If You Like EPS Growth Then Check Out Greene County Bancorp (NASDAQ:GCBC) Before It's Too Late

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

In contrast to all that, I prefer to spend time on companies like Greene County Bancorp (NASDAQ:GCBC), which has not only revenues, but also profits. While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

See our latest analysis for Greene County Bancorp

Greene County Bancorp's Earnings Per Share Are Growing.

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS). It's no surprise, then, that I like to invest in companies with EPS growth. Over the last three years, Greene County Bancorp has grown EPS by 15% per year. That's a good rate of growth, if it can be sustained.

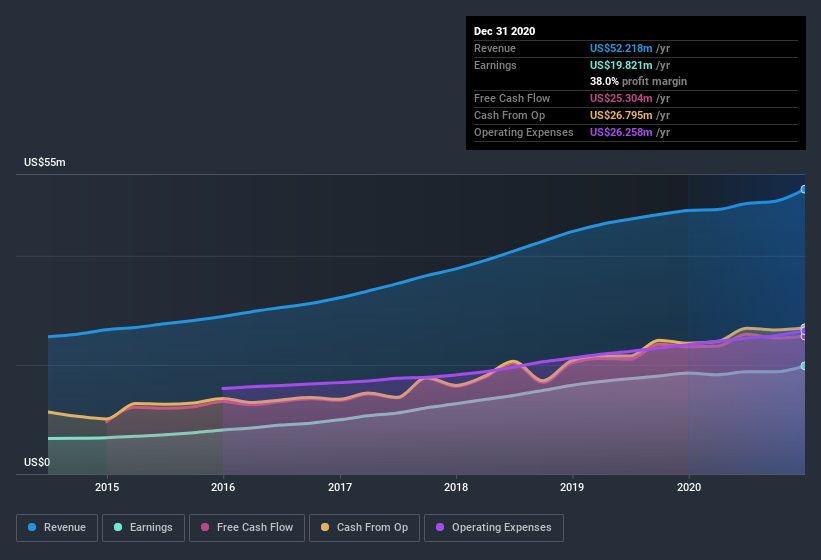

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). I note that Greene County Bancorp's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. Greene County Bancorp maintained stable EBIT margins over the last year, all while growing revenue 8.1% to US$52m. That's a real positive.

In the chart below, you can see how the company has grown earnings, and revenue, over time. Click on the chart to see the exact numbers.

Since Greene County Bancorp is no giant, with a market capitalization of US$214m, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Greene County Bancorp Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

It's good to see Greene County Bancorp insiders walking the walk, by spending US$277k on shares in just twelve months. And when you consider that there was no insider selling, you can understand why shareholders might believe that lady luck will grace this business. It is also worth noting that it was Independent Director Peter Hogan who made the biggest single purchase, worth US$42k, paying US$21.00 per share.

Along with the insider buying, another encouraging sign for Greene County Bancorp is that insiders, as a group, have a considerable shareholding. To be specific, they have US$18m worth of shares. That shows significant buy-in, and may indicate conviction in the business strategy. Those holdings account for over 8.3% of the company; visible skin in the game.

Should You Add Greene County Bancorp To Your Watchlist?

As I already mentioned, Greene County Bancorp is a growing business, which is what I like to see. Better yet, insiders are significant shareholders, and have been buying more shares. To me, that all makes it well worth a spot on your watchlist, as well as continuing research. While we've looked at the quality of the earnings, we haven't yet done any work to value the stock. So if you like to buy cheap, you may want to check if Greene County Bancorp is trading on a high P/E or a low P/E, relative to its industry.

The good news is that Greene County Bancorp is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.