If You Like EPS Growth Then Check Out Kinetic Mines and Energy (HKG:1277) Before It's Too Late

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Kinetic Mines and Energy (HKG:1277). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

See our latest analysis for Kinetic Mines and Energy

Kinetic Mines and Energy's Improving Profits

Over the last three years, Kinetic Mines and Energy has grown earnings per share (EPS) like young bamboo after rain; fast, and from a low base. So I don't think the percent growth rate is particularly meaningful. As a result, I'll zoom in on growth over the last year, instead. Like a wedge-tailed eagle on the wind, Kinetic Mines and Energy's EPS soared from CN¥0.064 to CN¥0.096, in just one year. That's a impressive gain of 49%.

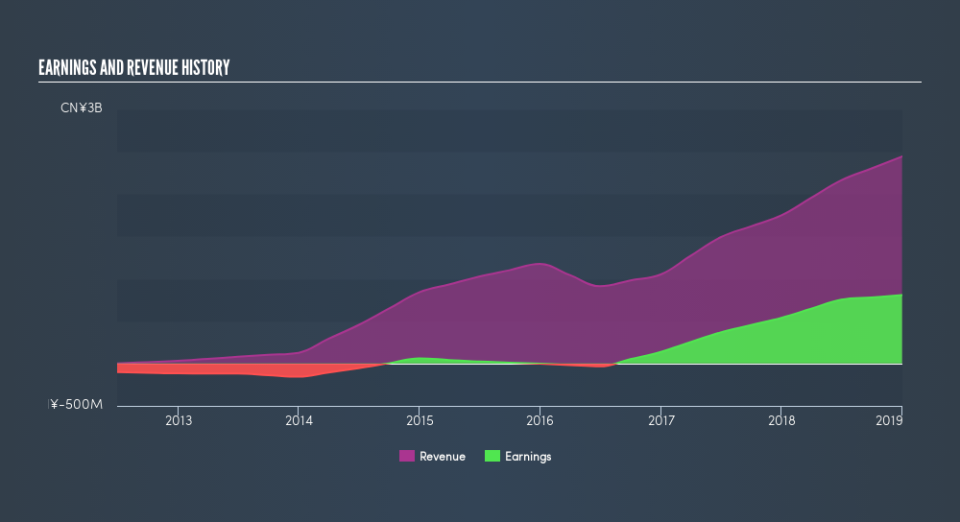

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. While we note Kinetic Mines and Energy's EBIT margins were flat over the last year, revenue grew by a solid 40% to CN¥2.4b. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

While profitability drives the upside, prudent investors always check the balance sheet, too.

Are Kinetic Mines and Energy Insiders Aligned With All Shareholders?

Personally, I like to see high insider ownership of a company, since it suggests that it will be managed in the interests of shareholders. So we're pleased to report that Kinetic Mines and Energy insiders own a meaningful share of the business. Indeed, with a collective holding of 73%, company insiders are in control and have plenty of capital behind the venture. To me this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. At the current share price, that insider holding is worth a whopping CN¥2.5b. Now that's what I call some serious skin in the game!

It means a lot to see insiders invested in the business, but I find myself wondering if remuneration policies are shareholder friendly. Well, based on the CEO pay, I'd say they are indeed. I discovered that the median total compensation for the CEOs of companies like Kinetic Mines and Energy with market caps between CN¥1.4b and CN¥5.5b is about CN¥2.0m.

The Kinetic Mines and Energy CEO received CN¥1.2m in compensation for the year ending December 2018. That seems pretty reasonable, especially given its below the median for similar sized companies. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. I'd also argue reasonable pay levels attest to good decision making more generally.

Should You Add Kinetic Mines and Energy To Your Watchlist?

Given my belief that share price follows earnings per share you can easily imagine how I feel about Kinetic Mines and Energy's strong EPS growth. If that's not enough, consider also that the CEO pay is quite reasonable, and insiders are well-invested alongside other shareholders. Each to their own, but I think all this makes Kinetic Mines and Energy look rather interesting indeed. Another important measure of business quality not discussed here, is return on equity (ROE). Click on this link to see how Kinetic Mines and Energy shapes up to industry peers, when it comes to ROE.

Of course, you can do well (sometimes) buying stocks that are not growing earnings and do not have insiders buying shares. But as a growth investor I always like to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.