Erdogan Teeters Before a Turkish Vote That’s Got the World Watching

- Oops!Something went wrong.Please try again later.

(Bloomberg) -- Recep Tayyip Erdogan was halfway through a well-choreographed TV interview on April 25 when the cameras unexpectedly cut away. Someone in the room could be heard exclaiming “Oh no!” as the broadcast abruptly ended. The Turkish president reappeared 20 minutes later looking pale and tired, said he had a stomach bug, and then disappeared from public view for two days.

Most Read from Bloomberg

Steve Schwarzman Holds Off Giving Money to DeSantis After Meeting Him

US Inflation Shows Signs of Moderating, Giving Fed Room to Pause

Treasuries Advance After CPI; Stocks Edge Higher: Markets Wrap

Vanguard’s Trillion-Dollar Man Leads a Fixed-Income Revolution

In the heat of the most pivotal election campaign in a generation, Turks got a rare glimpse of life without their powerful leader. Now the question resonating worldwide is whether they want to call time on his two decades in power.

Erdogan is seeking re-election on May 14 after molding the NATO military power in his own image. He’s changed just about everything, from the basic tools for managing the $900 billion economy, to Turkey’s positioning on the chessboard of a new Cold War. That’s why so much hangs on the neck-and-neck contest between Erdogan, 69, and his main challenger, Kemal Kilicdaroglu, 74 — and not only for Turkey’s 85 million population.

Leaders in Washington and Brussels, seeking to bolster the coalition backing Ukraine against Russian attack, are eager to see Turkey revive its historic alignment with the West. When Erdogan resurfaced, it was via video link to a ceremony on Turkey’s Mediterranean coast, where Russia is building the country’s first nuclear plant. Also attending, via a separate stream from the Kremlin, was Vladimir Putin.

For the world’s money managers, the election outcome could determine whether Turkey becomes a “buy” again. Investors plowed cash into the country during the boom times of the early Erdogan years. More recently, they’ve been heading for the exit as he and his loyal circle of technocrats defied economic orthodoxy by cutting interest rates while everyone else was raising them to cool inflation.

Onions vs Electric Cars

Turks will vote on Sunday before a possible run-off on May 28 should neither of the two main candidates win a majority. Parliamentary elections are being held at the same time and that race is also expected to be tight.

Erdogan is campaigning as a ruler who has big ideas and can turn them into reality, whether that’s domestically built fighter jets and electric cars or the breakthrough grain deal he helped broker between Russia and Ukraine. “We will open the gates of a big and powerful Turkey all together,” the president told a campaign rally on Monday in the Kirklareli province west of Istanbul.

The opposition, meanwhile, is hammering him on the soaring cost of staple foods. “Potatoes, onions, bye bye Erdogan,” which rhymes in Turkish, is a popular slogan.

Of course, for voters there are all kinds of other issues that could sway the outcome, from allegations of corruption, judicial bias and the increasing influence of religious groups, to the effectiveness of the government’s response to February earthquakes that left more than 50,000 people dead in southern Turkey.

But for the wider world, the questions looming largest are what will happen to Turkey’s diplomacy and its economic policy. And no matter who wins, the answers could be more blurred than the election battle lines might suggest.

