest consideration for those weighing up the switch to electric, as the Government pushes for most of the cars on the road to be battery-powered by the end of the decade.

There has been a distinct drop in demand for electric cars, with sales of new vehicles falling by 17.7pc last year according to figures from the Society of Motor Manufacturers and Traders.

The Government is also falling well short of its electric car charging infrastructure targets, having only installed at least six rapid or ultra-rapid chargers at a third of UK motorway service stations.

Insurance costs are rising amid concern over the dangers of electric vehicle fires.

Aviva temporarily removed insurance products for the Tesla Model Y, while John Lewis’s insurance underwriter, Covea, paused new insurance policies and renewals for all electric cars in September as it analysed risks and costs.

Repairs costs – exacerbated by a lack of trained mechanics – are also contributing to the heightened premiums.

Only 16pc of mechanics can work on electric vehicles, according to the Institute for the Motor Industry, and the cost of spare parts has grown as a result of rapid inflation. Replacing parts of electric vehicles can be particularly expensive, especially as a relatively minor collision has the potential to write off costly batteries.

Jonathan Hewett, chief executive of Thatcham Research, the motor insurers’ automotive research centre, believes insurance premiums will reduce once there is a better understanding of how the batteries work.

He said: “As more electric vehicles come onto the road, it’s pushing the costs of repairs up. We’re still in the very early stages of having battery-powered vehicles, and the understanding isn’t up there like it is with internal combustion.

“As the insurers get more data over time and when repair methods improve, they will be able to offer more cost-effective policies.”

Mr Hewett said he could not put a timeline on when premiums will begin to fall, but believes they will eventually ease.

He said he did not think the tax changes would have a large impact on electric car ownership, but that an improved roll-out of charging points will be key.

“The reductions in fiscal benefits may well be offset by the incentive of having cheaper day-to-day running. A lot of people I speak to love the performance of EVs but the thing they’re worried about is the ability to charge their vehicles,” he said.

Recommended

The seven potential hidden costs of your new electric vehicle