With EPS Growth And More, European Eltech (MCX:EELT) Is Interesting

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. But as Warren Buffett has mused, 'If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy.' When they buy such story stocks, investors are all too often the patsy.

So if you're like me, you might be more interested in profitable, growing companies, like European Eltech (MCX:EELT). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

See our latest analysis for European Eltech

How Fast Is European Eltech Growing Its Earnings Per Share?

In the last three years European Eltech's earnings per share took off like a rocket; fast, and from a low base. So the actual rate of growth doesn't tell us much. As a result, I'll zoom in on growth over the last year, instead. Like a firecracker arcing through the night sky, European Eltech's EPS shot from RUруб0.27 to RUруб0.55, over the last year. Year on year growth of 104% is certainly a sight to behold.

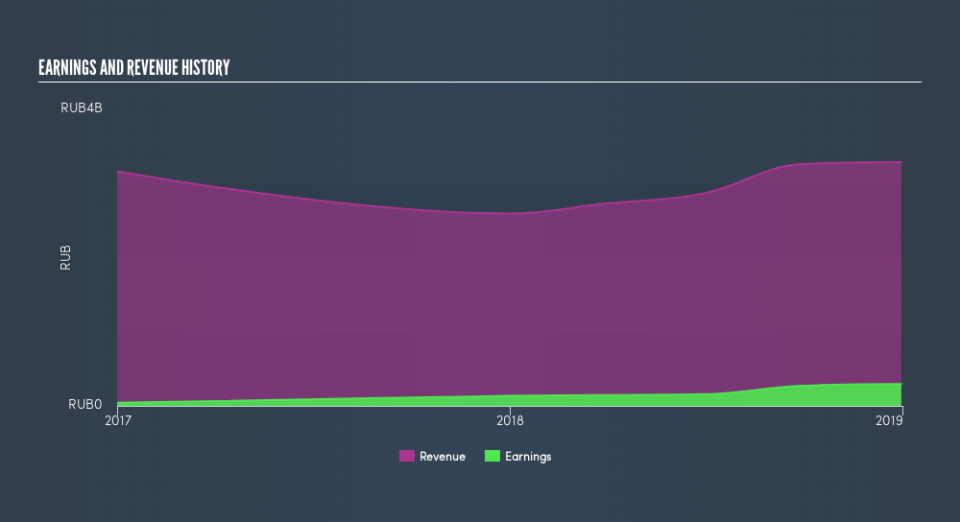

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. European Eltech maintained stable EBIT margins over the last year, all while growing revenue 27% to RUруб3.3b. That's a real positive.

In the chart below, you can see how the company has grown earnings, and revenue, over time. For finer detail, click on the image.

European Eltech isn't a huge company, given its market capitalization of RUруб7.1b. That makes it extra important to check on its balance sheet strength.

Are European Eltech Insiders Aligned With All Shareholders?

Many consider high insider ownership to be a strong sign of alignment between the leaders of a company and the ordinary shareholders. So as you can imagine, the fact that European Eltech insiders own a significant number of shares certainly appeals to me. Indeed, with a collective holding of 82%, company insiders are in control and have plenty of capital behind the venture. This makes me think they will be incentivised to plan for the long term - something I like to see. With that sort of holding, insiders have about RUруб5.8b riding on the stock, at current prices. That should be more than enough to keep them focussed on creating shareholder value!

Is European Eltech Worth Keeping An Eye On?

European Eltech's earnings per share growth have been levitating higher, like a mountain goat scaling the Alps. That sort of growth is nothing short of eye-catching, and the large investment held by insiders certainly brightens my view of the company. At times fast EPS growth is a sign the business has reached an inflection point; and I do like those. So to my mind European Eltech is worth putting on your watchlist; after all, shareholders do well when the market underestimates fast growing companies. Now, you could try to make up your mind on European Eltech by focusing on just these factors, or you could also consider how its price-to-earnings ratio compares to other companies in its industry.

You can invest in any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.