With EPS Growth And More, Bank of Commerce Holdings (NASDAQ:BOCH) Is Interesting

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Bank of Commerce Holdings (NASDAQ:BOCH). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

Check out our latest analysis for Bank of Commerce Holdings

How Quickly Is Bank of Commerce Holdings Increasing Earnings Per Share?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS). It's no surprise, then, that I like to invest in companies with EPS growth. As a tree reaches steadily for the sky, Bank of Commerce Holdings's EPS has grown 28% each year, compound, over three years. If the company can sustain that sort of growth, we'd expect shareholders to come away winners.

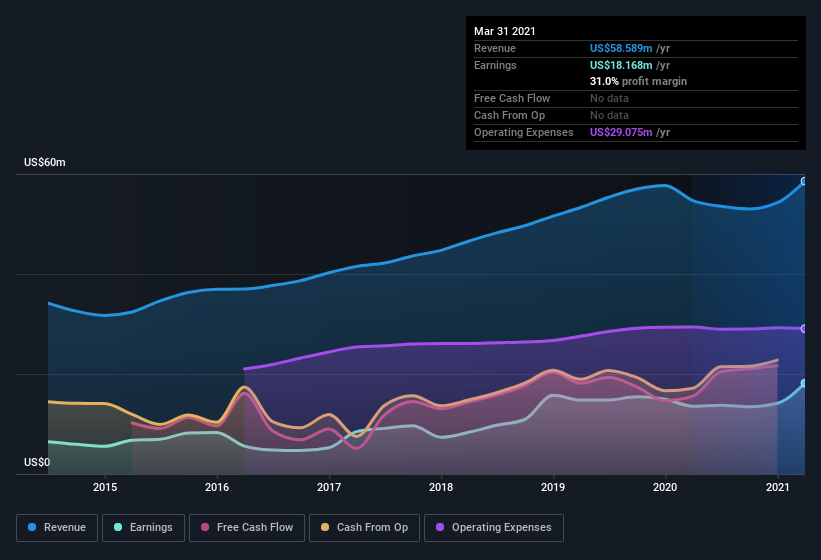

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. I note that Bank of Commerce Holdings's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. Bank of Commerce Holdings maintained stable EBIT margins over the last year, all while growing revenue 7.1% to US$59m. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

Fortunately, we've got access to analyst forecasts of Bank of Commerce Holdings's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Bank of Commerce Holdings Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Any way you look at it Bank of Commerce Holdings shareholders can gain quiet confidence from the fact that insiders shelled out US$493k to buy stock, over the last year. And when you consider that there was no insider selling, you can understand why shareholders might believe that lady luck will grace this business. We also note that it was the Independent Chairman of the Board, Lyle Tullis, who made the biggest single acquisition, paying US$159k for shares at about US$10.57 each.

Along with the insider buying, another encouraging sign for Bank of Commerce Holdings is that insiders, as a group, have a considerable shareholding. To be specific, they have US$15m worth of shares. That shows significant buy-in, and may indicate conviction in the business strategy. Those holdings account for over 6.6% of the company; visible skin in the game.

While insiders are apparently happy to hold and accumulate shares, that is just part of the pretty picture. That's because on our analysis the CEO, Randy Eslick, is paid less than the median for similar sized companies. For companies with market capitalizations between US$100m and US$400m, like Bank of Commerce Holdings, the median CEO pay is around US$1.0m.

The Bank of Commerce Holdings CEO received US$828k in compensation for the year ending . That seems pretty reasonable, especially given its below the median for similar sized companies. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of good governance, more generally.

Should You Add Bank of Commerce Holdings To Your Watchlist?

You can't deny that Bank of Commerce Holdings has grown its earnings per share at a very impressive rate. That's attractive. Not only that, but we can see that insiders both own a lot of, and are buying more, shares in the company. So it's fair to say I think this stock may well deserve a spot on your watchlist. It is worth noting though that we have found 2 warning signs for Bank of Commerce Holdings (1 shouldn't be ignored!) that you need to take into consideration.

The good news is that Bank of Commerce Holdings is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.