If You Like EPS Growth Then Check Out United Bancshares (NASDAQ:UBOH) Before It's Too Late

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in United Bancshares (NASDAQ:UBOH). While profit is not necessarily a social good, it's easy to admire a business than can consistently produce it. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

See our latest analysis for United Bancshares

United Bancshares's Earnings Per Share Are Growing.

The market is a voting machine in the short term, but a weighing machine in the long term, so share price follows earnings per share (EPS) eventually. It's no surprise, then, that I like to invest in companies with EPS growth. We can see that in the last three years United Bancshares grew its EPS by 11% per year. That growth rate is fairly good, assuming the company can keep it up.

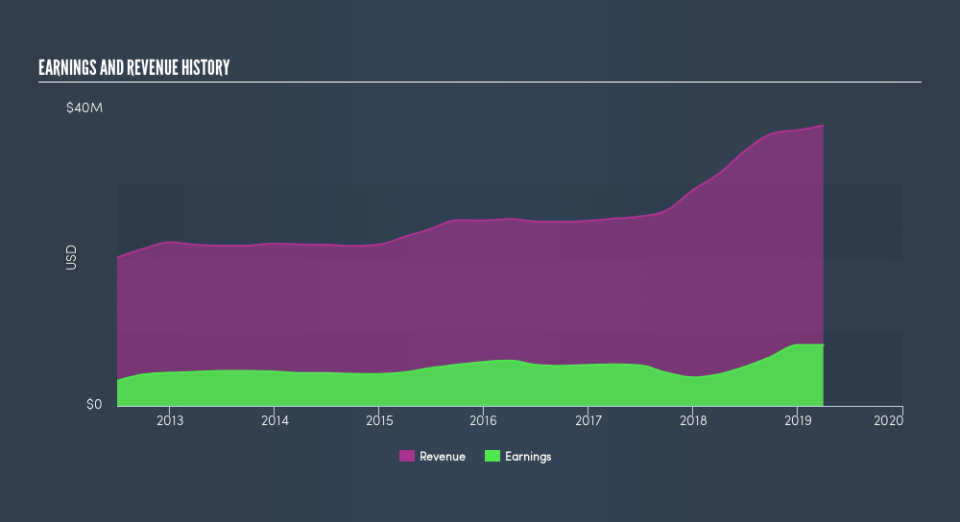

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. I note that United Bancshares's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. United Bancshares maintained stable EBIT margins over the last year, all while growing revenue 21% to US$38m. That's a real positive.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

Since United Bancshares is no giant, with a market capitalization of US$74m, so you should definitely check its cash and debt before getting too excited about its prospects.

Are United Bancshares Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

One positive for United Bancshares, is that company insiders paid US$17k for shares in the last year. While this isn't much, we also note an absence of sales. Zooming in, we can see that the biggest insider purchase was by CEO, President & Director Brian Young for US$11k worth of shares, at about US$22.44 per share.

Does United Bancshares Deserve A Spot On Your Watchlist?

One positive for United Bancshares is that it is growing EPS. That's nice to see. Not every business can grow its EPS, but United Bancshares certainly can. The cherry on top is the insider share purchases, which provide an extra impetus to keep and eye on this stock, at the very least. While we've looked at the quality of the earnings, we haven't yet done any work to value the stock. So if you like to buy cheap, you may want to check if United Bancshares is trading on a high P/E or a low P/E, relative to its industry.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of United Bancshares, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.