The Esautomotion (BIT:ESAU) Share Price Is Down 22% So Some Shareholders Are Getting Worried

Investors can approximate the average market return by buying an index fund. When you buy individual stocks, you can make higher profits, but you also face the risk of under-performance. That downside risk was realized by Esautomotion S.p.A. (BIT:ESAU) shareholders over the last year, as the share price declined 22%. That contrasts poorly with the market return of 21%. Because Esautomotion hasn't been listed for many years, the market is still learning about how the business performs. Shareholders have had an even rougher run lately, with the share price down 13% in the last 90 days.

View our latest analysis for Esautomotion

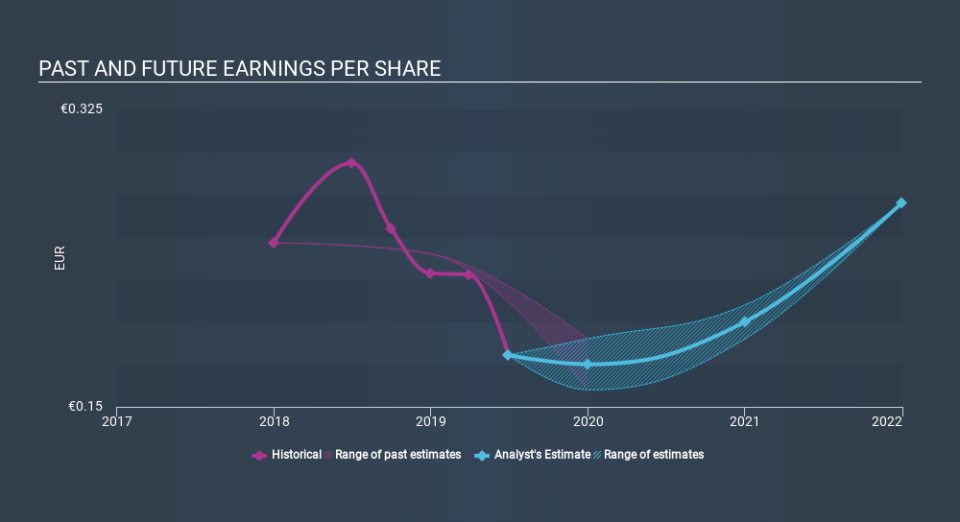

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Unfortunately Esautomotion reported an EPS drop of 39% for the last year. The share price fall of 22% isn't as bad as the reduction in earnings per share. So despite the weak per-share profits, some investors are probably relieved the situation wasn't more difficult.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

It might be well worthwhile taking a look at our free report on Esautomotion's earnings, revenue and cash flow.

A Different Perspective

Given that the market gained 21% in the last year, Esautomotion shareholders might be miffed that they lost 20%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. With the stock down 13% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Esautomotion has 3 warning signs (and 1 which shouldn't be ignored) we think you should know about.

But note: Esautomotion may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IT exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.