'Epicenter of e-commerce': CVG's booming cargo business supports discount airlines

Just shy of 20 years ago, Cincinnati/Northern Kentucky International Airport offered few airlines and high prices.

As flyers get ready for the busy holiday season, they may not realize the 7,700-acre facility known as CVG is the fastest-growing cargo airport in the world. By 2026, CVG is aiming to be the “epicenter of e-commerce” and the linchpin of a regional “aviation ecosystem.”

“We’re working on it right now,” said Candace McGraw, CVG's chief executive since 2011. “We’re thinking about it.”

From 1947 start, Delta becomes dominant

In the 1940s, Cincinnati leaders wanted Lunken Airport in the East End to be the epicenter for Greater Cincinnati air travel. In the 1950s, they wanted the Blue Ash Airport to fill that role.

Northern Kentucky leaders made a counter proposal for a Boone County site and won Congressional support and dollars.

The first airfield opened at what became CVG in 1944 and the first terminal in 1946. The first commercial flight, from American Airlines, departed in 1947. Delta Air Lines launched the same day as American.

In the decades that followed, Delta gained dominance. In the 1980s, it made CVG a hub. In the 1990s, it built its own terminal. By the early 2000s, Delta had more than 600 flights in and out of CVG a day – pushing overall airport passenger traffic to more than 20 million a year during the first half of the decade.

In 2005, Delta and Comair – the regional carrier it owned from 1999 until its closure in 2012 – flew a full 90% of all CVG passengers, data from the U.S. Department of Transportation shows.

Delta’s fate – and that of CVG – changed after the airline filed for bankruptcy in fall of 2005. The 2008 recession and industry-wide airline consolidation added to the airline’s troubles and its slow contraction at CVG.

As Delta pulled back, CVG traffic slipped to around 10 million by 2009, then 6 to 7 million through the next few years.

New carriers arrive, post-Delta

McGraw is used to questions about the 20-million passenger peak. “I’m always sort of sensitive to that,” she said.

Because Delta passengers were mostly on connecting flights, she said, “probably 90% of those people never left our terminal building.”

So they weren’t parking in CVG garages and lots, shopping in Greater Cincinnati or returning to local jobs that fuel the economy.

McGraw thinks 2019’s passenger total of 9 million best tells the modern-day CVG story. That’s about three times the number flying non-connecting flights during the Delta years, she said.

The numbers are returning to that level, after crashing during COVID, said Bobby Spann, vice president of air service development. “We are now ahead of where we were pre-COVID,” he said.

During its heyday, Delta “could charge whatever they wanted to charge and people would pay it because they needed the air service,” McGraw said.

Delta’s decline – it now flies about 25% of all CVG passengers each year – “gave us the ability to attract additional carriers,” she said.

Frontier Airlines was first, in 2013, then Allegiant Airlines in 2014 and Southwest in 2017.

Two more airlines launched service this year – deep-discounter Breeze Airlines in February and British Airways with direct flights to London in June. Both are benefiting from a 2020 JobsOhio program that provides up to $10 million a year to Ohio airports to guarantee the revenue levels that new carriers promise.

Delta and American announced expansions in 2023, too, including competing seasonal flights to Cancun starting next month.

Airports need to offer choices to fuel economic growth, according to Janet Harrah, an economist with Northern Kentucky University’s Haile College of Business.

“It’s very hard to sell your region if you don’t have the capacity to fly executives back and forth on a cost-effective basis,” she said.

In adding new carriers, CVG is ever-more important to the local economy, Harrah said. In 2012, the airport had a $3.6 billion economic impact, counting taxes, employment, construction and other metrics. The impact rose to $6.8 billion in 2018, according to a study by NKU and the University of Cincinnati. A new study, due out soon, will show higher numbers.

No. 6 in U.S., No. 12 globally, for cargo business

Cargo, of course, is the current star of CVG.

At present, about 45% of the planes passing through CVG are carrying freight vs. 55% with passengers.

More importantly, cargo is paying the bills. The freight business, at more than 2 million tons a year, now brings in close to 70% of landing fees, the airport’s No. 2 source of revenue. Passenger flights bring in the rest. Those figures were flipped as recently as 2010.

The airport is thriving, in part, because its two giant freight tenants – DHL Express and Amazon Air – pay landing fees that “lower the overall cost for the passenger carriers to operate on the airfield here,” McGraw said.

The fact that both were in place well before COVID proved crucial.

“Cargo was immensely important to us in our bottom line throughout this pandemic situation,” McGraw said in an online presentation at the time. “It is literally helping us keep our lights on.”

