Warren’s wealth tax pitch: ‘We can invest in America’

Presidential candidate Elizabeth Warren’s proposed ultra-millionaire tax has been met with its fair share of criticism since she proposed it earlier this year.

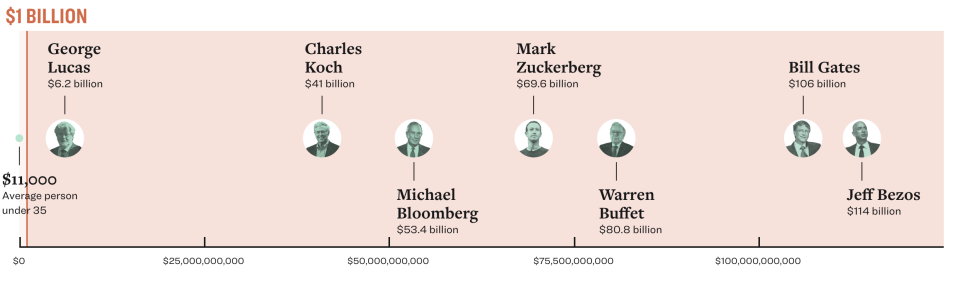

Warren’s wealth tax would impose an annual tax of 2% on every dollar of net worth a household has above $50 million, with the rate increasing to 6% for every dollar of net worth over $1 billion. However, some critics argue that this would stifle innovation and punish high earners for their success.

“They’re just wrong!” Warren said when asked about it during the Democratic presidential debate on Thursday. “The idea of a two cent tax on the great fortunes in this country, $50 million and above, for two cents, what can we do? We can invest in the rest of America.”

The Massachusetts senator argued that her wealth tax would be used to guarantee universal child care, provide early childhood education for every child in the country from ages 3 to 5, and cancel student loan debt.

“We can invest that 2% in early childhood education and child care,” Warren said. “That means those babies get top notch care. Their mommas can finish education.”

‘Building this economy from the ground up’

Earlier this week, Warren unveiled an interactive feature on her campaign website aimed at educating readers on the aspects of her ultra-millionaire tax and how it would shrink the wealth gap.

“It only applies to the richest 0.1% — so about 75,000 American households,” her page states. “Two cents on every dollar of wealth above $50 million, and another 4 cents for every dollar above $1 billion. Because that thin slice at the top has SO MUCH wealth, the tax would generate nearly $3 trillion over the next 10 years.”

According to economists Emmanuel Saez and Gabriel Zucman, Warren’s wealth tax would raise approximately $2.75 trillion over a decade, with $0.3 trillion coming from the billionaire 1% surtax. It would also generate 1.0% of GDP per year.

“We can start building this economy from the ground up,” Warren said.

Adriana is an associate editor for Yahoo Finance. Follow her on Twitter @adrianambells.

READ MORE:

Warren defends wealth tax: 'I'm tired of freeloading billionaires'

Elizabeth Warren unveils wealth tax calculator for 'confused' billionaires

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.