Emeco Holdings' (ASX:EHL) Stock Price Has Reduced59% In The Past Year

Want to participate in a short research study? Help shape the future of investing tools and earn a $40 gift card!

Taking the occasional loss comes part and parcel with investing on the stock market. Anyone who held Emeco Holdings Limited (ASX:EHL) over the last year knows what a loser feels like. The share price has slid 59% in that time. To make matters worse, the returns over three years have also been really disappointing (the share price is 32% lower than three years ago). Furthermore, it's down 22% in about a quarter. That's not much fun for holders.

Check out our latest analysis for Emeco Holdings

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Even though the Emeco Holdings share price is down over the year, its EPS actually improved. It's quite possible that growth expectations may have been unreasonable in the past.

It's surprising to see the share price fall so much, despite the improved EPS. So it's well worth checking out some other metrics, too.

Emeco Holdings' revenue is actually up 12% over the last year. Since the fundamental metrics don't readily explain the share price drop, there might be an opportunity if the market has overreacted.

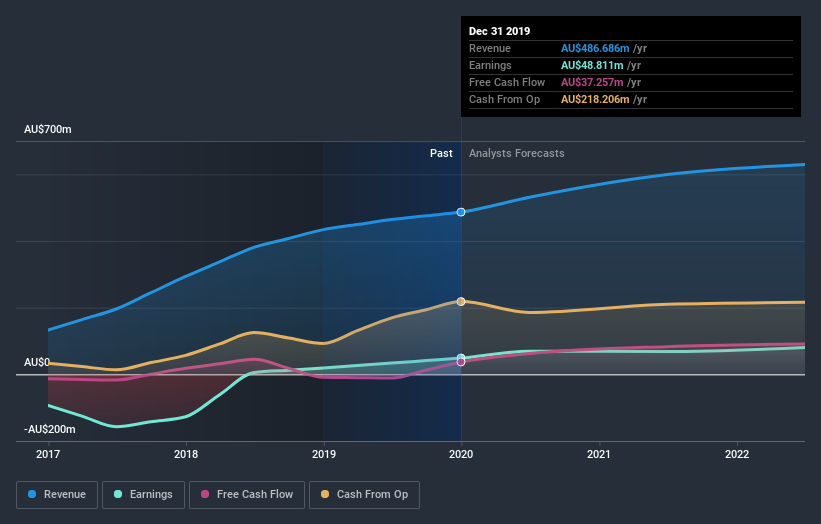

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We know that Emeco Holdings has improved its bottom line over the last three years, but what does the future have in store? This free interactive report on Emeco Holdings' balance sheet strength is a great place to start, if you want to investigate the stock further.

What about the Total Shareholder Return (TSR)?

We've already covered Emeco Holdings' share price action, but we should also mention its total shareholder return (TSR). The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Emeco Holdings' TSR of was a loss of 58% for the year. That wasn't as bad as its share price return, because it has paid dividends.

A Different Perspective

We regret to report that Emeco Holdings shareholders are down 58% for the year. Unfortunately, that's worse than the broader market decline of 7.0%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Longer term investors wouldn't be so upset, since they would have made 2.6%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Like risks, for instance. Every company has them, and we've spotted 4 warning signs for Emeco Holdings (of which 1 is significant!) you should know about.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.