If You Like EPS Growth Then Check Out China MeiDong Auto Holdings (HKG:1268) Before It's Too Late

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in China MeiDong Auto Holdings (HKG:1268). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

View our latest analysis for China MeiDong Auto Holdings

How Fast Is China MeiDong Auto Holdings Growing?

If a company can keep growing earnings per share (EPS) long enough, its share price will eventually follow. That makes EPS growth an attractive quality for any company. Who among us would not applaud China MeiDong Auto Holdings's stratospheric annual EPS growth of 54%, compound, over the last three years? Growth that fast may well be fleeting, but like a lotus blooming from a murky pond, it sparks joy for the wary stock pickers.

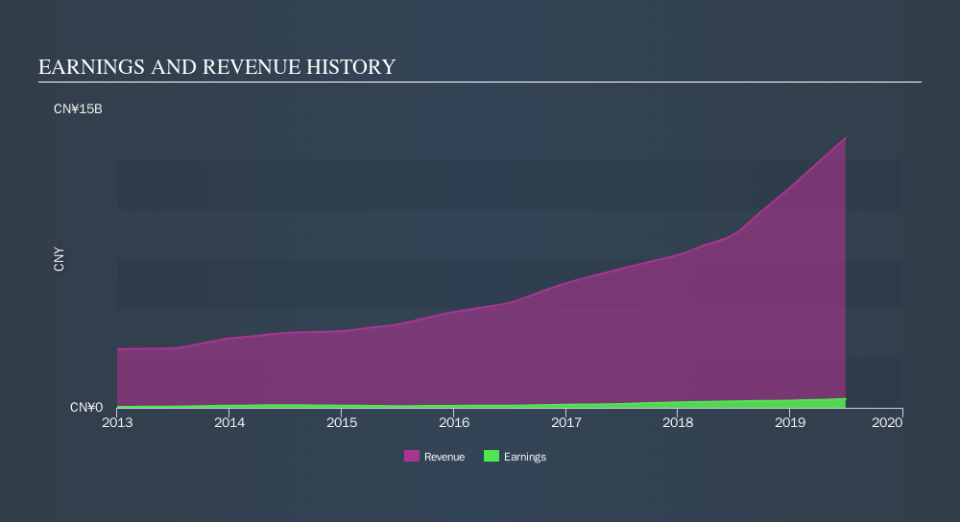

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. While we note China MeiDong Auto Holdings's EBIT margins were flat over the last year, revenue grew by a solid 56% to CN¥14b. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for China MeiDong Auto Holdings's future profits.

Are China MeiDong Auto Holdings Insiders Aligned With All Shareholders?

Many consider high insider ownership to be a strong sign of alignment between the leaders of a company and the ordinary shareholders. So we're pleased to report that China MeiDong Auto Holdings insiders own a meaningful share of the business. Indeed, with a collective holding of 65%, company insiders are in control and have plenty of capital behind the venture. This makes me think they will be incentivised to plan for the long term - something I like to see. At the current share price, that insider holding is worth a whopping CN¥5.3b. Now that's what I call some serious skin in the game!

Is China MeiDong Auto Holdings Worth Keeping An Eye On?

China MeiDong Auto Holdings's earnings per share have taken off like a rocket aimed right at the moon. That sort of growth is nothing short of eye-catching, and the large investment held by insiders certainly brightens my view of the company. The hope is, of course, that the strong growth marks a fundamental improvement in the business economics. So yes, on this short analysis I do think it's worth considering China MeiDong Auto Holdings for a spot on your watchlist. If you think China MeiDong Auto Holdings might suit your style as an investor, you could go straight to its annual report, or you could first check our discounted cash flow (DCF) valuation for the company.

Although China MeiDong Auto Holdings certainly looks good to me, I would like it more if insiders were buying up shares. If you like to see insider buying, too, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.