With EPS Growth And More, Austco Healthcare (ASX:AHC) Is Interesting

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Austco Healthcare (ASX:AHC). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

Check out our latest analysis for Austco Healthcare

How Fast Is Austco Healthcare Growing Its Earnings Per Share?

In the last three years Austco Healthcare's earnings per share took off like a rocket; fast, and from a low base. So the actual rate of growth doesn't tell us much. As a result, I'll zoom in on growth over the last year, instead. Austco Healthcare has grown its trailing twelve month EPS from AU$0.0081 to AU$0.0088, in the last year. That amounts to a small improvement of 8.7%.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. To cut to the chase Austco Healthcare's EBIT margins dropped last year, and so did its revenue. That is, not a hint of euphemism here, suboptimal.

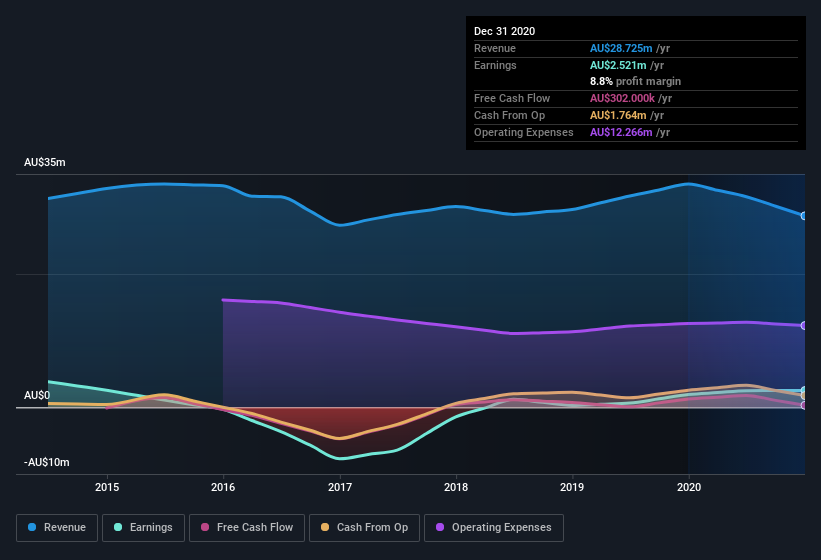

In the chart below, you can see how the company has grown earnings, and revenue, over time. For finer detail, click on the image.

Austco Healthcare isn't a huge company, given its market capitalization of AU$33m. That makes it extra important to check on its balance sheet strength.

Are Austco Healthcare Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

We haven't seen any insiders selling Austco Healthcare shares, in the last year. So it's definitely nice that CEO & Executive Director Clayton Astles bought AU$28k worth of shares at an average price of around AU$0.08.

On top of the insider buying, we can also see that Austco Healthcare insiders own a large chunk of the company. Actually, with 49% of the company to their names, insiders are profoundly invested in the business. I'm reassured by this kind of alignment, as it suggests the business will be run for the benefit of shareholders. Valued at only AU$33m Austco Healthcare is really small for a listed company. That means insiders only have AU$16m worth of shares, despite the large proportional holding. That's not a huge stake in absolute terms, but it should help keep insiders aligned with other shareholders.

Should You Add Austco Healthcare To Your Watchlist?

One positive for Austco Healthcare is that it is growing EPS. That's nice to see. Better yet, insiders are significant shareholders, and have been buying more shares. To me, that all makes it well worth a spot on your watchlist, as well as continuing research. Before you take the next step you should know about the 2 warning signs for Austco Healthcare (1 shouldn't be ignored!) that we have uncovered.

The good news is that Austco Healthcare is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.