Enterprise Products (EPD) Dips 2.7% Despite Q2 Earnings Beat

Enterprise Products Partners LP EPD reported second-quarter 2021 adjusted earnings per limited partner unit of 51 cents, which beat the Zacks Consensus Estimate of 50 cents. Moreover, the bottom line improved from the year-ago quarter’s profit of 47 cents.

Total quarterly revenues of $9,450 million surpassed the Zacks Consensus Estimate of $7,786 million. Also, the top line significantly increased from $5,751 million in the prior-year quarter.

The strong quarterly results can be attributed to higher contributions from the partnership’s natural gas processing business and increased pipeline transportation volumes in Petrochemical & Refined Products Services.

Despite the strong earnings results, the partnership’s stock price declined 2.7% since the earnings announcement on Jul 28. Investors believe that industry growth is unlikely to witness a significant acceleration in the medium term on the anticipation of continued volatility in the energy business as coronavirus variants are spreading rapidly across the major economies.

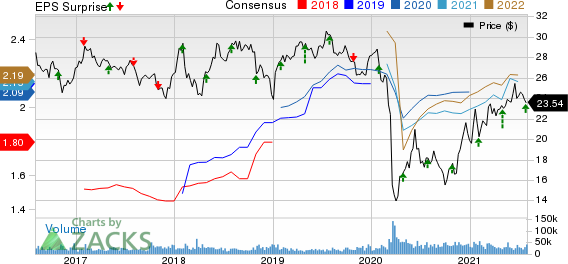

Enterprise Products Partners L.P. Price, Consensus and EPS Surprise

Enterprise Products Partners L.P. price-consensus-eps-surprise-chart | Enterprise Products Partners L.P. Quote

Segmental Performance

Gross operating income at NGL Pipelines & Services increased from $968.1 million in the year-ago quarter to $1,097.6 million. Higher contributions from the partnership’s natural gas processing business and related NGL marketing activities primarily aided the segment.

Natural Gas Pipelines and Services’ gross operating income decreased to $202 million from $208.9 million in the year-ago quarter. The decline was due to lower contributions from the partnership’s Permian Basin natural gas gathering system.

Crude Oil Pipelines & Services recorded a gross operating income of $418.9 million, which decreased from $634.4 million in the prior-year quarter, owing to a drop in fees and transportation volumes from the South Texas crude oil pipeline system.

Gross operating income at Petrochemical & Refined Products Services amounted to $326.3 million compared with $191.5 million a year ago, thanks to higher pipeline transportation volumes.

DCF

Quarterly distribution improved 1.1% year over year to 45 cents per common unit or $1.80 per unit on an annualized basis.

Adjusted distributable cash flow was $1,598.5 million, slightly up from $1,577.3 million a year ago, and provided coverage of 1.6X. Notably, the partnership retained $607 million of distributable cash flow in the June-end quarter.

Financials

In second-quarter 2021, Enterprise Products’ total capital expenditure was $634 million.

As of Jun 30, 2021, its outstanding total debt principal was $28.8 billion. Enterprise Products’ consolidated liquidity amounted to $5.4 billion, which included unrestricted cash on hand and available borrowing capacity under its revolving credit facility.

Outlook

The partnership expects growth capital spending of $1.7 billion and $800 million, respectively, for 2021 and 2022. It reiterates its sustaining capital spending of $440 million for 2021.

Zacks Rank & Stocks to Consider

Enterprise Products currently carries a Zacks Rank #3 (Hold).

Some better-ranked players in the energy space are Cabot Oil & Gas Corporation COG, PDC Energy, Inc. PDCE and Suncor Energy Inc. SU, each currently sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Cabot’s earnings for 2021 are expected to increase 10.3% year over year.

PDC Energy’s earnings for 2021 are expected to increase 23.2% year over year.

Suncor’s earnings for 2021 are expected to increase 21.3% year over year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cabot Oil & Gas Corporation (COG) : Free Stock Analysis Report

Enterprise Products Partners L.P. (EPD) : Free Stock Analysis Report

Suncor Energy Inc. (SU) : Free Stock Analysis Report

PDC Energy, Inc. (PDCE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research