Both operators are fully vested in CVG:

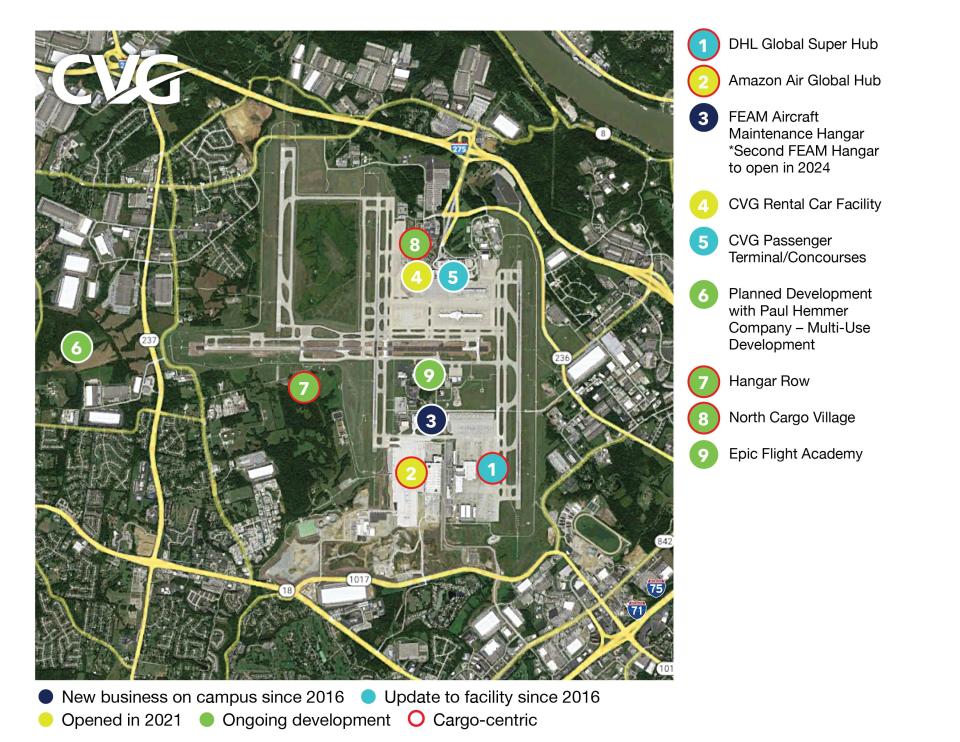

DHL, the international express shipping company that counts CVG as one of its three global hubs, will spend $192 million to open a new maintenance hangar by the end of 2025. It is taking 50 more acres of CVG land for the expansion, adding to its 194-acre footprint.

Express mail giant Amazon arrived in 2017, launching its $1.5 billion Amazon Air Hub in 2021. Now leasing 650 acres on the south side of CVG, Amazon has an option for 450 more acres to the north.

The two share credit for CVG’s ranking as fastest-growing cargo airport in the world, with a 70% surge in cargo business over the past five years, according to Airports Council International. That puts the airport at No. 6 for U.S. cargo and 12th largest globally in the council’s rankings.

Not every airport has had the foresight or facilities to make room for freight fliers, Harrah noted. “That’s a credit to leadership,” she said.

Construction projects, big and small

As CVG customers well know, construction has been a constant at the airport in recent years.

To reconfigure for new passenger and freight airlines, CVG tore down two terminals and a concourse, constructed new space for car rentals and ground transportation, and renovated baggage claim areas – all since 2017.

Work continues today. The airport is installing a new baggage handling system in its remaining terminal, along with a new exit system for arriving passengers. Concourse B is getting new jet bridges – the structures passengers walk through to get from the terminal to their planes.

CVG also has been adding food vendors. Skyline Chili and Frisch’s opened this month, following Braxton Brewing Taproom and Wendy’s earlier in the year.

Bigger projects are in the works:

North Cargo Village is seeking tenants that handle less time-sensitive freight, with a campus north of the terminal. Burrell Aviation of Aspen, Colorado, is the first taker, announcing plans in May to build a $20 million cargo warehouse on about 4.5 acres.

Hangar Row, on some 350 acres on the south side of CVG property, is envisioned for businesses that maintain and service aircraft. FEAM Aero will open a second maintenance hangar there, a $40.2 million investment, early next year. FEAM also partnered with Epic Flight Academy on a $7 million mechanic training facility, soon to open nearby.

A veriport may come to CVG sometime after that. The Kenton County Airport Board this fall OK’d spending close to $604,000 to investigate possibilities for a veriport, which would serve what are called “advanced air mobility” aircraft. AAMs move people and goods in aircraft, sometimes without pilots, powered by electricity or hybrid fuels.

COVID recovery, completion of plan

Like all airports, CVG has been in COVID-recovery mode in the last few years.

As cargo business saved the day, so did federal dollars. CVG took in $32.3 million in COVID-relief dollars between 2020 and 2022, according to its financial reports, no small amount for an organization with about $126 million in annual revenue.

Passenger traffic is bouncing back, hitting 7.9 million by this July 31, compared to 7.6 million for all of 2022.

As McGraw and her staff get to the end of a 2021-25 strategic plan, they are continuing to sell CVG as a place to conduct all kinds of aviation business.

McGraw, 60, will be on hand to see that through, with a contract she said ends in mid-2025. (The airport has not yet responded to the Enquirer’s public records request for the contract.)

After that?

“There’s nobody in town that loves their job more than I do,” she said. “But I also think there’ll be a time when it will be time for a fresh set of eyes and fresh energy to take it to the next level.”

This article originally appeared on Cincinnati Enquirer: CVG: How good is the airport, how busy is the airport?