Turkey’s Changing World View

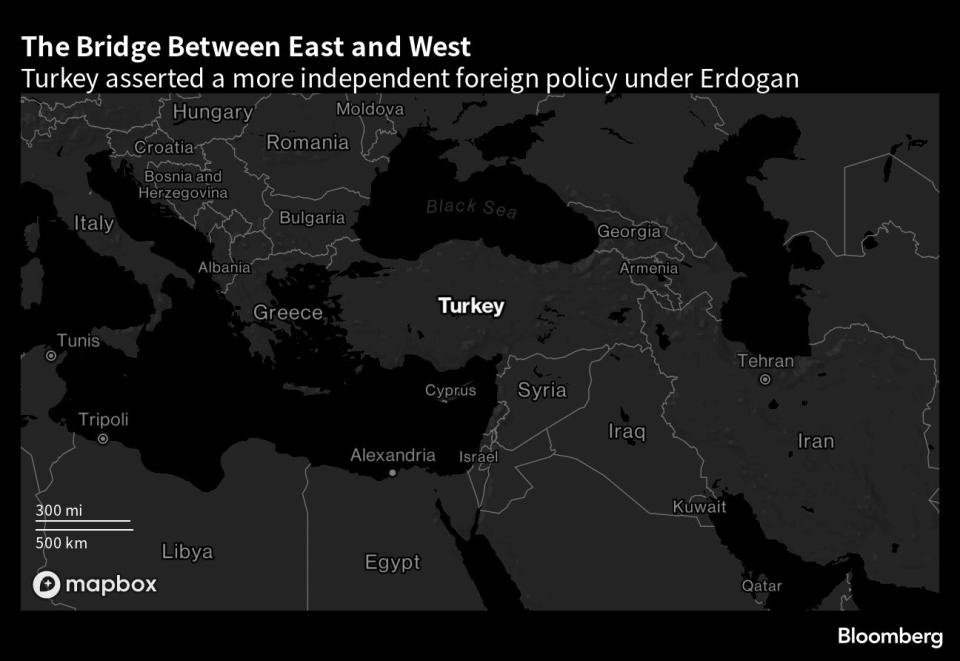

Erdogan has gradually carved out a more assertive and independent role in the world, often clashing with the European Union, which has effectively frozen Turkey’s bid to join, and the US. In a world increasingly polarized between Atlantic and Eurasian powers, a glance at the map is enough to explain why.

In Turkey’s own neighborhood, the campaign to unseat Syrian President Bashar al-Assad saw the Turkish leader broadly aligned with Western capitals a decade ago. But after Erdogan survived a 2016 coup attempt — allegedly masterminded by a cleric living in the US — his mistrust of Washington began to weigh more heavily on foreign policy. Turkey bought S-400 air-defense missiles from Russia, opening a deep rift with the US. It’s now joining Moscow-backed efforts to rehabilitate Assad, who remains a pariah in Washington and Brussels.

The opposition says it wants to reset ties with the US and Europe and will probably deliver on some fronts. That includes removing obstacles to Sweden’s membership of NATO, held up by Erdogan on the grounds of the Nordic country’s support for Kurdish separatist groups, and retiring Russian military hardware.

“There’s a need to correct Turkey’s widening distance from the West,” said Ahmet Unal Cevikoz, a former ambassador who’s now a senior official in Kilicdaroglu’s party.

But the world has changed during Erdogan’s two decades in office, with China rising as Western clout wanes. That’s upending power dynamics across the Middle East. The recent Saudi-Iranian détente, brokered by Beijing, is just one example. Turkey will be caught up in those currents whoever is in charge.

Erdogan has condemned the Russian occupation of Crimea and sold killer drones to Ukraine. The Turkish army, NATO’s largest after the US, has fought against Moscow-backed forces in Syria and Libya. Yet Erdogan has the ear of Putin, and opposition chiefs share his reluctance to sanction Russia, which supplies Turkey with natural gas, tourists, and now nuclear knowhow. And normalization with Syria will likely continue whoever wins the presidential vote.

Defying Economic Gravity

The elections are most of all a referendum on standards of living. In the past, Erdogan’s go-for-growth approach helped Turkey consistently beat most peers in the Group of 20 major economies. But it’s morphed into something more like growth-at-all-costs — and lately the costs have been high.

