With EPS Growth And More, Bastogi (BIT:B) Is Interesting

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

So if you're like me, you might be more interested in profitable, growing companies, like Bastogi (BIT:B). While profit is not necessarily a social good, it's easy to admire a business than can consistently produce it. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

View our latest analysis for Bastogi

Bastogi's Improving Profits

Over the last three years, Bastogi has grown earnings per share (EPS) like young bamboo after rain; fast, and from a low base. So I don't think the percent growth rate is particularly meaningful. Thus, it makes sense to focus on more recent growth rates, instead. Like the last firework on New Year's Eve accelerating into the sky, Bastogi's EPS shot from €0.077 to €0.15, over the last year. Year on year growth of 93% is certainly a sight to behold.

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). Not all of Bastogi's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers I've used might not be the best representation of the underlying business. Bastogi's EBIT margins have actually improved by 12.8 percentage points in the last year, to reach 4.9%, but, on the flip side, revenue was down 12%. That falls short of ideal.

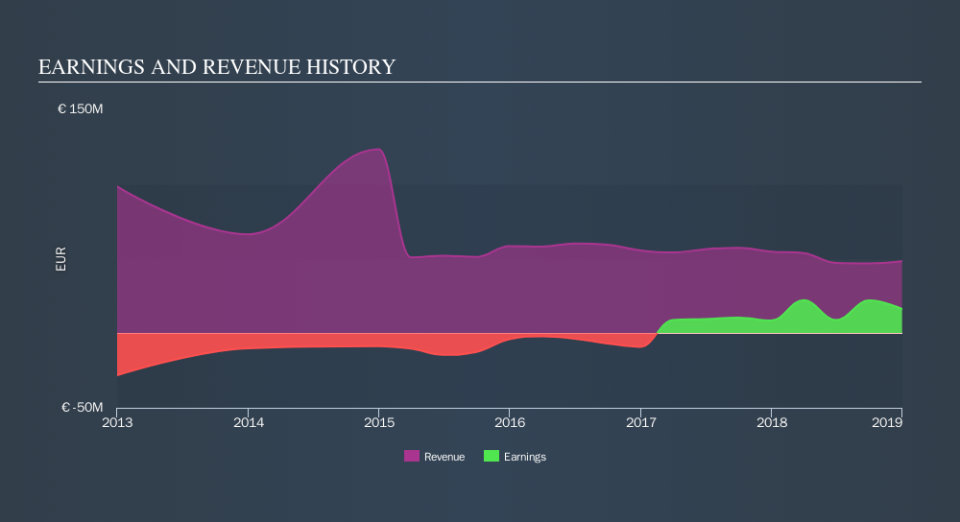

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

Since Bastogi is no giant, with a market capitalization of €108m, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Bastogi Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

For the sake of balance, I do note Bastogi insiders sold -€56.8k worth of shares last year. But that is far less than the large €105k share acquisition by Matteo Cabassi.

And the insider buying isn't the only sign of alignment between shareholders and the board, since Bastogi insiders own more than a third of the company. Indeed, with a collective holding of 84%, company insiders are in control and have plenty of capital behind the venture. This makes me think they will be incentivised to plan for the long term - something I like to see. With that sort of holding, insiders have about €91m riding on the stock, at current prices. That should be more than enough to keep them focussed on creating shareholder value!

Does Bastogi Deserve A Spot On Your Watchlist?

Bastogi's earnings have taken off like any random crypto-currency did, back in 2017. The cherry on top is that insiders own a bunch of shares, and one has been buying more. Because of the potential that it has reached an inflection point, I'd suggest Bastogi belongs on the top of your watchlist. While we've looked at the quality of the earnings, we haven't yet done any work to value the stock. So if you like to buy cheap, you may want to check if Bastogi is trading on a high P/E or a low P/E, relative to its industry.

The good news is that Bastogi is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.