If You Like EPS Growth Then Check Out Bombay Burmah Trading (NSE:BBTC) Before It's Too Late

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

In contrast to all that, I prefer to spend time on companies like Bombay Burmah Trading (NSE:BBTC), which has not only revenues, but also profits. While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

View our latest analysis for Bombay Burmah Trading

Bombay Burmah Trading's Earnings Per Share Are Growing.

As one of my mentors once told me, share price follows earnings per share (EPS). It's no surprise, then, that I like to invest in companies with EPS growth. As a tree reaches steadily for the sky, Bombay Burmah Trading's EPS has grown 32% each year, compound, over three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be smiling.

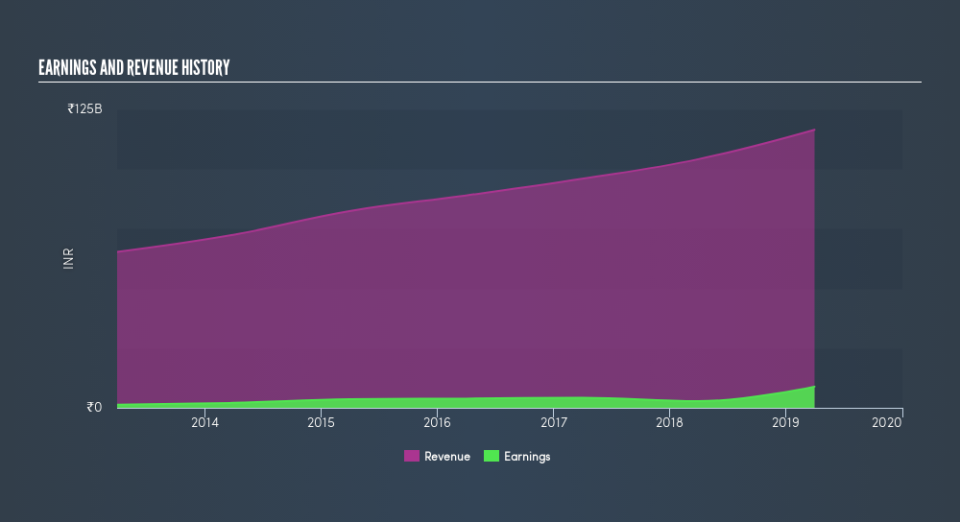

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. I note that Bombay Burmah Trading's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. Bombay Burmah Trading maintained stable EBIT margins over the last year, all while growing revenue 12% to ₹116b. That's a real positive.

In the chart below, you can see how the company has grown earnings, and revenue, over time. To see the actual numbers, click on the chart.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Bombay Burmah Trading's balance sheet strength, before getting too excited.

Are Bombay Burmah Trading Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

The first bit of good news is that no Bombay Burmah Trading insiders reported share sales in the last twelve months. But the really good news is that MD & Director Ness Wadia spent ₹17m buying stock stock, at an average price of around ₹1,238. Big buys like that give me a sense of opportunity; actions speak louder than words.

The good news, alongside the insider buying, for Bombay Burmah Trading bulls is that insiders (collectively) have a meaningful investment in the stock. Notably, they have an enormous stake in the company, worth ₹7.1b. This suggests to me that leadership will be very mindful of shareholders' interests when making decisions!

Should You Add Bombay Burmah Trading To Your Watchlist?

You can't deny that Bombay Burmah Trading has grown its earnings per share at a very impressive rate. That's attractive. Better still, insiders own a large chunk of the company and one has even been buying more shares. So it's fair to say I think this stock may well deserve a spot on your watchlist. While we've looked at the quality of the earnings, we haven't yet done any work to value the stock. So if you like to buy cheap, you may want to check if Bombay Burmah Trading is trading on a high P/E or a low P/E, relative to its industry.

As a growth investor I do like to see insider buying. But Bombay Burmah Trading isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.