Watch: Why Erdogan Faces a Close Race in Turkey’s Election

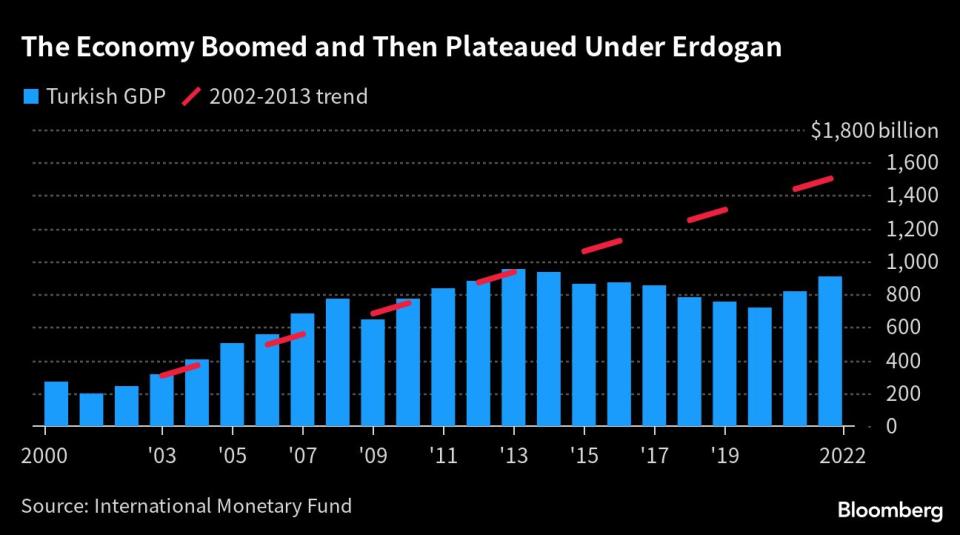

Measured in dollars, Turkey’s economy almost quadrupled during Erdogan’s first decade in power, reaching close to $960 billion in 2013. Since then, it’s remained shy of the trillion-dollar mark despite — or perhaps because of — Erdogan’s all-out push for growth.

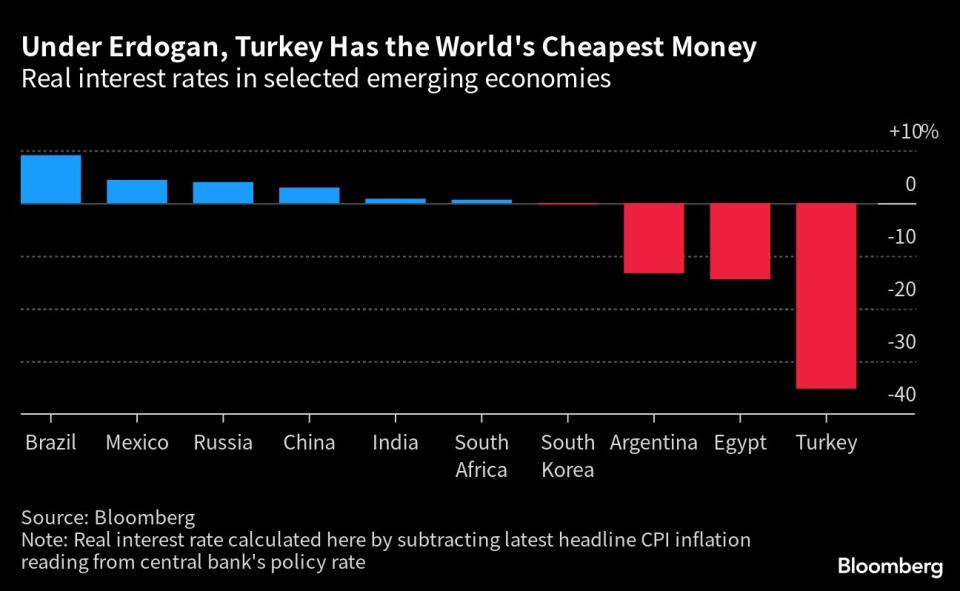

That’s involved pumping in cheap credit and backing a theory that flies in the face of economic orthodoxy: Erdogan says higher interest rates push inflation up, not down, so they should be kept low. The view was imposed on a central bank shorn of its independence and forced to build a new toolkit that can deliver on political objectives like boosting exports, and encourage households and firms to keep faith with a plunging lira.

It adds up to what the government calls a new Turkey Economic Model. Erdogan aims to boost investment with low borrowing costs, and increase exports with a weak currency. Eventually, the theory goes, Turkey will turn into an industrial powerhouse, its trade deficit flip into a surplus, and the lira go from weakness to strength.

