With EPS Growth And More, Riverview Bancorp (NASDAQ:RVSB) Is Interesting

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Riverview Bancorp (NASDAQ:RVSB). While profit is not necessarily a social good, it's easy to admire a business than can consistently produce it. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

See our latest analysis for Riverview Bancorp

Riverview Bancorp's Earnings Per Share Are Growing.

If a company can keep growing earnings per share (EPS) long enough, its share price will eventually follow. That means EPS growth is considered a real positive by most successful long-term investors. Who among us would not applaud Riverview Bancorp's stratospheric annual EPS growth of 38%, compound, over the last three years? While that sort of growth rate isn't sustainable for long, it certainly catches my attention; like a crow with a sparkly stone.

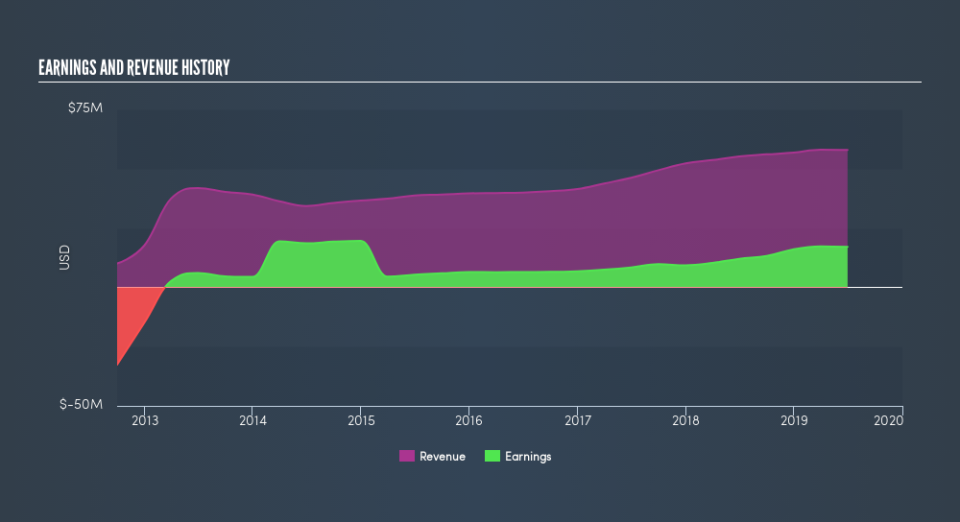

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Not all of Riverview Bancorp's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers I've used might not be the best representation of the underlying business. While we note Riverview Bancorp's EBIT margins were flat over the last year, revenue grew by a solid 4.9% to US$58m. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Since Riverview Bancorp is no giant, with a market capitalization of US$181m, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Riverview Bancorp Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

It's good to see Riverview Bancorp insiders walking the walk, by spending US$295k on shares in just twelve months. When you contrast that with the complete lack of sales, it's easy for shareholders to brim with joyful expectancy. We also note that it was the Director, Patricia Eby, who made the biggest single acquisition, paying US$124k for shares at about US$7.72 each.

The good news, alongside the insider buying, for Riverview Bancorp bulls is that insiders (collectively) have a meaningful investment in the stock. To be specific, they have US$13m worth of shares. That shows significant buy-in, and may indicate conviction in the business strategy. Those holdings account for over 7.3% of the company; visible skin in the game.

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. That's because on our analysis the CEO, Kevin Lycklama, is paid less than the median for similar sized companies. I discovered that the median total compensation for the CEOs of companies like Riverview Bancorp with market caps between US$100m and US$400m is about US$1.2m.

The Riverview Bancorp CEO received US$702k in compensation for the year ending March 2019. That comes in below the average for similar sized companies, and seems pretty reasonable to me. While the level of CEO compensation isn't a huge factor in my view of the company, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. I'd also argue reasonable pay levels attest to good decision making more generally.

Should You Add Riverview Bancorp To Your Watchlist?

Riverview Bancorp's earnings per share growth have been levitating higher, like a mountain goat scaling the Alps. Better yet, we can observe insider buying and the chief executive pay looks reasonable. The strong EPS growth suggests Riverview Bancorp may be at an inflection point. For those chasing fast growth, then, I'd suggest to stock merits monitoring. Now, you could try to make up your mind on Riverview Bancorp by focusing on just these factors, or you could also consider how its price-to-earnings ratio compares to other companies in its industry.

As a growth investor I do like to see insider buying. But Riverview Bancorp isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.