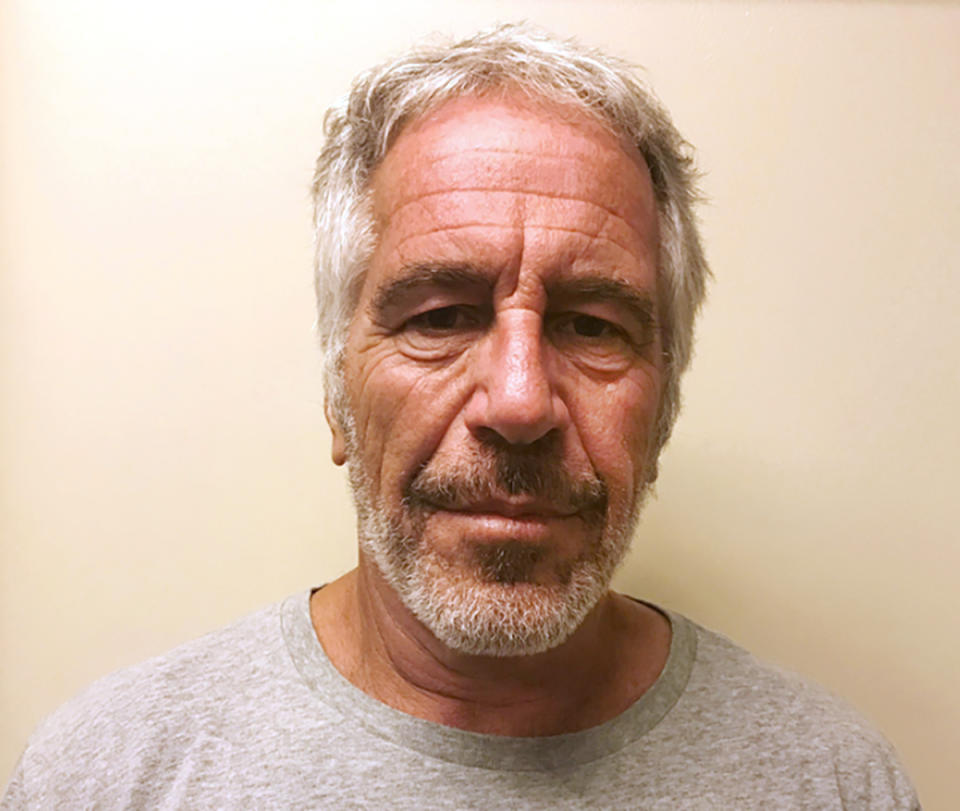

Epstein created trust with $578 million days before suicide: Morning Brief

Tuesday, August 20, 2019

Get the Morning Brief sent directly to your inbox every Monday to Friday by 6:30 a.m. ET. Subscribe

WHAT TO WATCH

Retail takes centerstage, as two heavyweights release quarterly results ahead of the market open.

Home Depot (HD) reported adjusted earnings of $3.17 per share on $31.03 billion in revenue, beating expectations of $3.08 per share on $30.96 billion in revenue, according to data compiled by Bloomberg.

Home Depot has managed to beat earnings estimates every quarter since November 2012, but a couple of issues have been plaguing the home improvement giant in recent quarters, including the wetter-than-normal weather and lumber pricing pressures. Management has also previously said that Home Depot wouldn’t feel much pressure from tariffs.

Kohl’s (KSS) will also report second-quarter results ahead of the opening bell. Analysts are expecting the department store to report adjusted earnings of $1.53 per share on $4.20 billion in revenue. Same-store sales are expected to have fallen 2.3% during the quarter.

Much like the other retailers, tariffs will be a key focal point for investors. Kohl’s currently sources about 20% of its products from China, but its partner brands import their goods from China, so Kohl’s is exposed through those brands indirectly. Analysts are predicting that Kohl’s will slash its full-year guidance in response to the looming tariffs set to go into place later this year.

Other notable earnings reports scheduled for Tuesday include TJX Companies (TJX) before market open, and Toll Brothers (TOL), Urban Outfitters (URBN) after market close.

TOP NEWS

Epstein created trust with $578 million days before suicide: Jeffrey Epstein wrote a will just two days before his suicide, saying he had about $578 million in assets that he placed in a trust, which could complicate efforts by women who say he sexually abused them to collect damages. [Bloomberg]

Pound falls to $1.20 as Boris Johnson sets out Brexit demands: The pound fell against both the euro and the dollar on Tuesday morning as fears continued that Britain is heading for a disruptive hard Brexit on October 31. Prime Minister Boris Johnson wrote to European Council president Donald Tusk late on Monday reiterating his call for the EU to scrap the so-called Irish backstop. [Yahoo Finance UK]

Twitter, Facebook suspend accounts linked to disinformation in Hong Kong protests: Twitter (TWTR) on Monday announced that it had suspended hundreds of accounts on its platform in connection with the protests roiling Hong Kong, citing a “significant state-backed information operation” sowing disinformation. [Yahoo Finance]

Amazon, Google, Facebook testify against France’s digital sales tax: Amazon, Facebook and Google say France’s digital services tax will hurt their businesses — and warn it could encourage other countries to adopt similar taxes. France imposed a 3% tax on global tech companies with $832 million in global revenue and digital sales of $27.7 million in France. The United States Trade Representative held a hearing about its investigation into the tax on Monday. [Yahoo Finance]

GE puts long-term care costs back in the spotlight: Individual long-term care (LTC) insurance is back in the spotlight after a hard-hitting and controversial analysis last week highlighted General Electric’s (GE) risk exposure from that part of its portfolio. While GE does have heightened exposure, the problem is not isolated to the troubled industrial giant. That’s because all of the industry’s players are confronting a challenge of accurately pricing the future, at a time when people are living longer, and costs of care have soared. [Yahoo Finance]

MORE FROM YAHOO FINANCE

A US recession is probably coming so investors should just deal with it

4 ways Trump can forestall a recession

'THE PUTS HAVE EXPIRED': Morgan Stanley warns that neither trade nor the Fed can save them now

General Electric: We operate with 'integrity,' stand by our financial reporting

Millennial drinking habits show why White Claw and hard seltzers are just getting started

To ensure delivery of the Morning Brief to your inbox, please add newsletter@yahoofinance.com to your safe sender list.

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.