Read More

Erdogan Faces Biggest Voter Threat After Years of Economic Chaos

Erdogan Risks Election Aftershock Amid Fumbled Quake Response

Turkey’s Micromanager-in-Chief Faces Test of His Political Life

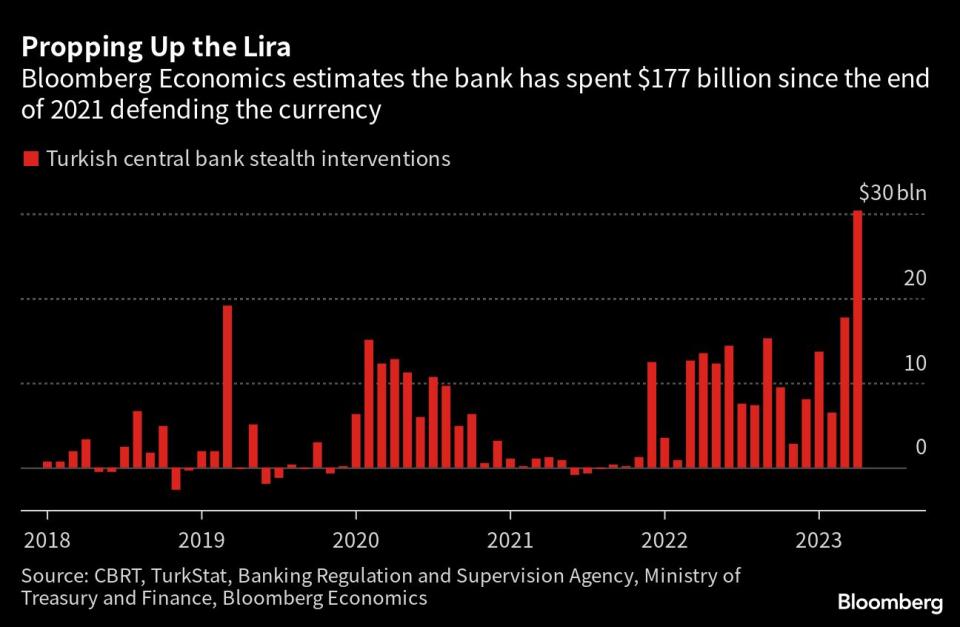

In practice, Turkey has entered into a vicious cycle. A weaker currency raises inflation, which reduces the purchasing power of the lira, prompting Turks to seek alternative ways of saving. Higher interest rates would break this cycle. But the benchmark rate is some 35 percentage points below inflation — making Turkey an extreme global outlier and leaving the lira, which has suffered two crises in the past five years, vulnerable to another run.The central bank has burned through $177 billion propping up the currency since December 2021, Bloomberg Economics estimates. Mystery inflows of money, perhaps from Russia, as well as transfers from energy-rich Gulf Arab countries have helped stave off a third crash.

Even so, all the conditions for a bust — a ballooning trade deficit, a pileup of external debt coming due, and not enough foreign currency reserves to fill the gap — are in place. The currency has fallen 23% against the dollar over the past year and Bloomberg calculations show derivatives traders see a more-than-even chance it will sink another 25% by the end of September.

For voters, a debt crisis remains something of an abstraction. The same is not true of another consequence of extreme policy settings: inflation. Price rises topped 80% late last year — even higher than the peak just before Erdogan came to power. While the inflation rate has since dropped by about half, to 44% last month, it remains a key election battleground.

Finance Minister Nureddin Nebati blamed the soaring cost of living on the commodity price-spike that followed the pandemic and Russia’s invasion of Ukraine, and defended Erdogan’s economic model. “It’s been designed with Turkey’s circumstances and vision in mind,” Nebati said on May 5. “Some people may be expecting an increase in interest rates. It won’t happen.”

Rates May Rise Anyway

For all the rhetoric, Turkey’s fragilities will likely mean a pivot after elections, no matter who wins. Bloomberg Economics expects that an opposition victory would bring a swift return to more conventional monetary management — a quick hike in interest rates to fight inflation and steady the currency. It would take longer to unwind the whole web of central-bank policy that’s evolved under Erdogan.

If the president is re-elected, Bloomberg Economics’ view is that interest rates would still rise — though by a smaller amount, and at a slower pace, as Erdogan remains unconvinced of the wisdom of textbook economics.

Either way, Turkey faces a painful adjustment away from policies that are barreling the economy toward crisis.

“The least market-friendly outcome would be for Erdogan to win re-election,” said Nick Stadtmiller, head of product at Medley Global Advisors. “It seems likely Erdogan would continue his unorthodox policies for as long as he can. But I can’t see how this can end well.”

--With assistance from Firat Kozok, Selcan Hacaoglu and Tugce Ozsoy.

Most Read from Bloomberg Businessweek

AI Drug Discovery Is a $50 Billion Opportunity for Big Pharma

‘Nearshoring’ Push Is Fueling Tech Job Demand in Latin America

©2023 Bloomberg L.P.